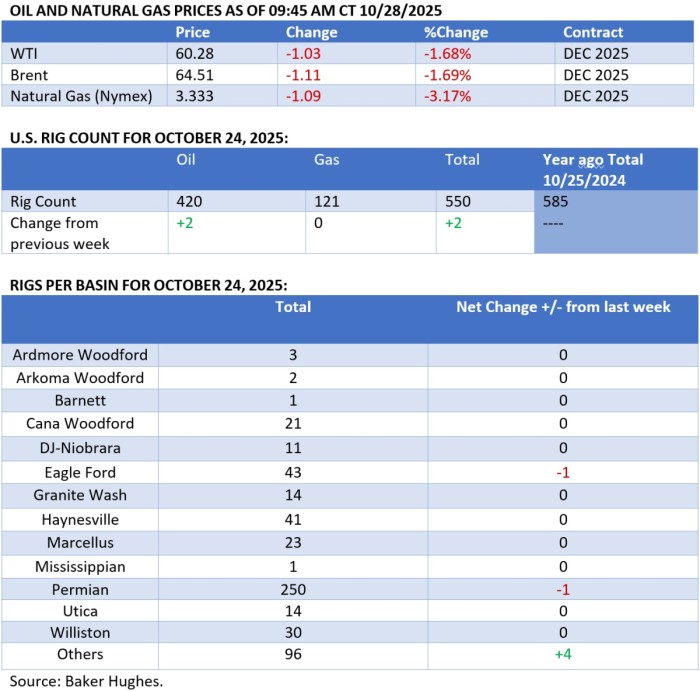

Brent crude hovers near $65 as traders await the outcome of this week’s Trump–Xi meeting in South Korea.

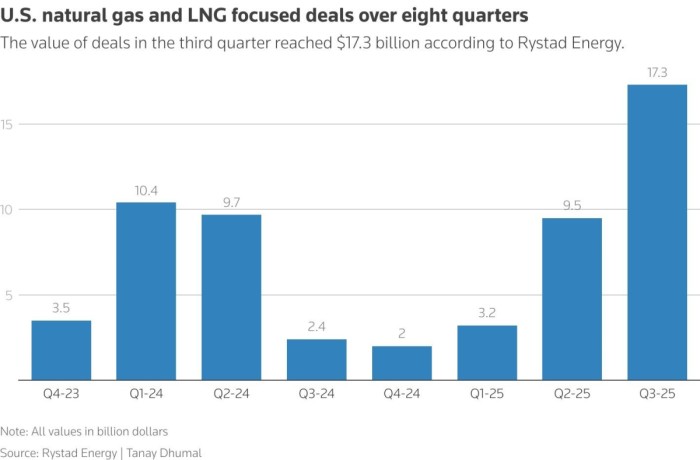

From Black Gold to Blue Flame – US Dealmakers Pivot to Gas

– The US oil industry’s consolidation drive has run out of steam as low-60 crude prices made it much harder for private equity firms to sell their undeveloped assets; however, gas deals still have a lot of room left.

– According to Enverus, US upstream dealmaking dipped by almost 30% in Q3 2025, totalling only $9.7 billion with Crescent Energy’s $3 billion takeover of Vital Energy marking the single largest transaction.

– That said, M&A activity in purely gas-focused plays is heating up, especially in Louisiana’s Haynesville Basin that saw Stone Ridge Holdings’ $1.3 billion deal in July, to be followed by Japan’s JERA spending $1.5 billion this month.

– Gas consolidation deals in the US have already amounted to $30 billion in January-September 2025, already higher than last year’s $22.5 billion total.

– Market rumours see at least $28 billion of gas and LNG assets up for sale in the United States, including but not limited to Ascent Resources, GeoSouthern and NextDecade’s Rio Grande LNG project.

Market Movers

– Algeria’s national oil company Sonatrach has resumed exploration activities in Libya, spudding an exploratory well in the country’s Block 96/2 after an 11-year hiatus.

– Indonesia’s national oil firm Pertamina has farmed into Petronas’ ultra-deepwater Bobara field in the country, taking a 24.5% participating interest under the 30-year production sharing contract.

– QatarEnergy has taken a 40% stake in Egypt’s North Rafah offshore concession, with ENI (BIT:ENI) remaining the project operator as it continues to hunt for gas in the Mediterranean Sea.

