Indian Oil Corporation Ltd (IOCL) is looking to diversify into data centres, nuclear power generation, shipping, critical mineral mining, and battery manufacturing among sectors, said people aware of the development.

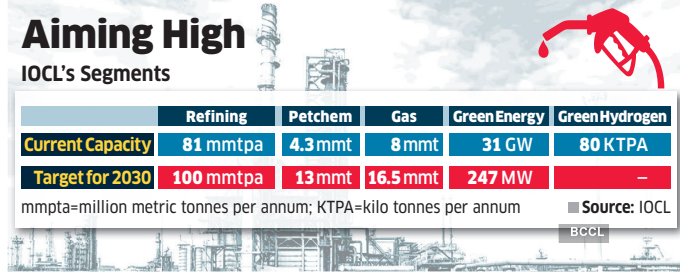

In its core business, India’s top refiner and fuel retailer is targeting 100 million metric tonnes per annum (mmtpa) refining capacity and 13 mmtpa petrochemical capacity by FY28, the people said.

These initiatives are part of IOCL’s strategy to reach $1 trillion revenue and achieve net zero emissions operationally by 2047. Senior IOCL executives highlighted in their ‘Imagining Tomorrow’ presentation to the board last month growth areas that the company will focus on till 2030.

The state-run company’s refining capacity target will mark a 25% jump from 81 mmtpa currently.

Plenty of partnerships

Petrochemical output will rise more than threefold from 4.3 mmtpa. Natural gas distribution and trading business will more than double to 16.5 million metric tonnes (mmt) from 8 mmt.

In the new businesses of green energy, IOCL is targeting 31 GW capacity, a sharp increase from 247 MW presently. It is also aiming at 80 kilo tonnes per annum (ktpa) green hydrogen capacity, and five gigawatt hours lithium-ion cell battery production.

In an email response, a spokesperson for IOCL said in line with the company’s vision of the ‘Energy of India’, it is exploring all potential areas relating to the energy business, including entering new segments. “The company’s expansion into the new and alternate energy space involves substantial capital expenditure, with projects being implemented both on the company’s balance sheet and through specially-formed special purpose vehicles (SPVs),” the spokesperson said, adding to ease execution and implementation risks, IOCL is collaborating with leading strategic partners across sectors.

These partnerships not only help in risk diversification but also contribute to fund mobilisation through shared investment commitments.

“The significant capital outlay required for these initiatives will be financed through a well-balanced mix of internal accruals and debt,” the spokesperson said, without elaborating on the capex plans.

In the data centre business, IOCL is exploring opportunities to monetise existing spare fibre assets, available real estate, besides leveraging synergies with existing and planned green energy and new business domains. “The company is also planning to set up import and export-ready infrastructure on the East and the West coast, and will enter Africa and other geographies for retailing,” said one of the persons cited above.

The company is also exploring ways to bolster its maritime logistics through partnerships—both in India and abroad—as per the presentation, adding that as part of its energy transition strategy, it plans to join multiple nuclear power projects. IOCL currently has a joint venture with Nuclear Power Corporation of India Ltd to set up two 700 MW units. “Work is underway to identify and finalise the project site.”

In shipping, the company is looking to tie-up with Shipping Corporation of India for very large crude carriers (VLCCs), the people said. The company is also restructuring its pipeline business to boost profits, they added.

Indian Oil operates over 20,000 km of cross-country pipelines, forming the backbone of its fuel transportation logistics. “Restructuring in pipelines is a continuous process which entails embracing cutting-edge technologies to further enhance operational efficiency. This allows us to position and utilise our workforce more efficiently, enabling us to manage a large quantum of work with optimised resources without compromising quality, reliability, or safety,” the IOCL spokesperson said.