(Oil Price)– The discovery of the massive Vaca Muerta shale play was a game changer for the economically troubled South American nation of Argentina. The country, which with 2024 gross domestic product of $632 billion ranks as the second largest economy in South America and third largest in the broader region of Latin America, is rapidly becoming one of the region’s leading hydrocarbon producers.

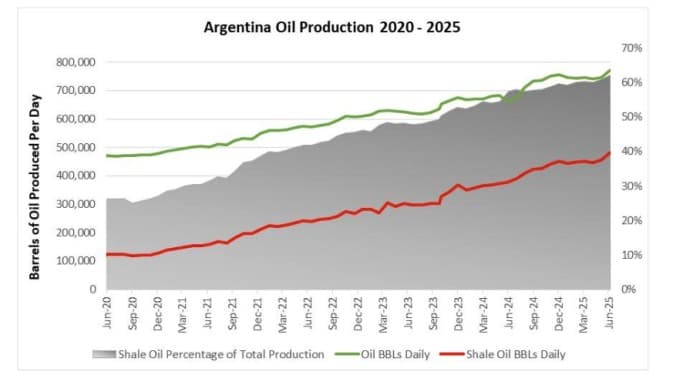

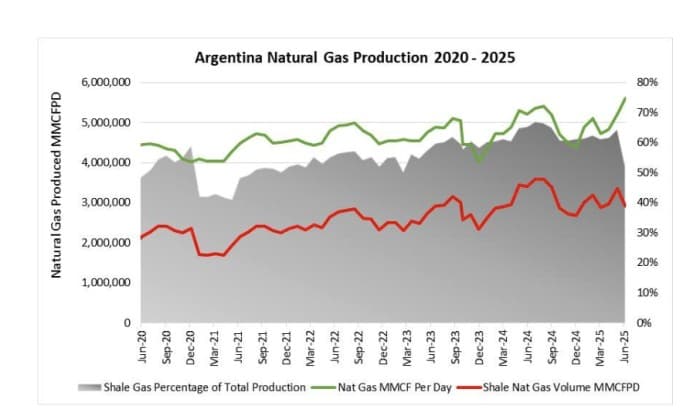

The latest data from Argentina’s Ministry of Economy shows shale oil production hit an all-time high for June 2025, although overall petroleum output dipped lower. Meanwhile, all important natural gas output registered a new high for June 2025, with stronger-than-expected conventional field production bolstering overall output after a decline in shale gas volumes.

Argentina’s hydrocarbon output continues to expand at a solid clip, despite the country’s numerous economic and social challenges. This is due to the tremendous hydrocarbon potential of the 8.6-million-acre Vaca Muerta shale formation, located in the Neuquén Basin. The geological body, despite being discovered in 1927, did not have its hydrocarbon potential fully evaluated until 2011 when it was determined the formation contains an estimated 16 billion barrels of recoverable shale oil along with 308 trillion cubic feet of shale gas.

Those gargantuan numbers make the Vaca Muerta one of the top five unconventional hydrocarbon formations globally, with it containing the world’s fourth-largest shale oil and second-largest shale gas resources. Indeed, the geological body is now being compared to the prolific world-class U.S. Permian Shale, underscoring its considerable potential. The successful exploitation of the Vaca Muerta will not only be a silver bullet for Argentina’s crisis-prone economy but will also make the country a leading South American oil and natural gas producer.

Official government data shows Argentina lifted an average of 771,888 barrels of crude oil per day during June 2025, more than 62% weighted to shale oil the largest proportion reported yet.

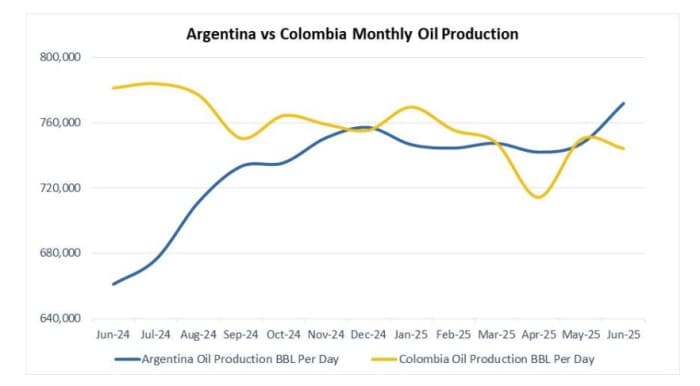

Argentina’s June 2025 oil output is 3.32% higher month over month and a whopping 16.79% greater than the same period a year earlier. As a result, the country’s petroleum production once again exceeded Colombia, making Argentina Latin America’s fourth-largest oil producer.