– Japan’s leading power generation company JERA has agreed to purchase US upstream gas assets in Louisiana’s Haynesville basin for $1.5 billion in cash, adding 0.5 Bcf/d of production to its portfolio.

– US oil major ExxonMobil (NYSE:XOM) signed a non-binding memorandum of understanding with Gabon’s Oil and Gas Ministry for unspecified deepwater blocks, marking its re-entry into the African country following its exit in 2015.

Tuesday, October 28, 2025

The Trump-Xi meeting in South Korea is set to define the market sentiment of this week, with ICE Brent seeing only minor downward corrections to $65 per barrel. So far there has been little physical disruption from sanctions on Russia’s Rosneft and Lukoil, with the oil markets still in wait-and-see mode to gauge the crude production and export impact of US sanctions.

Sanctioned Major Mulls Asset Fire Sale. Russia’s No.2 oil producer Lukoil is considering selling its international assets in response to sanctions from the Trump administration, adding that it could ask for a wind-down extension from the Treasury Department in case planned divestments get delayed.

Related: UK Sets £1.08 Billion Offshore Wind Budget In 2030 Push

Iraq Plays Down Impact of Oilfield Fire. Iraqi crude exports are continuing uninterrupted, according to the country’s oil minister Hayan Abdel Ghani, after a storage tank fire at the 500,000 b/d Zubair oil field left two workers dead and disrupted pipeline flows to the Basrah export terminal.

Kuwait’s Key Refinery Hits Roadblock. The 615,000 b/d Al Zour refinery operated by Kuwait’s state oil firm ??? is reported to have halted several key units after a fire incident on October 21, curbing some 150,000 b/d of diesel output and prompting the NOC to issue a gasoline import tender.

Indian Refiners Await Russia Sanctions Clarity. Indian refiners have stopped placing orders on new Russian purchases as they await instructions from the country’s government, with October imports coming in at 1.7 million b/d, some 50,000 b/d lower than this year’s January-September average.

Venezuela Ends All Trinidad Gas Projects. Venezuela’s PDVSA has suspended all energy-related cooperation with Trinidad and Tobago, including the giant 4.2 ICf Dragon gas field that straddles the two countries’ maritime zones, accusing them of becoming the ‘US empire’s aircraft carrier.

Namibia Power Grab Worsens Oil Outlook. Namibia’s recently elected President Netumba Nandi-Ndaitwah removed energy minister Natangwe Ithete from his position after just 7 months in the job and took over the role herself, denting hopes of reaching first oil from Venus and Mopane by 2030.

OPEC+ Ambition Tamed by Low Prices. As eight OPEC+ nations are set to meet to discuss December 2025 production quotas, media reports indicate that the Saudi Arabia-led group is leaning towards a modest 137,000 b/a month-over-month increase, avoiding abrupt moves.

Mozambique Sees Traction on Key LNG Project. French oil major TotalEnergies (NYSE:TTE) has finally lifted force majeure on its planned 13 mtpa Mozambique LNG project after a 4-year hiatus triggered by an Islamic State attack on the Cabo Delgado region, eyeing first gas in 2029.

Trump Doubles Down on Nuclear. Canada’s top miner Cameco (TSO:CCO) and investment firm Brookfield Asset Management have agreed to invest $80 billion to build new nuclear reactors across the US, teaming up with the Trump administration to reinvigorate jointly owned Westinghouse.

China’s Coal Output Quota to Last Longer. China’s coal mining industry is expecting a further tightening of Beijing’s production curbs, imposed in late August as a means to limit incessant supply increases, as the country’s regulators have asked coal producers to keep prices ‘reasonable’.

Pushing Failures Aside, Nigeria Dreams Big. Africa’s richest man Aliko Dangote announced he would seek to expand his 650,000 b/d refinery outside of Lagos, doubling the plant’s capacity to 1.4 million b/d by 2028 even if current utilization rates are only around 50-60%.

China Goes Hard on Underground Caverns. The International Gas Union’s latest annual report shows that China continues to boost its underground natural gas storage capacity, adding 6 bcm over the past year and now ranking 6th globally behind the United States and Russia.

Buoyant Copper Volatile on Trump News. Optimism about a China-US trade agreement lifted copper prices to their highest since May 2024 this week, touching $11,094 per metric tonne on Monday, only for traders to book profits and send the LME three-month contract back to $10,950/mt.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com