India has added just 5 per cent to its refining capacity over the past seven years—a sharp contrast to the 69 per cent expansion originally planned by 2025. A mix of climate-related demand uncertainty, land constraints, and the pandemic has slowed progress, further deepening the country’s dependence on energy imports.

India’s refining capacity was projected to rise from 245 million tonnes per annum (mtpa) in 2017-18 to 414 mtpa by 2025 and 439 mtpa by 2030, according to a 2018 report by an official panel of oil ministry officials and industry executives, which based its projection on “firm plans” by refiners.

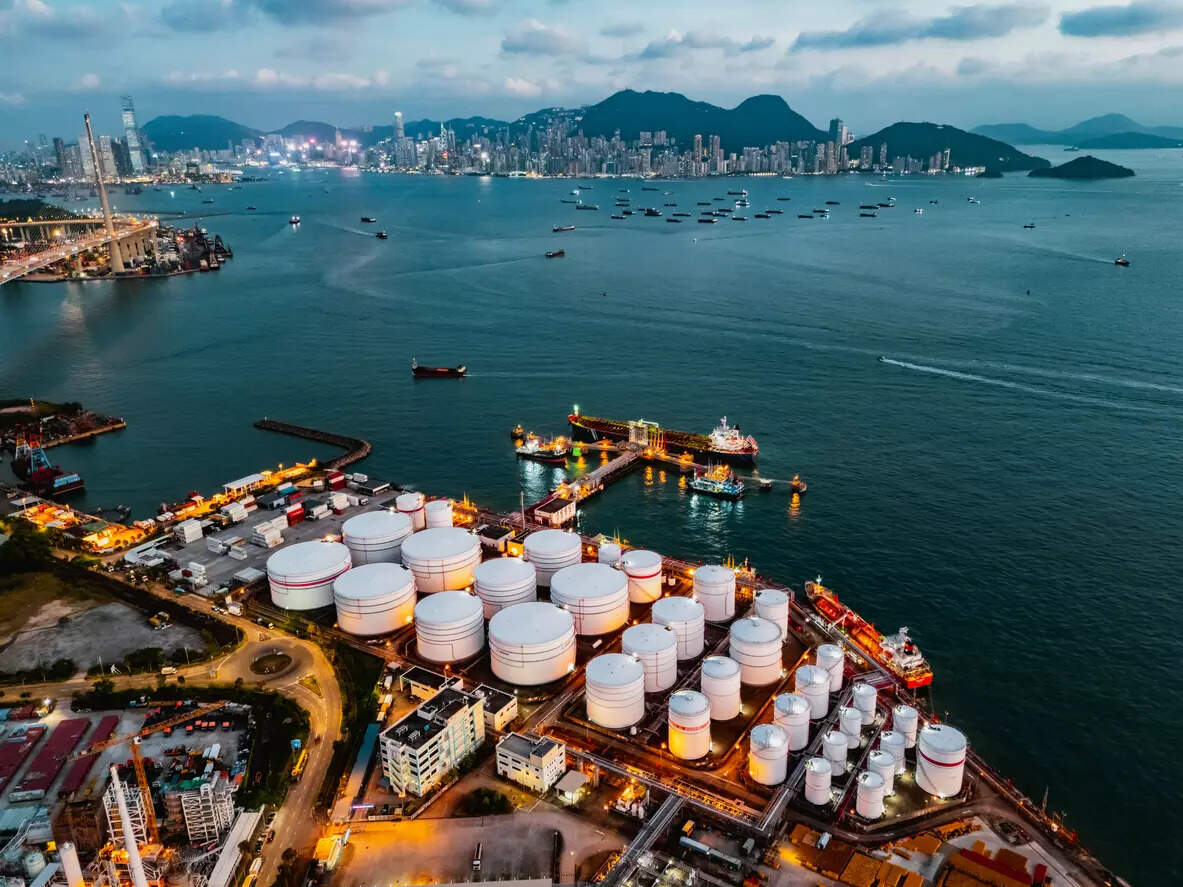

The refining capacity, however, has risen to just 258 mtpa, according to oil ministry data. The major misses included the India-Saudi 60 mtpa greenfield joint venture project, Rosneft-backed Nayara Energy’s 25 mtpa expansion, Reliance Industries’ 7.5 mtpa addition, and Indian Oil’s 34 mtpa target.

The BPCL-NRL combined capacity expanded by 2 mtpa, compared to a projected 26.4 mtpa by 2025, while the HPCL-ONGC group achieved an 11 mtpa increase—the largest by any group—against its 23 mtpa target. Some expansion projects, including those by Indian Oil and HPCL, are under construction and expected to come online over the next few years.

Indian Oil, HPCL, BPCL, RIL, and Nayara declined to comment.

Slower expansion, coupled with surging domestic demand, has pushed up India’s imports of petroleum products by 43 per cent in seven years to 2024-25, while exports have declined by 3 per cent in volume terms.

B Ashok, former chairman of Indian Oil, says the uncertainty over the impact of energy transition policies, both domestically and globally, has “made decision-makers more circumspect”. While acknowledging that refineries are “high capex and high gestation projects”, he warned that India needs fast-executed greenfield refinery projects to support its rapidly expanding economy. These projects, however, must incorporate new technologies to address green concerns and be backed by new risk-sharing models, he said.

B Anand, former CEO of Nayara Energy and of the TCG Group’s petrochemical business, also agrees that the shadow of transition looms over refinery growth. “Globally, the refining growth story is diminishing. Access to new-age capital for hydrocarbons due to net zero concerns has reduced,” he said.

Ashok added that climate efforts are generating competing demand for capital. “With emphasis on transition and climate impact mitigation efforts, the capital requirements within the organisations are varied and stretched. These are also impacting the view of future refining projects,” said Ashok, who also led the India-Saudi joint venture project, which didn’t take off primarily due to land constraints.

Anand says India should focus on petrochemicals, as demand is expected to rise with rapid urbanisation and e-commerce. “For India, building new refineries with so much crude import dependence is not a good idea. We should instead focus on investing in petrochemicals, which has a promising future,” he said.