In an era where corporate accountability extends far beyond balance sheets, Environmental, Social, and Governance (ESG) reporting has emerged as a cornerstone of sustainable business practice. Yet, as regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) and California’s SB-253 demand increasingly detailed disclosures, a critical divide is widening: between enterprises that can afford sophisticated digital reporting infrastructure and the small-to-medium enterprises (SMEs) in their supply chains that cannot. This accessibility gap threatens to fragment global supply chains and undermine the transparency that sustainable finance depends on.

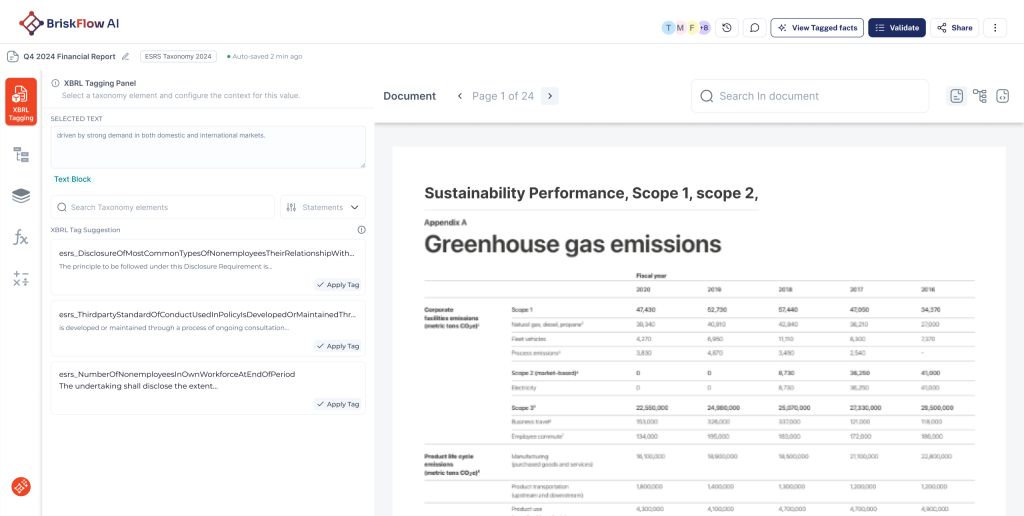

The missing link is XBRL (eXtensible Business Reporting Language)—the digital tagging standard that turns static PDF reports into machine-readable, liquid data. While the market is flooded with sustainability platforms, most stop at data collection. Only a select few have mastered the “last mile” of digital reporting.

At the forefront of this shift is BriskFlow, an AI-powered infrastructure platform that’s making structured reporting universally accessible — SaaS providers, enterprises, consulting firms, and the SMEs that form the backbone of global supply chains.

The ESG Reporting Landscape: A Widening Digital Divide and island of integration

The sustainability reporting ecosystem is vast, with platforms ranging from carbon trackers like Persefoni to comprehensive suites like Novisto and Diligent. These tools excel at data collection, framework alignment (e.g., GRI, TCFD, SASB), and visualization, helping companies navigate double materiality assessments and stakeholder engagement. However, most output reports in static formats—PDFs or spreadsheets—that limit comparability and usability.

Regulators and investors demand more: machine-readable data for automated analysis, benchmarking, and assurance. XBRL addresses this by embedding tags into disclosures, enabling seamless integration with financial reporting systems. It’s already standard for SEC filings and ESEF in Europe; now, it’s extending to ESG under CSRD and California SB-253. Yet, adoption reveals a troubling pattern: while 73% of large firms assure their ESG data (per a 2024 XBRL International study), structured formats remain concentrated among enterprises with significant compliance budgets.

The problem isn’t just technical—it’s economic. XBRL tagging needs expensive software tools and it is time-intensive, creating a two-tier system where large corporations can afford going digital while SMEs face barriers to entry. This matters because supply chain transparency is the gap in the process. For CSRD’s Scope 3 data points, enterprises need emissions and sustainability metrics from their suppliers. If SMEs can’t provide structured and transparent data, they risk being excluded — and enterprises have unreliable disclosures that undermine investor confidence.

Three Forces Driving Universal Accessibility

The push for democratized structured reporting comes from three converging pressures:

1. Regulatory Mandates (The Compliance Driver)

For EU CSRD, digital tagging for sustainability disclosures, aligned with ESEF standards is highly material. So is true for California’s SB-253, BRSR in India, ASRS in Australia, TSRS in Turkey, and other upcoming regulations

2. Supply Chain Reality (The SME Challenge)

Large enterprises now require structured data from suppliers to have Scope 3 disclosure. The Voluntary Standard for SMEs (VSME) was created specifically to meet right-size disclosure requirements for smaller entities, but without affordable tools, SMEs can’t participate.

3. Investor Demand (The Capital Allocation Driver)

European regulators have proposed requirements for SFDR financial product disclosures to be generated in Inline XBRL (iXBRL) format. Investors need comparable, machine-readable data to assess ESG risks and allocate capital effectively. When sustainability data is as liquid and trusted as financial data, capital can flow to credible performance rather than marketing narratives.

