Donald Trump rattled markets again by threatening secondary sanctions on Russian energy buyers and setting a tighter ceasefire deadline for Moscow, driving Brent crude above $70 as traders also eyed progress on US-China trade talks.

Trump’s $750 Billion Energy Export Vow Has Failed Already

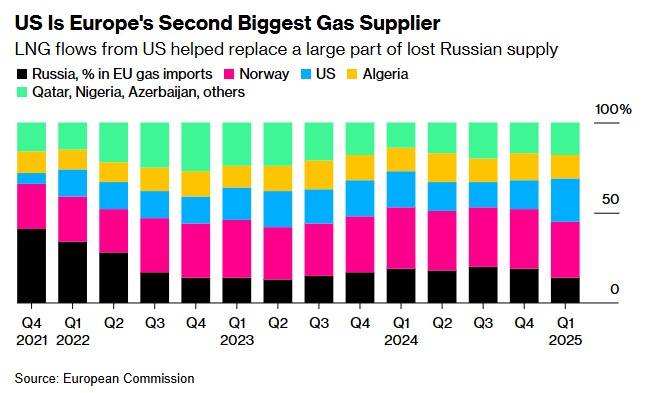

– One of the key tenets of the US-EU trade deal, namely that European countries would buy $750 billion of American energy over the next three years, would be close to impossible to achieve.

– Europe’s total energy imports from the US already totalled slightly south of $80 billion last year, after LNG deliveries ticked in at 36 million tonnes and crude oil supplies soared to a record 74.5 million tonnes.

– Tripling current energy flows would be a Herculean task, with European refining demand handicapped by the closure of four plants in 2025 and regional gas consumption to increase by 1.5% from last year, equivalent to roughly 3 million metric tonnes of incremental LNG.

– The pledge could be further watered down by the EU counting its investments into the US energy sector as part of the $750 billion, as well as Brussels counting new nuclear projects into it even if none of the small nuclear reactors would see daylight this decade.

Market Movers

– Global mining giant Rio Tinto (NYSE:RIO) is reportedly considering the sale of its titanium unit due to weak prices and low returns, finding it hard to compete with mushrooming Chinese mines.

– US LNG developer Venture Global (NYSE:VG) announced that it had reached a final investment decision on the $15 billion Calcasieu Pass 2 project, aiming for peak capacity of 28 mtpa with first deliveries starting in 2027.

– US power company Duke Energy (NYSE:DUK) stated it would sell its Tennessee natural gas distribution business to regional utility firm Spire (NYSE:SR) for $2.5 billion in cash, seeking to unlock capital to invest in grid upgrades.

– Thailand’s national oil company PTT bought out the 50% ownership share of US oil major Chevron (NYSE:CVX) from the offshore A-18 block in the Malaysia-Thailand Joint Development Area for $450 million, taken over following its Hess acquisition.

Tuesday, July 29, 2025

Donald Trump continues to be the main newsmaker across the globe, shortening the deadline for Russia to make progress on its Ukraine ceasefire talks, threatening secondary sanctions on buyers of Russian energy. This was enough to lift ICE Brent futures above $70 per barrel, further buoyed by market optimism that US-China trade talks could bear fruition after Trump squeezed out a deal from the European Union.

OPEC+ Calls For Better Compliance. Ahead of the full OPEC+ meeting this Sunday, ministers from the Joint Ministerial Monitoring Committee reiterated the oil group’s need for better compliance with oil production quotas, asking non-compliant nations for compensation plans by August 18.

Qatar Threatens EU over Human Rights Regulations. Qatar has threatened to cut LNG deliveries to Europe if Brussels doesn’t amend its corporate sustainability due diligence directive, which requires regional buyers to find and disclose human rights and climate policy violations in their supply chains.

Norway Still Suffers From Compressor Blues. Problems with the Hammerfest LNG terminal’s compressor system have prompted Norway’s state oil company Equinor (NYSE:EQNR) to extended its three-month maintenance outage at Europe’s largest LNG export facility to August 3.

The American AI Boom Is Straining the US Grid. The rapid rise of power demand from data centre developers has prompted US grid operator PJM, covering most of America’s Mideast, to issue nine top-level emergency alerts over the past five weeks, compared to just one last summer.

It’s Good to Be a Vitol Employee. Global trading house Vitol Group paid out $10.6 billion through its employee buyback scheme last year, the highest ever payments after its share buybacks soared to a then-record $6.4 billion in 2023, even though the firm’s net profit fell from its 2022-2023 peak.

Trump Lays into UK Oil Policy. US President Donald Trump criticized the United Kingdom’s oil and gas policy, describing the North Sea as a ‘treasure chest for the country’ and called on the Starmer government to lower its 78% windfall profit tax to incentivize oil drillers to produce more.

Aided by the State, Mexico’s Oil Industry Churns Out Profits. Mexico’s national oil company Pemex reported a net profit of $3.17 billion in Q2 2025, despite its revenues falling 4.4% compared to Q1 on lower oil prices, with the NOC reporting a $5 billion financial stimulus from the Mexican government.

Brussels Seeks to Derail UAE’s Expansion. The European Commission has opened an in-depth investigation of ADNOC’s $17 billion bid for German chemicals giant Covestro, agreed in October 2024, alleging that UAE subsidies and capital increases could distort Europe’s internal market.

Russia Slaps Ban on All Gasoline Exports. The Russian government imposed a full ban on the exports of gasoline until the end of August, citing runaway domestic prices that have come within a whisker of surpassing the all-time high of ?76,875 per metric tonne ($970/mt) from September 2023.

Baker Hughes Expands Into LNG Equipment. US drilling giant Baker Hughes (NASDAQ:BKR) agreed to buy Chart Industries in a $13.6 billion all-cash deal, marking this year’s largest oil services M&A deal to date, boosting its exposure to valve and measurement technology in LNG and gas projects.

Sanctioned Refiner Takes Microsoft to Court. Russian-backed Indian refiner Nayara Energy, having appointed a new CEO in Sergey Denisov this week, started legal proceedings against Microsoft (NASDAQ:MSFT) following the unilateral suspension of its Outlook email accounts and Teams.

Global Coal Mining Capacity Tapers Off. New coal mining capacity fell to a 10-year low last year, with miners worldwide adding just 105 million tonnes of capacity, however researchers warn that the slowdown in China and India is mostly down to delays in regulatory approvals.

Chile Talks Will Define Copper’s Next Move. Prices of copper have been easing lately, with the LME three-month contract dipping to $9,760 per metric tonne after Chile asked the Trump administration to include copper in their upcoming trade talks, potentially exempting it from the punitive 50% tariff.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com