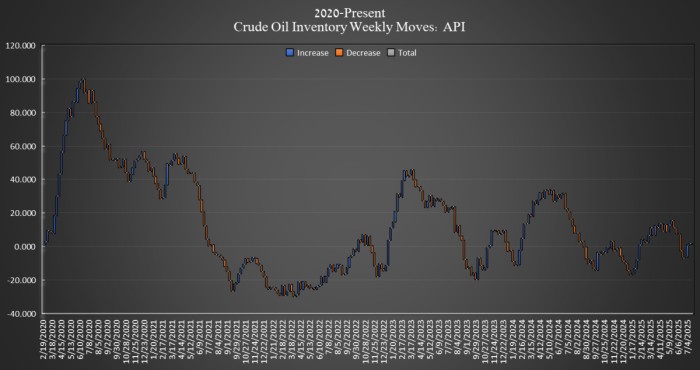

The American Petroleum Institute (API) estimated that crude oil inventories in the United States fell this week, noting that inventories declined by 577,000 barrels in the week ending July 18.

So far this year, crude oil inventories are up 11 million barrels, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) saw another rare drop this week, dropping another 200,000 barrels to 402.5 million barrels in the week ending July 18, after falling in the week prior as well. The depletion is likely a reflection of the Department of Energy’s approval of an emergency release from the SPR to ExxonMobil in an effort to ease logistical challenges at its Baton Rouge refinery that affected the quality of its Mars grade oil. The release was intended to be a loan which ExxonMobil will return in the future, along with additional barrels.

Inventory levels in the SPR are hundreds of millions shy of the levels in inventory prior to the SPR withdrawal that took place under the Biden Administration.

At 3:37 pm ET, Brent crude was trading down $0.40 (0.58%) on the day, landing at $68.81—nearly flat from price levels this time last week.

WTI was also trading down on the day, by $0.84 (-1.25%) at $33.36—down roughly $0.30 per barrel from last week’s price.

Gasoline inventories fell in the week ending July 18 by 1.228 million barrels. As of last week, gasoline inventories were slightly above the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose substantially this week, by 3.480 million barrels. Distillate inventories were 21% below the five-year average as of the week ending July 11, the latest EIA data shows.

Cushing inventories—the benchmark crude stored and traded at the key delivery point for U.S. futures contracts in Cushing, Oklahoma—rose by 314,000 barrels in the week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com