There is once again a great deal of noise regarding the oil glut. Some say it is the largest since COVID, while others are dismissing it as hype. By looking at data from the OECD, Kpler, the Oxford Energy Institute, and other independent analyses, it becomes clear that it is the composition and location of today’s oil glut that makes it particularly difficult to quantify.

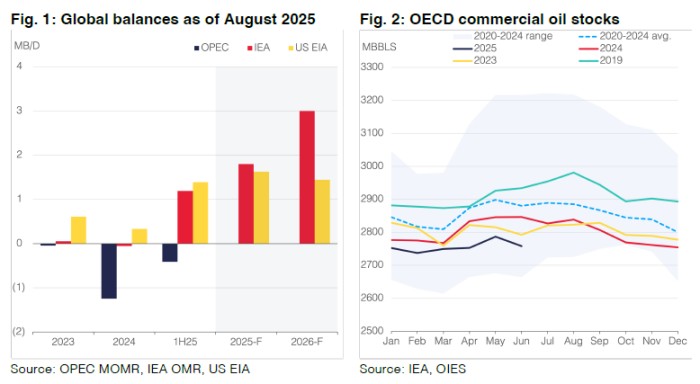

As has been noted in the recent Oxford Energy Institute report, despite repeated forecasts of surpluses, OECD stocks have barely budged. The buildup is happening mainly in non-OECD economies, with China almost single-handedly driving the trend. Ex-China, non-OECD stocks are broadly in line with their five-year average. The opacity is the problem: China provides no official inventory data, forcing traders to rely on satellite trackers and inferred balances. Estimates vary wildly, implied stock builds since 2023 top 800 million barrels in some models, while observable increases are closer to 110 million. Much of China’s strategic reserve sits in underground caverns, making verification nearly impossible.

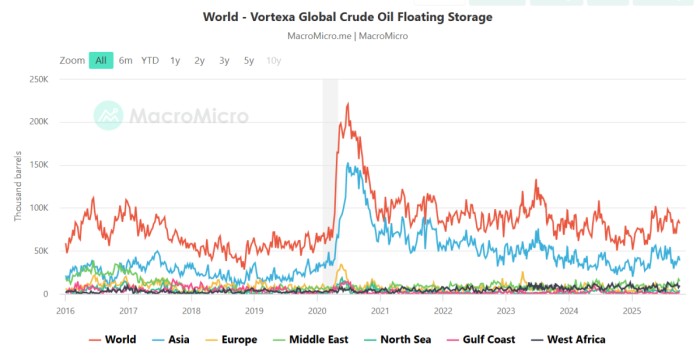

This opacity explains why satellite data like Kpler’s shows a flood of crude on the water while official inventories remain subdued. The ships are real, but much of that oil is still in transit, waiting for discharge or being diverted into opaque Chinese storage. It creates the illusion of a global glut when the physical barrels haven’t yet landed in transparent systems.

Source: Macromicro

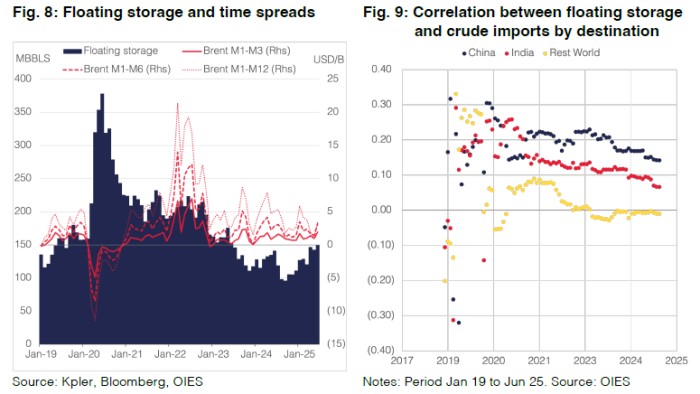

The OIES report maintains that stockpiling defies normal market logic, arguing that price structures do not point to a glut. Yet recent price movements suggest otherwise. Brent and WTI have shifted into contango, showing classic signs of easing balances and rising inventories. The market now appears to be behaving more in line with surplus dynamics, indicating that a glut may in fact be developing despite OIES’s interpretation.

