Oil markets remain hostage to Trump-driven uncertainty, as mixed signals on India’s stance toward Russian crude collide with renewed speculation around U.S.–Iran nuclear talks.

Could Oil Be Back in Vogue?

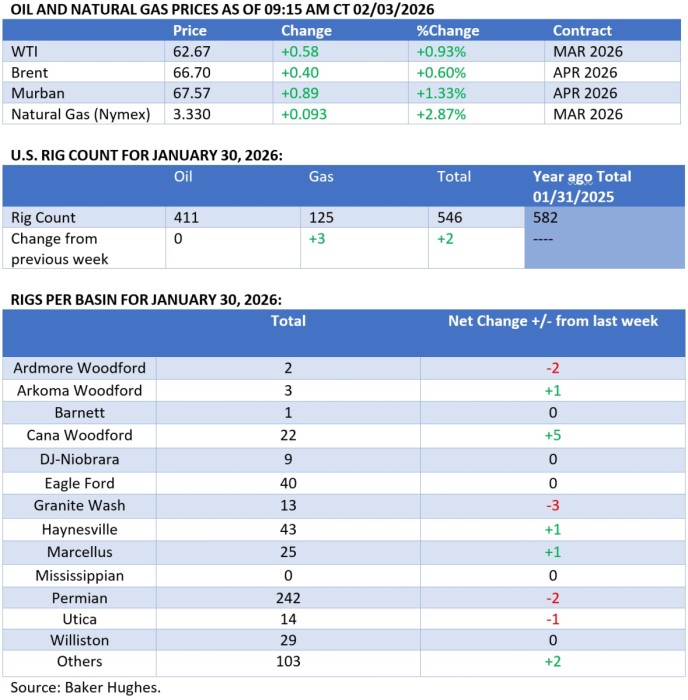

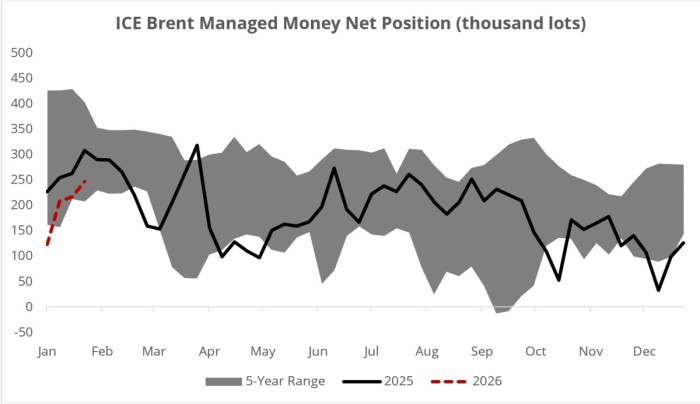

– 2026 was dubbed the year of oversupply, however January prices were in line with last year’s levels (ICE Brent averaged $64.7 per barrel and closed the month at $70.7 per barrel), defying gloomy demand predictions.

– Trump’s erratic comments on Iran, first promising to act ‘with speed and violence’ against Iran and then agreeing to high-level nuclear talks in Istanbul, have brought back oil’s lost geopolitical premium.

– Open interest held in ICE Brent futures rose to its highest on record January 26, totalling a hefty 2.65 million contracts (it has dropped by more than 200,000 lots since).

– Hedge funds’ positioning has also turned bullish, with the net length held by money managers in ICE Brent futures and options doubling since the beginning of 2026 to 246,917 contracts, the highest reading since early September 2025.

Market Movers

– Norway’s state oil company Equinor (NYSE:EQNR) has agreed to sell its onshore business in Argentina’s Vaca Muerta shale play, currently producing 25,000 boe/d, to local producer Vista Energy for $1.1 billion, half paid in cash and the other half in Vista shares.

– Shell’s (LON:SHEL) Nigerian subsidiary will suspend production at the 125,000 b/d Bonga field in Nigeria’s deepwater offshore to carry out planned maintenance works at the project’s dedicated FPSO vessel.

– US LNG developer Excelerate Energy (NYSE:EE) has agreed to jointly develop a 1.5 mtpa LNG import terminal at India’s eastern Haldia port together with local firm Invenire Energy, set to become India’s first FSRU unit.

– QatarEnergy, one of the top LNG suppliers globally, has signed a 27-year term deal with Japan’s leading utility company JERA to supply 3 million tonnes of LNG annually from 2028 onwards.

Tuesday, February 03, 2026

Trump continues to set the mood for oil prices, with the US-India trade deal sending another ripple of uncertainty into the markets regarding the future of Russian oil exports. Indian refiners have so far kept mum about them stopping said purchases, leaving President Trump to be so far the only public figure to confirm India’s import ban. Concurrently, US-Iran nuclear talks could heat up the speculative part of the markets, providing a price floor under ICE Brent, currently trading at $67 per barrel.

