Crude oil prices saw their most substantial weekly gain since October, with both Brent and West Texas Intermediate rising over $2 per barrel, driven by escalating U.S. pressure on Venezuela and a U.S. military strike in Nigeria.

The U.S. has imposed a partial blockade on tanker traffic from Venezuela, with the Coast Guard pursuing the sanctioned vessel Bella 1, which was allegedly tied to the Iranian government.

Despite the U.S. escalation, analysts state that supply-side disruptions are the primary driver of the oil price climb, with at least six sanctioned tankers reported to have loaded oil from Venezuela since December 11.

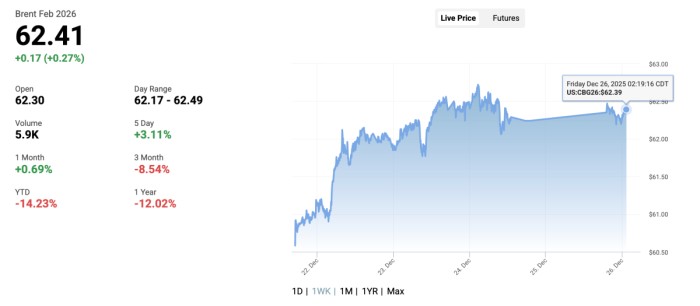

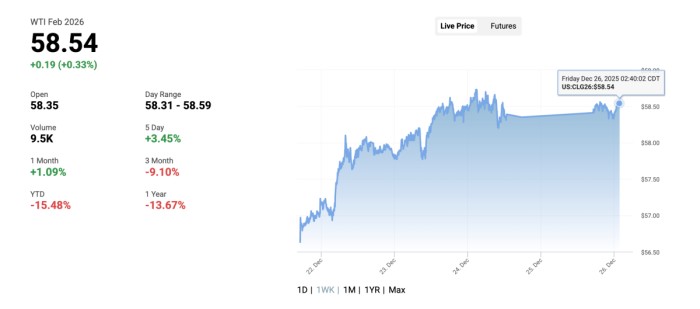

Crude oil prices were set for the most substantial gain since October this week amid intensifying U.S. pressure on Venezuela, with both Brent crude and West Texas Intermediate gaining over $2 per barrel in the last full week of 2025.

A newly reported U.S. military strike on Islamic State terrorists in Nigeria contributed to the oil price climb.

At the time of writing, Brent crude was trading at $62.41 per barrel…

With West Texas Intermediate at $58.54 per barrel, after media cited President Donald Trump as saying U.S. forces had delivered a “powerful and deadly” strike against the Islamic State in Nigeria.

AP cited a Defense Department official as saying the strike was coordinated with the Nigerian government.

Meanwhile, in Venezuela, U.S. forces have imposed a partial blockade on tanker traffic from the country and the Coast Guard is still chasing a tanker that turned away from its Venezuela course last weekend. According to a Reuters report, the Coast Guard is waiting for reinforcements in order to be able to seize the vessel.

The Bella 1, which is the vessel that the Coast Guard is pursuing, is a very large crude carrier that was en route to Venezuela to load crude. According to U.S. officials, the vessel was not flying a valid national flag. The Bella 1 was sanctioned because of alleged ties between its owner and the Iranian government.

Earlier in the week, however, Bloomberg reported that at least half a dozen sanctioned tankers have loaded oil from Venezuela since December 11, when the U.S. escalated the pressure on Venezuelan oil exports, per data from Kpler.

“Supply-side disruptions have become the primary driver of oil prices,” one Galaxy Futures analyst told Reuters today. That’s despite the fact that oil loadings continue from Venezuela and that the U.S. strike on Islamic State was not in an oil-producing region of Nigeria.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com

Back to homepage