The Elite Few: Platforms Pioneering XBRL for Sustainability

Among hundreds of ESG platforms, a handful stand out for their XBRL capabilities:

Workiva: Workiva’s cloud platform unifies financial and ESG workflows with native XBRL/iXBRL tagging. It supports CSRD, ESRS, and ESEF, with AI-driven benchmarking and ERP integrations. For multinationals with substantial compliance budgets, Workiva’s audit trails ensure limited assurance under CSRD, reducing errors by 40% compared to legacy methods.

IRIS CARBON: Tailored for global filers, IRIS CARBON automates XBRL tagging across ESG frameworks like IFRS S1/S2 and GRI. It excels at generating compliant outputs for SEC, ESMA, and local regulators.

Envoria: Focused on European compliance, Envoria integrates XBRL tagging into report editors, supporting ESRS and Article 8 taxonomies. Its collaborative workflows serve enterprises scaling to CSRD compliance.

These platforms separate from the pack by treating XBRL as a core feature, not an add-on. They enable “closed-loop” reporting—where data flows from collection to submission without format shifts—driving efficiency and trust. As one XBRL Europe whitepaper argues, this interconnectivity between ESG and financial domains unlocks “holistic value creation,” allowing investors to model long-term risks like climate exposure with precision. The pricing and complexity also remain prohibitive, perpetuating the digital divide that BriskFlow aims to eliminate.

Spotlight on BriskFlow: The Infrastructure for Universal Digital Reporting

Founded in 2025 amid the CSRD’s rollout, BriskFlow emerged from a different insight: sustainability data should be as accessible as financial data. This distinct infrastructure-first approach has already garnered industry attention, landing BriskFlow on Trellis’s list of corporate sustainability tools to use in 2026 alongside innovators like Google and EcoVadis. Rather than building another enterprise-only dashboard, BriskFlow is constructing the infrastructure layer that makes structured reporting affordable and effortless across the entire ecosystem—from listed enterprises to their local suppliers.

The Accessibility Innovation

BriskFlow uses a Two-Layer AI architecture to slash the cost and complexity of compliance:

The Discovery Layer (AI Agent): Ingests reports exceeding 100,000+ lines of unstructured data, drastically reducing billable hours required for tagging—making digital reporting viable for smaller budgets and lean teams.

The LLM Co-Pilot: Democratizes regulatory expertise by analyzing context to distinguish between complex concepts (like “Gross” vs. “Net” emissions), allowing XBRL generalists to produce expert-level files.

Human-in-the-Loop Validation: Analysts validate high-confidence suggestions through a no-code interface, producing audit-ready files in hours rather than weeks.

Three Audiences, One Infrastructure

BriskFlow serves the complete ecosystem:

SaaS Platforms: Embed structured reporting via API or white-label integration. Serve the full market—without building separate infrastructure.

Consulting Firms: Offer XBRL tagging as a premium service across client bases, from large corporates to their SME suppliers. Faster turnaround, scalable delivery, new revenue streams.

Companies & SMEs: Generate submission-ready XBRL/iXBRL reports without hiring specialists. Solutions are right-sized to budgets—whether a listed enterprise or an SME in the supply chain.

The Path Forward: Collaboration as the Ultimate Differentiator

As ESG reporting matures, the winners will be those fostering ecosystems, not isolated tools. The competitive landscape is shifting. Companies that adopt accessible Digital infrastructure can:

Strengthen supply chain relationships by enabling SME suppliers to participate in structured reporting

Accelerate investor confidence by providing machine-readable data that supports capital allocation decisions

Future-proof operations as digital mandates expand globally

For consulting firms, partnerships with infrastructure providers like BriskFlow differentiate services and create new revenue streams. For SaaS platforms, white-label XBRL capabilities serve growing market demand without diverting engineering resources.

The Strategic Imperative

The question isn’t whether structured reporting will become universal—it’s whether your organization will be positioned to benefit when it does. Companies should:

Audit current capabilities against CSRD, IFRS S1/S2, SB-253, and VSME requirements

Prioritize infrastructure over point solutions to serve entire ecosystems

Evaluate partnership models that enable capability expansion without upfront investment

Consider supply chain implications of digital divide in compliance capabilities

For investors demanding SFDR-compliant data, the message is clear: Support infrastructure that makes structured reporting accessible across portfolios, not just to largest holdings.

Building the Future of Transparent Capital Allocation

BriskFlow’s vision extends beyond compliance automation. “If AI is the engine of the future, structured data is the fuel,” the company asserts. “We provide the refinery that makes it accessible to everyone.”

In a market where transparency determines capital flow, accessibility isn’t charity—it’s infrastructure. By bridging the digital divide between enterprises and their supply chains, BriskFlow is enabling a future where sustainability data is as liquid, comparable, and trusted as financial data. Where “greenwashing” is eliminated because every disclosure is digitally verifiable. Where investors can compare ESG performance as easily as earnings.

The era of PDF reports is ending. The question isn’t who can afford to participate in structured reporting—it’s who will lead in making it universal. As regulations tighten and supply chains demand transparency, accessible XBRL infrastructure will prove not a burden, but the foundation for sustainable business in the digital age.