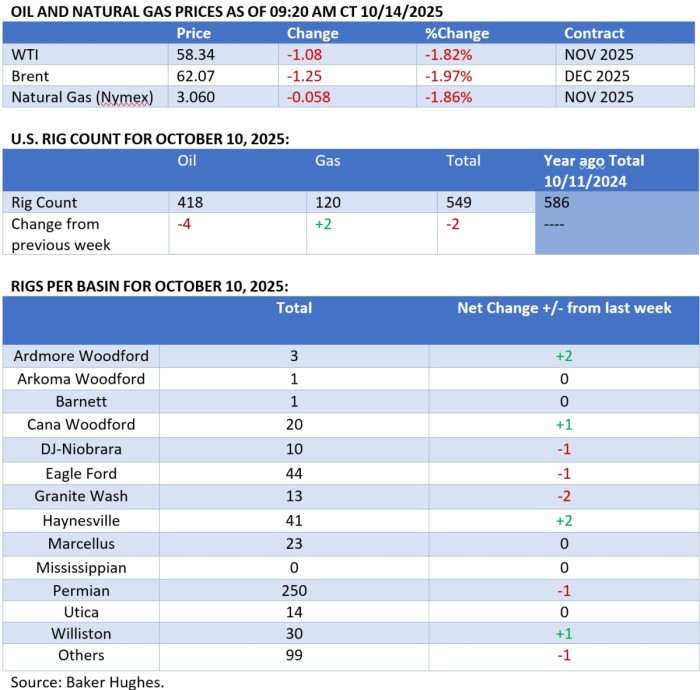

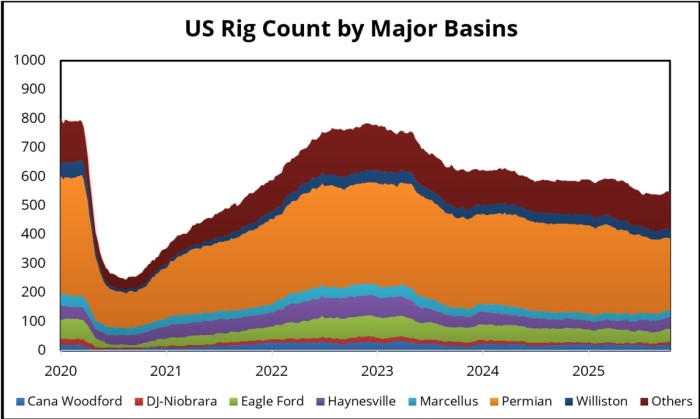

(Oil Price)– The prospect of a contango is casting a shadow over oil markets, with the entire 2026 WTI futures curve now trading below $60 per barrel—beneath breakeven levels for most new shale wells. TotalEnergies CEO Patrick Pouyanné and Vitol’s Russel Hardy warn that prices this low could cut U.S. shale output by 200,000 to 300,000 barrels per day next year, tightening supply just as demand steadies.

Backwardation Fades: Crude Market Signals Trouble Ahead for 2026

The spectre of a looming contango is haunting crude oil markets, especially now that the entire WTI futures contract curve for 2026 trades below $60 per barrel, i.e. below breakeven levels for most new shale wells.

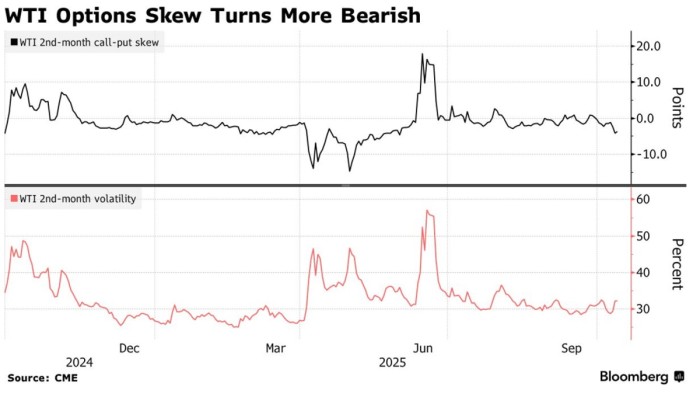

Backwardation, the hallmark of sanctions-impacted 2023 and 2024, now only extends until February 2026, with a mere 70 cents separating the November and February futures contracts.

Whilst ICE Brent futures show the same narrowing backwardation trend, there’s still almost $1 per barrel of a difference between Dated and ICE Brent, suggesting pockets of physical strength for November-loading cargoes.

