(WO) — TotalEnergies has agreed to sell its 45% operated interest in two unconventional oil and gas blocks in Argentina’s Vaca Muerta play to YPF SA for $500 million.

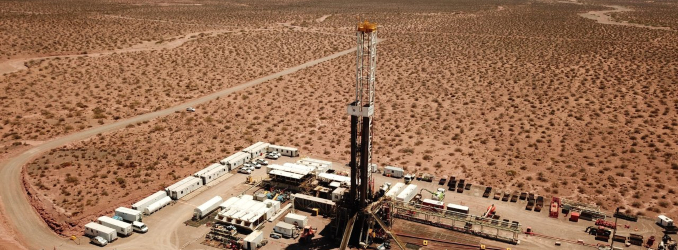

The assets, Rincon La Ceniza and La Escalonada, span 51,000 net acres in the Neuquén Basin and are in the pilot development phase. Total Austral, a TotalEnergies affiliate, operates the blocks alongside Gas y Petroleo de Neuquen (10%) and O&G Developments LTD S.A, owned by Shell (45%).

“The sale of Rincon La Ceniza and La Escalonada blocks is part of our active portfolio management strategy. TotalEnergies remains fully committed to Argentina, where it operates a large unconventional area of 183,000 nets acres in the Vaca Muerta play, after the divestment of these two blocks which represented around 20% of our net acreage in that play,” said Javier Rielo, Senior Vice President Americas, Exploration & Production at TotalEnergies. “The Company is currently producing gas and condensates from the operated blocks Aguada Pichana Este and San Roque, with a combined production of around 50,000 boe/d in TotalEnergies share in 2024. This transaction allows us to unlock value from part of our portfolio, while focusing on the development of our core assets in the Neuquén Basin and in the offshore of Tierra del Fuego.”

The transaction is subject to customary closing conditions.