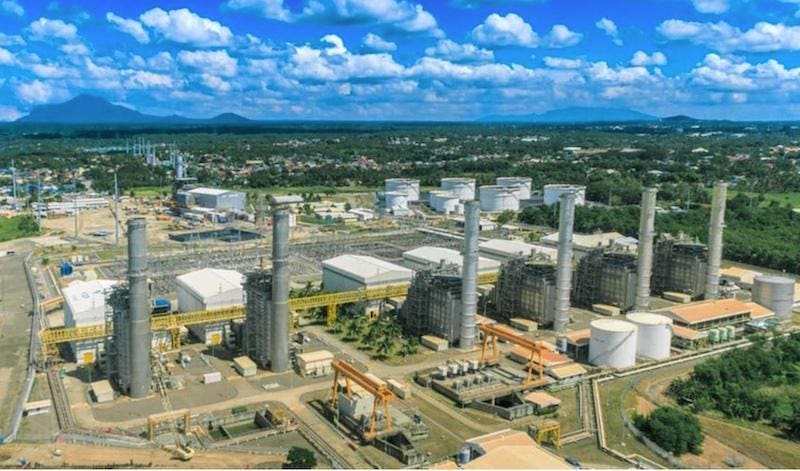

The Santa Rita combined cycle gas plant in Batangas (south of Manila) is one of the First Gen assets … More

Courtesy of First Gen

Prime Infrastructure—controlled by casino-to-ports billionaire Enrique Razon Jr.—has agreed to buy 60% of the gas assets of the Lopez family-backed First Gen for 50 billion pesos ($896 million).

Under a term sheet entered into by both parties and subject to a definitive agreement, Prime Infra will buy the controlling stake in four existing gas-fired power plants and a planned fifth facility with a combined capacity 3,247 megawatts, along with an offshore liquefied natural gas terminal, according to a document furnished to Forbes Asia. The assets are all located in Batangas province, south of Manila.

The partnership will enable First Gen and Prime Infra to “further nurture, enhance and expand their natural gas platforms,” helping to secure the country’s energy independence, according to the document.

The gas plants will boost the profile of Prime Infra, which owns a substantial stake in the Malampaya gas field. The company is investing $800 million on drilling and exploration to boost the output of Malampaya, which has been dwindling in recent years.

Prime Infra’s power assets include two existing solar farms with a combined capacity of 128MW and two hydroelectric plants, which will have a combined capacity of 2,000MW once completed.

For First Gen, the partial sale will help bankroll the $9 billion it plans to invest to quadruple its renewable energy capacity to 13 gigawatts in the six years through 2030. First Gen derives 55% of its capacity from gas while the rest comes from wind, solar, hydro and geothermal.

After spending about $1.2 billion in 2024, that included the purchase of the 165 MW Casecnan hydro power facility in Nueva Ecija, north of Manila, it has earmarked another $601 million in capital expenditures this year, with as much as 90% allocated for 140MW of geothermal capacity, while the rest will be spent on a 50MW solar project.

The Razon-Lopez deal is the latest strategic partnership to shake up the Philippine energy sector following a $3.3 billion gas and LNG joint venture announced by billionaire Ramon Ang’s San Miguel Corp. with Aboitiz Power and a unit the Manila Electric Co.

With a real-time net worth of $12 billion, Razon also has interests in global port operator ICTSI and Bloomberry, which owns two casino resorts in Metro Manila. In 2022, he planned to list Prime Infra, which also provides water utility and waste management services, but decided to postpone the IPO due to unfavorable market conditions.

Besides their interest in energy, the Lopez family, which has a net worth of $230 million, is also the controlling shareholder of ABS-CBN, once the country’s largest broadcaster. It pivoted to online streaming and content sharing with other networks after Philippine lawmakers in 2020 rejected the media company’s bid to renew its franchise.