Nov 27 2025

The European Federation for Transport and Environment commissioned ERM to carry out a study looking at CO2 transportation for e-fuels production in Europe.

Why do we still need to capture carbon for the future green transport system, how much is sustainable, and how should we move it around?

To achieve its net-zero target by 2050, Europe must decarbonise all of its transport sector. While direct electrification is rapidly scaling in the road sector, sectors such aviation and shipping remain harder to electrifyand continue to rely on energy-dense fuels. For these sectors, e-fuels are one of the preferred options available. But not all e-fuels are produced the same way and not all carbon sources are eligible as sustainable under EU rules.

What are the different types of e-fuels?

In the aviation sector, the flagship e-fuel is e-kerosene, often termed e-SAF, which can be blended into fossil jet fuel and used directly into existing aircraft engines. Producing e-kerosene requires large quantities of green hydrogen and a steady supply of CO2. For each ton of green hydrogen required, around 8 tonnes of CO2 are needed.

Shipping has more e-fuels options available. Two e-fuels options are e-methanol and e-ammonia. While the latter is carbon-free, e-methanol is a carbon-based fuel, like e-kerosene, requiring around 7 tonnes of CO2 per tonne of green hydrogen.

Why does the source of carbon matter?

In carbon-based fuels, the CO2 becomes embedded in the fuel molecule and is released back into the atmosphere when combusted. Unlike other CO2 utilisations, e-fuels do not store carbon temporarily. They only delay its release. The EU RFNBO rules correctly factor in this, with all fossil CO2 becoming ineligible from 2041 (with a deadline already from 2036 for carbon from fossil power generation), obliging e-fuels producers to turn towards sustainable carbon sources.

This leaves only two long-term options:

Direct Air Capture (DAC): refers to the capture of CO2 that is directly present in the atmosphere.

Sustainable biogenic CO2: refers to the capture of CO2 from sustainable biomass-based processes, such as pulp and paper mills.

In the short and mid-term, biogenic CO2 is the easiest and cheapest CO2 option. DAC will be essential in the long-term but currently the technology cannot yet supply the volumes required at economically viable cost.

What is the availability of biogenic CO2 for e-fuels in the short to medium term?

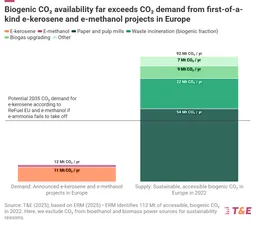

Europe has a diverse set of biogenic CO2 sources but only some are truly sustainable for e-fuel production. The ERM report commissioned by T&E identifies 92 Mt per year of sustainable and accessible biogenic CO2 in Europe in 2022. ‘Sustainable’ excludes bioethanol fermentation and biomass power plants that rely on unsustainable feedstocks. Sustainable sources include amongst others, pulp and paper mills, energy-from-waste, and biogas upgrading plants.

As shown in the graph below, the sustainable biogenic CO2 availability in Europe is more than enough to supply first of a kind e-kerosene and e-methanol projects, which require around 300 kt per year of CO2 each.

Are e-fuels the only sector needing biogenic CO2? What other demands for CCU or CCS?

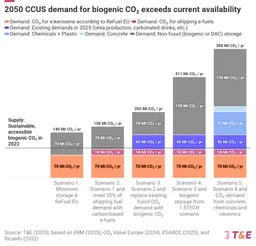

But e-fuels are not the only sector looking for biogenic CO2. The same carbon streams are being targeted by permanent carbon storage projects, especially Bioenergy with Carbon Capture and Storage (BECCS), as well as other CCU uses in chemicals, plastics and concrete. By 2050, combined CCUS demand for biogenic CO2 could rise well beyond today’s 92 Mt of sustainable, accessible supply, meaning not everyone will get the carbon they need.

With sustainable biogenic CO2 both limited and increasingly contested, T&E argues that the EU should prioritise its usage and hence, stop promoting BECCS based on burning biomass for power and instead make sure these scarce carbon resources go to sustainable uses like e-fuels production.

The chart below shows that by 2050, the total CCUS demand for biogenic CO2 ranges from 140 Mt CO2 in the minimum demand scenario to ~400 Mt CO2 per year in a high demand scenario. With the 92 Mt of sustainable, accessible biogenic CO2 in Europe, even the minimum demand case already exceeds supply.Ultimately, DAC will need to be scaled up to meet demand for carbon utilisation and storage, and e-fuels will need to turn towards DAC to be scalable.

How to access these biogenic carbon sources?

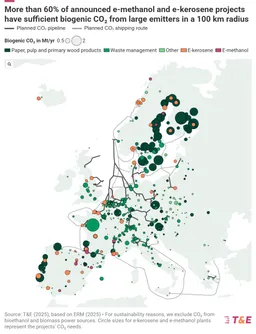

The challenge is that e-fuel plants are not always located next to biogenic CO2 emitters.

Four transport modes are considered to transport biogenic CO2, namely pipelines, rail, trucks, and shipping.

Pipelines are the most efficient option for large, steady flows. However, planned CO2 pipelines are heavily concentrated around the North Sea, leaving major biogenic sources in Finland, Sweden, Slovakia and Central/Eastern Europe unconnected.

Rail is a cost-effective option for the typical e-fuel plant scale, with around 300 kt per year over medium distances (around 300 km).

Trucking can help aggregate smaller, high-purity volumes (e.g., from biogas plants) in the early years.

Shipping may play a role for large coastal hubs

Transporting CO2 via pipeline, rail, ship or truck will be essential as the volumes of e-fuels increase. Our study shows that while 60% of announced projects are within 100 km of accessible biogenic CO2, the remaining are farther away. Planning CO2 transport is crucial. With proper planning and guaranteed third-party access, this CO2 could be made accessible to e-fuel producers, helping connect large untapped volumes to future plants.

What is the cheapest way to transport CO2?

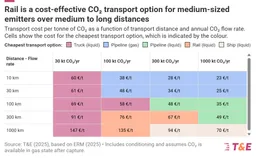

The study shows that there is no single preferable way to transport CO2. The most suitable option depends on the flow rate and distance from the biogenic CO2 source to the e-fuel plant.

As shown in the table below, for large, steady flows over shorter distances, pipelines are the most cost-effective solution, with transport costs below €50 per tonne of CO2. For a typical e-fuels plant handling larger volumes, a few hundred thousand tonnes per year over a few hundred kilometres, rail can be competitive, costing around 67 EUR per tonne for 300 kt over 300 km.

Ships are the most cost-effective option for transporting CO2, but only over long distances and with a high flow rate in large coastal hubs. Overall our findings show that transporting biogenic CO2, even over longer distances, adds only less than 10% to the production cost of e-fuels.

What is the EU planning on CO2 transport and what are T&E’s main policy recommendations?

In light of the 2040 climate target, the EU has started to underscore the need for CCUS to meet the EU 2050 climate objectives and hence to plan the development of competitive markets and transportation infrastructure for CO2. As part of this, the Commission is working on a new CO2 transportation infrastructure and market legislation.

This framework should map where sustainable biogenic CO2 is available and where e-fuel plants are planned, guarantee fair third-party access to pipelines and other CO2 transport modes, and create a transparent, competitive market rather than monopoly networks. Done right, this legislation can make CO2 infrastructure an enabler for e-fuels and other sustainable uses of biogenic carbon, instead of a tool that mainly locks in fossil emissions