Argentina’s natural gas output is also growing at a solid clip it driven by the exploitation of the Vaca Muerta. For June 2025, natural gas production hit an all-time high of 5.6 billion cubic feet per day, which was a notable 7.5% increase compared to a month prior and 7.59% higher year over year.

Remarkably, that record output was achieved despite a sharp decline in shale gas production, which fell by 13.31% month over month and 14.44% year over year to just under 2.5 billion cubic feet per day for June 2025. As a consequence, shale gas accounted for only 52% of all natural gas lifted, representing a significant reduction from previous months, when it exceeded 60% since the start of 2024.

Impressively, Argentina reported strong production numbers despite the rig count falling. According to industry consultancy Baker Hughes, at the end of June 2025, there were 42 active rigs (30 oil and 12 gas) compared to 50 rigs (38 oil and 12 gas) a year earlier. This indicates the operational efficiency of shale oil and gas operations in the Vaca Muerta is improving, with overall hydrocarbon output rising despite a drop in the number of active rigs. It also underscores the improved performance of aging mature conventional oil and gas fields in the provinces of Río Negro, La Pampa, and Mendoza. Those trends bode well for further growth, even if industry investment flattens out, which is a risk because of Argentina’s fragile economy, despite Milei’s strong fiscal reforms, and ongoing geopolitical uncertainty impacting oil prices.

For these reasons, Argentina’s Neuquén Basin, where Vaca Muerta is located, is now the country’s largest hydrocarbon-producing sedimentary province and is responsible for nearly all the production growth experienced over the last decade. For June 2025, 72% of all oil and 73.5% of natural gas produced in Argentina were lifted in the Neuquén basin while for the first six months, the geological formation pumped 71% of all oil and natural gas pumped during that period. Consequently, Neuquén is now Argentina’s leading hydrocarbon-producing province. Output will keep expanding with $9 billion of petroleum investment expected in Neuquén during 2025 alone, most of which will be directed to the Vaca Muerta.

National oil company YPF, the largest hydrocarbon producer in the Vaca Muerta and Argentina, is responsible for most of that investment and subsequent production growth. The company will inject up to $5.2 billion into its portfolio in 2025, with approximately two-thirds, or $3.6 billion, of that capital allocated to upstream assets. This forms part of YPF’s nearly $36 billion investment plan for 2025 to 2030. Argentina’s national oil company anticipates that net shale oil production will reach 470,000 barrels per day by 2030. This is nearly four times greater than the 122,000 barrels per day lifted by YPF during 2024 and three times more than the 172,000 barrels per day extracted for the first six months of 2025.

Argentina’s hydrocarbon output is expected to rise further over the coming months as additional key infrastructure, notably transport and storage facilities, comes online. Significant infrastructure upgrades in Argentina’s oil patch are responsible for the Vaca Muerta’s notable uptick in hydrocarbon production since the 2020 COVID-19 pandemic. The August 2023 completion of the 900 million cubic feet per day Perito Moreno gas pipeline, along with its related pressurization facilities, boosted takeaway capacity, allowing drillers to increase production. This facility is being expanded, which upon completion in 2027 will lift daily transportation capacity to 1.4 billion cubic feet of natural gas per day.

Another important piece of infrastructure currently under construction is the 550,000-barrel-per-day Vaca Muerta Sur Oil Pipeline. This facility will connect the Loma Campana field in Neuquén Province to an export facility being built at the port of Punta Colorada in Río Negro Province. Upon completion, the pipeline will substantially increase takeaway capacity, thereby allowing hydrocarbon output to expand further. Pampa Energy, the Vaca Muerta’s eleventh-largest shale oil producer, invested $426 million to build a hydrocarbon treatment plant at the Rincon de Aranda field in Neuquén province. This is part of a $1.5 billion investment plan that will allow Pampa to scale up operations at the Rincon de Aranda field, which is pumping around 3,103 barrels of shale oil and 1.2 million cubic feet of shale gas per day. Those events demonstrate the feverish rate at which critical infrastructure is being built out so production will expand at a solid clip.

The Vaca Muerta shale continues to exceed all expectations, with the formation on track to become a recognized world-class asset for producing unconventional oil and natural gas. As additional critical infrastructure comes online and Argentina’s economy stabilizes, because of President Javier Milei’s strong pro-business reforms, foreign investment in the Vaca Muerta will rise, driving further development and production growth. The appeal of the shale formation is boosted by its low operating overheads, with lifting costs of around $5 per barrel, and Buenos Aires’ commitment to attracting investment by easing regulation, with capital controls to be removed in early 2026. For these reasons, Argentina’s oil production is on track to exceed one million barrels per day by 2030, cementing its place as South America’s third-largest oil producer.

By Matthew Smith for Oilprice.com