Positioning of hedge fund money managers reflects the doom and gloom with the net length held in WTI futures and options currently at 29,410 contracts, 15% of what it was at the beginning of this year.

Market Movers

– US LNG developer Venture Global (NYSE:VG) reached an arbitration settlement with China’s state-controlled Unipec over its failure to deliver cargoes under a 3-year fixed-price contract, avoiding an arbitration litigation akin to BP.

– Canadian oil producer Strathcona Resources formally abandoned its hostile takeover bid for peer producer MEG Energy (TSO:MEG), paving the way for a prospective MEG-Cenovus merger despite it owning 14.2% of the former.

– US oil major Chevron (NYSE:CVX) is close to signing an exploration deal with the Greek government to develop four deepwater blocks south of the island of Crete, with surveying set to start in 2026 already.

– UK-based energy major Shell (LON:SHEL) has greenlighted the development of the HI offshore gas field in Nigeria for an estimated cost of $2 billion, alongside joint venture partner Sunlink Energies.

Tuesday, October 14, 2025

Resurgent US-China trade tensions have dealt a painful blow to oil sentiment at large, as President Trump’s reimposition of 100% import tariffs from November 1 (over and above the 30% currently in place) bodes ill for the global economy in 2026. With backwardation at its shallowest since January 2024, ICE Brent at $62 per barrel feels more of a temporary level before the next big slide.

OPEC Downplays 2026 Supply Surplus. OPEC kept its demand forecast for 2025 and 2026, questioning the danger of a supply surplus next year, saying that if OPEC+ kept production at its September 2025 levels, balances would remain at a deficit.

Saudi Arabia Spends Big on Algeria. Algeria’s state-owned oil firm Sonatrach reported that it had signed a $5.4 billion contract with Saudi Arabia’s Midad Energy to develop oil and gas fields in the Illizi Basin, with a production-sharing contract signed for 30 years.

Iraq Flaunts Idea of OPEC+ Quota Review. Iraq’s prime minister Mohammed al-Sudani has called for a formal review of the country’s 4.43 million b/d OPEC+ production quota, citing reconstruction needs and rapid population growth as Kurdish exports restarted.

Kuwait Boosts Its Offshore Tally. Kuwait Oil Company, the upstream arm of national oil firm KPC, made an offshore gas discovery with its Jazza exploration well, with the field spanning 16 square miles and estimated to hold around 1 TCf of natural gas.

Sanctions Derail Chinese Oil Imports. Last week’s US sanctions on the key Rizhao crude oil terminal have prompted China’s leading refiner Sinopec to divert the 2-million-barrel New Vista supertanker carrying the UAE grade Upper Zakum, seeking a new port.

India Aims to Hedge Its Hydro Generation. India’s power planning authority has launched a $77 billion expansion plan to move 76 GW of hydro generation away from the Brahmaputra Basin bordering China, as Beijing could cut dry-season flows by 85%.

China Slashes September Rare Earth Exports. Chinese rare earth exports fell to 4,000 metric tonnes in September, marking a 31% decline month-over-month and the third consecutive monthly drop as Beijing tightens the screws on flows to Western buyers.

Australia Wants Key Mineral Deal with US. The Australian government is considering the introduction of mandated floor prices for critical minerals, building out a $800 million strategic metal reserve, and joint funding of new mining projects with the US.

Argentina Gets Closer to Second LNG Facility. Argentina’s state-controlled YPF (NYSE:YPF) signed a final technical agreement with Italy’s ENI (BIT:ENI) to build a 12 mtpa LNG export facility, consisting of two liquefaction trains, aiming for a 2029 start.

US Feedgas Demand Hits New Record. The return of the Cove Point LNG terminal in Maryland after a three-week maintenance period has lifted US LNG feedgas demand to a new all-time high above 18 BCf/d, also buoyed by Plaquemines LNG ramping up.

Egypt Diverts LNG Cargoes to Europe. A combination of lower seasonal demand, high inventories, and marginally increasing domestic supply have led Egypt to defer several LNG cargoes from Q4 to into next year and resell 4-5 prompt cargoes to Europe.

US Ups the Ante on IMO Shipping Rules. The Trump administration reiterated its threat of port fees, sanctions, and visa bans on countries supporting the IMO’s Net-Zero shipping framework by 2050, just as the UN body meets to discuss it, October 14-17.

Brussels Agrees to UAE’s Big Chemicals Move. According to media sources, the European Commission is set to approve ADNOC’s $17 billion takeover of German chemicals company Covestro after the former offered to adjust its articles of association.

By Tom Kool for Oilprice.com