OPEC+ Keeps Waiting as Prices Dip. Faced with an unpredictable Trump policy on Iran, OPEC+ members voted to keep production quotas flat in March 2026, sticking to their talking point of global oil demand in Q1 being lower than in other periods of the year, with the next meeting set for March 1.

US-India Trade Deal Puts Russian Supply at Risk. Donald Trump announced that India would halt Russian oil purchases as part of a wider US-India trade deal to lower US tariffs from the current 50% to 18%; however, Indian officials have so far refrained from any comments on lower Russian imports.

Russia Lifts Gasoline Export Ban for Producers. Russia’s government has lifted a ban on gasoline exports, first introduced in March 2025 after a series of Ukrainian drone strikes damaged Russian refineries; however, non-producers (i.e. traders) would still be barred from exporting until July 31.

Malaysia Arrests Iranian Crude Tankers. Malaysia’s Maritime Enforcement Agency claims to have detained two tankers carrying out an illegal STS transfer in its waters, both the 24-year old Nora and the 20-year old Rcelebra have been seen moving towards Chinese waters after the arrest.

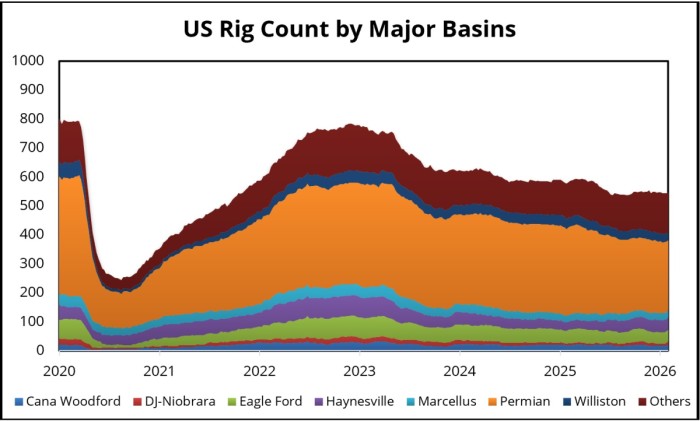

US Shale’s Largest 2026 Merger Is On. US shale specialists Devon Energy (NYSE:DVN) and Coterra Energy (NYSE:CTRA) have agreed to merge in a $58 billion all-stock deal, expecting to close the deal by Q2 2026 only to continue keeping the Devon name and keep its headquarters in Houston.

Mexico Told to Stop Supplying Oil to Cuba. US President Trump ordered Mexico to halt crude oil deliveries to Cuba after the White House labelled the island country ‘an unusual and extraordinary threat’ to US national security, sending on average one Aframax tanker per month in 2025.

Libya Eyes Higher Gas Exports to Europe. Libya has set its sight on increasing natural gas exports to Europe by the early 2030s, banking on the return of oil majors to its upstream sector, as the 10 bcm/year capacity Greenstream pipeline to Italy has only been utilized at 10% capacity recently.

Seesawing Gold Rebounds Again. Gold prices have posted their largest daily gain in 17 years today, jumping back to $4,920 per ounce after the market started to recover from last week’s massive precious metal sell-off, prompted by Trump’s announcement of the new Federal Reserve chairman.

Dangote Reaches Out to China for Help. Nigeria’s 650,000 bld giant Dangote refinery has reached a strategic partnership with China’s state-backed construction company XCMG to jointly develop service solutions for its upcoming petrochemicals expansion, particularly on polypropylene.

US Launches Critical Minerals Stockpiling Drive. The Trump administration has started to build a strategic critical-minerals depository with $12 billion in seed money to counter dependence on China, with the US Ex-Im Bank loaning $10 billion to the joint venture that includes GM, Boeing and Google.

Venezuela’s Exports Recover Under Trump’s Control. Following the US abduction of President Nicolas Maduro, Venezuela’s oil exports have been steadily recovering and averaged 800,000 b/d in January, with trading houses Vitol and Trafigura accounting for half all exported volumes.

Africa Banks on Solar Boom. Africa recorded its fastest solar growth in history last year, adding 4.5 GW of new capacity and exceeding industry forecasts, with more than a third of that coming from South Africa alone as other regional powerhouses such as Nigeria lag behind (installing 0.8 GW).

Indonesian Coal Gets Stuck in Quota Limbo. Indonesian miners paused spot coal exports after the country’s authorities issued 2026 individual production quotas some 40-70% lower than last year’s levels, suggesting Jakarta seeks to increase the profitability of mining by generally slashing output.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com