Oil prices were flat in early Asian trading on Monday as markets digested the dramatic capture of Venezuela’s President, Nicolás Maduro, by the U.S. military. Against the backdrop of an oversupplied crude market and steady OPEC+ policy, traders appeared content to await tangible physical developments in the market rather than bet on a short term supply shock or the longer-term return of Venezuelan crude to markets.

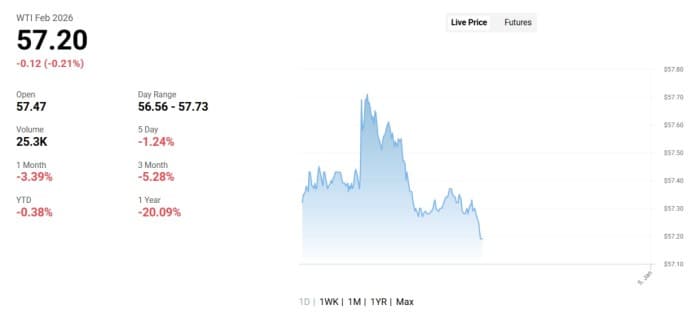

At the time of writing, West Texas Intermediate futures were down 0.21% at $57.20 after climbing to $57.69 at the start of the session.

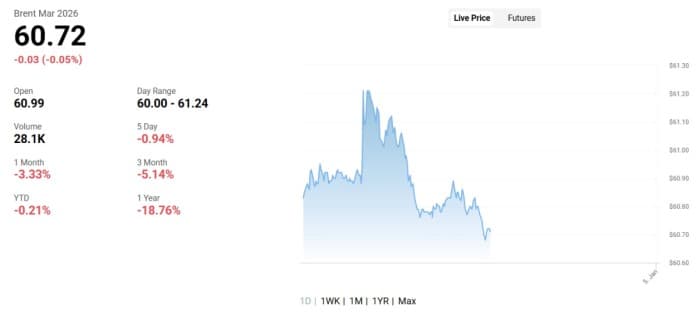

Brent, meanwhile, was trading flat at $60.72 after seeing a similar slight rise at the start of the session.

The prevailing sentiment amongst oil analysts seems to be that the capture of Maduro will result in even more oil entering the market in the medium- to long-term, with President Trump making it very clear that he wants U.S. oil majors to re-enter the country.

The fact that the two countries appear to have avoided a full-scale war suggests a significant supply disruption is less likely, although Venezuela’s state oil company, PDVSA, is moving to cut oil output as it runs out of storage capacity due to the U.S. blockade of exports.

Adding to the restrained market reaction, OPEC+ reaffirmed its decision to hold output steady at its meeting on Sunday, emphasizing its commitment to market stability.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com