Previously, we reported that U.S. investors are increasingly pumping money into Canada’s fossil fuels sector, with U.S. funds now owing nearly 60% of Canada’s Oil & Gas sector thanks to low costs, favorable policy changes and the completion of the Trans Mountain Pipeline (TMX) expansion. That’s a major shift from a decade ago when global funds were busy divesting from Canadian oil sands driven by a combination of low global oil prices, high production costs, and increasing environmental concerns over pollution. Back then, the likes of Shell Plc (NYSE:SHEL), ConocoPhillips (NYSE:COP), Marathon Oil (NYSE:MRO) and Norway’s Statoil sold all or significant portions of their oil sands assets, as they prepared for “a low-carbon future.” Alberta oil sands are among the world’s most carbon-intensive large-scale crude oil operations, with a higher greenhouse gas emissions profile per barrel than many other types of crude oil.

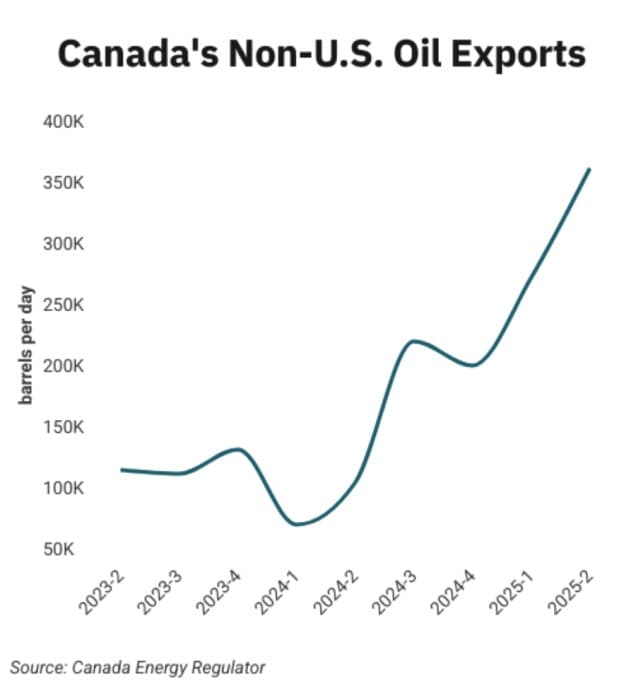

Well, it appears that Canada’s heavy oil is back in play, too. Demand for heavy Canadian oil has been surging lately, thanks to growing demand from China. Indeed, demand has grown so much that the discount on Canadian crude compared to West Texas Intermediate (WTI) crude has narrowed to just $10-$12 per barrel, much lower than ~ $50 per barrel they attracted seven years ago mainly due to pipeline bottlenecks. Completion of TMX has helped Canada export as much as 890,000 barrels of crude a day to China and Asia, pulling barrels away from the U.S. Midwest and Gulf Coast. According to Jeff Kralowetz, VP of business development at Argus Media, Canadian crude bound for China traded at a higher price in Vancouver than in the U.S. Gulf in October, with costs for larger tankers that typically ship from the U.S. Gulf rising faster compared to rates for the smaller vessels that ship out of Vancouver.

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Susan Bell, senior researcher at Rystad Energy, said.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Kevin Birn, chief analyst at S&P Global.

Source: EnergyNow

Canadian crude exports are primarily “heavy” oil from the Alberta oil sands, with the Western Canadian Select (WCS), a major heavy oil blend, having a low API gravity of around 19 to 22 degrees, compared to 38-44 degrees for “light” crudes, including from the Permian Basin in the United States. Heavy crude generally trades at a discount to light crude due to its lower quality, which makes it more difficult and expensive to refine due to its higher sulfur content.

Some refineries are specifically designed to process heavy, sour crude to improve their profit margins. However, a larger proportion of refineries need more expensive processing units to handle heavy crude compared to light crude. The discount reflects the extra refining costs, and can widen or narrow based on supply and demand, transportation costs, and pipeline capacity.

Falling Costs

One of the biggest attractions of the Canadian oil sector is falling costs. Existing Canadian oil sands projects have very low operating costs, with half-cycle breakeven prices as low as US$18-$45 per barrel (WTI basis), with an average of around $27/bbl. This is generally competitive with, or lower than, the operating costs of many U.S. tight oil plays. Meanwhile, technological upgrades and cost discipline by major existing oil sands producers have significantly lowered their full-cycle breakeven to a range of US$40.85-$43.10 per barrel, well below the US$65 average for U.S. shale drillers.

Related: Why Are Seattle Drivers Paying So Much More for Gas?

Canada’s oil sands heavyweight, Imperial Oil (NYSE:IMO), is a good case in point. Imperial Oil saves approximately CDN$30 million (US$22 million) a year by using Boston Dynamics‘ Spot robots (often referred to as “Spot dogs”) at its Cold Lake, Alberta facility.

The Spot robots perform routine and time-consuming equipment inspections and maintenance tasks, such as monitoring heat exchangers and oil/water interfaces. The robots can be deployed in hazardous environments or hard-to-reach areas, reducing potential human exposure to risk and the associated costs and downtime from safety incidents. By automating up to 70% of operator inspection rounds, the robots free up human workers to focus on more complex, higher-value, and critical tasks that require human judgment.

Further, the data collected by the robots’ various sensors (visual, thermal, acoustic, and gas detection) helps Imperial move toward predictive maintenance, allowing them to detect early signs of equipment failure and address issues before they cause costly downtime.

The increased automation has helped enhance the company’s overall operational efficiency, helping to contribute to a C$700 million boost to Imperial’s bottom line in 2024. Imperial’s earnings are projected to continue climbing to hit C$1.2 billion by 2027.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com