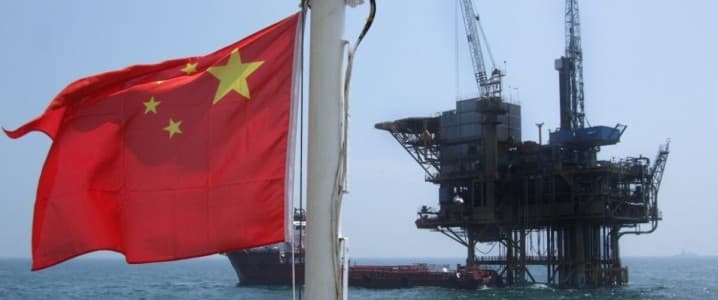

China National Offshore Oil Corporation (CNOOC) has fully launched the second phase of its Deep-Sea No. 1 natural gas project in the South China Sea, boosting domestic output by 4.5 billion cubic meters (bcm) per year. The project, China’s largest deepwater gas development to date, officially reached full capacity on June 26, according to CNOOC officials cited by China Daily.

With total geological reserves exceeding 150 bcm, Deep-Sea No. 1 is seen as a cornerstone of China’s efforts to strengthen energy security and reduce reliance on imported liquefied natural gas (LNG). Phase one of the field began operating in 2021. Gas from the field is now flowing to mainland cities including Sanya, Zhuhai, and Hong Kong via subsea pipelines.

The second-phase expansion includes high-pressure wells drilled more than 1,500 meters beneath the seabed and over 100 kilometers offshore. CNOOC engineers have called it one of the company’s most technically complex projects to date, highlighting both deepwater drilling and long-distance gas transport as major engineering achievements.

The ramp-up comes amid Beijing’s broader strategy to replace coal with cleaner fuels while advancing long-term carbon neutrality goals. Natural gas currently makes up about 9 percent of China’s primary energy mix, and the government has prioritized domestic gas development as part of its five-year energy security plan.

Energy analysts note that increased output from fields like Deep-Sea No. 1 will help China manage seasonal demand peaks, reduce LNG import costs, and stabilize supply to the country’s southern coastal industrial base.

CNOOC, which specializes in offshore oil and gas developments in China and internationally, reported earlier this year that its net oil and gas production for 2024 was about 720 million barrels of oil equivalent—setting a record high for the sixth consecutive year. It also booked a profit jump of 11.4% for 2024, to $19 billion, on the back of the record-breaking production rate.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com