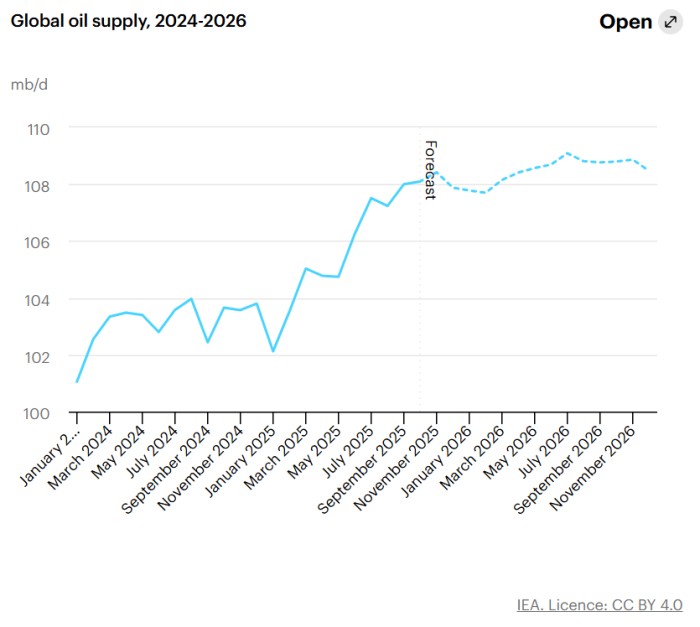

Then there is the International Energy Agency’s October report, which echoes that picture but scales it globally. The market ran an average surplus of 1.9 mb/d through the first nine months of 2025, adding 225 million barrels to world stocks – over a third in China. Outside China, inventories in advanced economies actually fell, and key pricing hubs like Cushing remain low. This split explains why prices have held firm even as global supply, up roughly 3 mb/d in 2025, outpaces demand growth of only about 700 kb/d.

Floating storage magnifies the effect. Sanctioned exporters such as Iran and Russia rely increasingly on offshore tankers and ship-to-ship transfers before cargoes reach China. The IEA estimates oil-on-water volumes jumped by 102 million barrels in the third quarter – the largest rise since the pandemic. Once those vessels discharge, onshore stocks outside China will finally rise, likely pressuring prices. These offshore “dark fleet” operations are effectively shadow storage under Chinese control, expanding Beijing’s ability to absorb crude outside conventional monitoring. It means part of the apparent oversupply is actually parked offshore as a strategic buffer, not a market excess.

Another interesting insight is the new refinery–petrochemical complexes in China are converting more crude into feedstocks like naphtha, absorbing barrels that don’t appear in export data. In 2025, China’s refined product exports fell roughly 10% year-on-year, even as refinery runs increased. Meanwhile, the IEA reports U.S. natural-gas-liquid inventories surged this year amid weak Chinese petrochemical demand. The result is a spatial imbalance: liquids build up in the U.S., crude pools in China, and middle-distillates stay tight elsewhere – creating the appearance of both glut and scarcity across different segments.

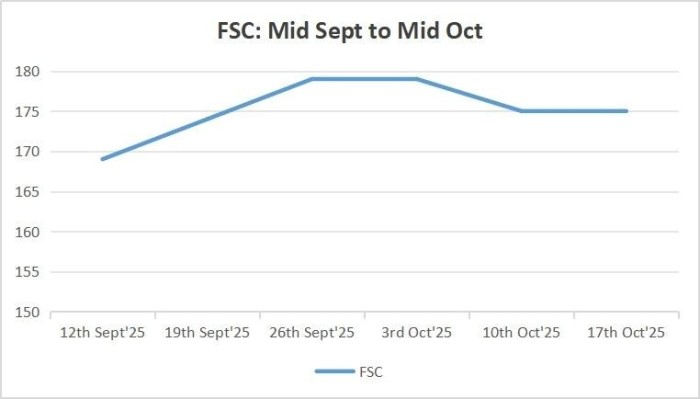

Among non-OPEC producers, the United States continues to stand out as the principal source of incremental supply. Recent field data point to a sector that remains remarkably steady, even as global benchmarks soften. According to Primary Vision’s latest indicators, both the Frac Spread Count and Frac Job Count have held near multi-week highs, reflecting stable completion activity across key shale basins. In mid-October, active spreads hovered in the mid-170s while job counts stayed just above 200 – virtually unchanged week-over-week and only slightly below late-September peaks. This steadiness suggests that operators are maintaining a full slate of work despite lower prices, supported by sustained efficiency gains and robust well productivity.

Put together, the explanations are multiple and overlapping: cheap prices, new legal mandates, expanded storage, diversification away from the dollar, insurance against sanctions, petrochemical demand, and potential military contingencies. None can be ruled out, and all may be true at once. What remains undeniable is that China has become the key sink for surplus crude, shaping both the perception of an oil glut and the trajectory of prices. Whether opportunism, strategy, or preparation for darker scenarios, Beijing has good reasons, even if opaque, to keep buying barrels it doesn’t seem to need.

The result is what traders now call a “stealth surplus”: global supply quietly exceeds demand, but the excess is absorbed into China’s opaque system rather than visible inventories. The market is oversupplied in reality, yet still looks tight on paper. When Chinese buying slows or storage fills, that hidden surplus will surface quickly – turning today’s calm into tomorrow’s glut.

By Osama Rizvi for Oilprice.com

More Top Reads From Oilprice.com: