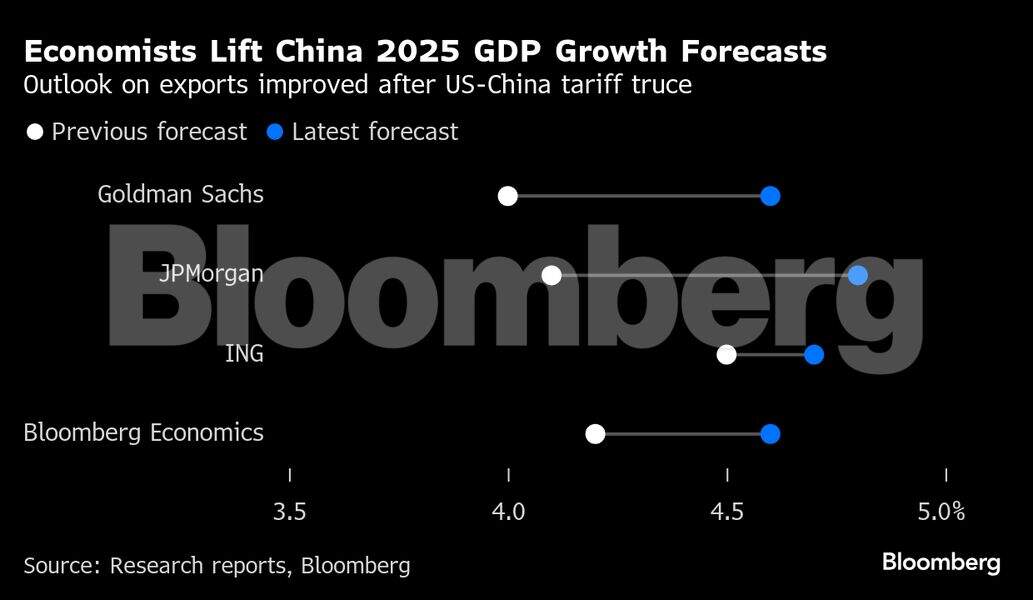

Economists marked up their forecasts for growth in the US and China after the world’s two-largest economies reached a temporary agreement to reduce tariffs on each other. China’s economy is now seen expanding at least 4.6 per cent this year from as low as 4 per cent previously, according to new estimates from Goldman Sachs Group Inc., JPMorgan Chase & Co., ING Groep NV and Bloomberg Economics. Projections for the US still point to a slowdown, but several economists dropped their recession calls.

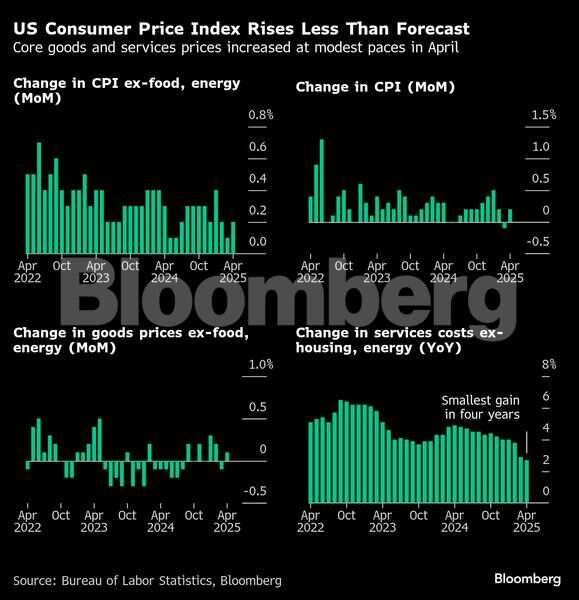

While tariffs are widely expected to boost inflation, that hasn’t yet shown up in the data. US consumer prices rose by less than forecast, while a report on producer prices indicated businesses absorbed much of the costs from the new levies as they took effect last month.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

The latest CPI report highlighted two underlying dynamics in the economy. Goods categories exposed to higher tariffs, including new cars and apparel, didn’t see the kind of price increases that economists had expected by now. That suggests importers and retailers are absorbing some of the extra costs and imported products sold now had arrived before the brunt of the tariffs — namely on China — were in effect. Separately, some weakness in services categories like travel and recreation suggest consumers are cutting on leisure and other discretionary spending.

For all the worry about tariffs causing pain for American consumers, shoppers have so far been mostly shielded from — or shrugged off — higher prices at the checkout aisle. Profit margins at retailers and wholesalers shrank in April by the most in almost a year. Manufacturers signaled they are paying higher prices. Yet consumer inflation remained tame, and Walmart Inc. reported solid sales as it kept prices low.

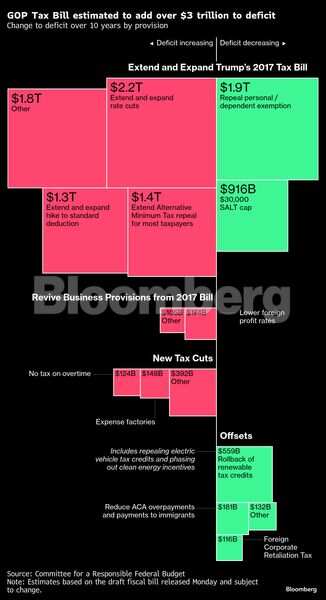

GOP Tax Bill estimated to add over $3 trillion to deficit | Change to deficit over 10 years by provision

The cost of Republican lawmakers’ draft plan for sweeping tax cuts weighed in at $3.8 trillion over the next 10 years in one official estimate. The reality is likely much higher, thanks to the use of budget and political tools designed to minimize the appearance of the fiscal hit, according to independent analysts including former Republican staff members.

Asia

Goldman Sachs Group Inc. and other major banks boosted their forecasts for China’s 2025 economic growth, citing a better outlook for exports following the tariff truce with the US.

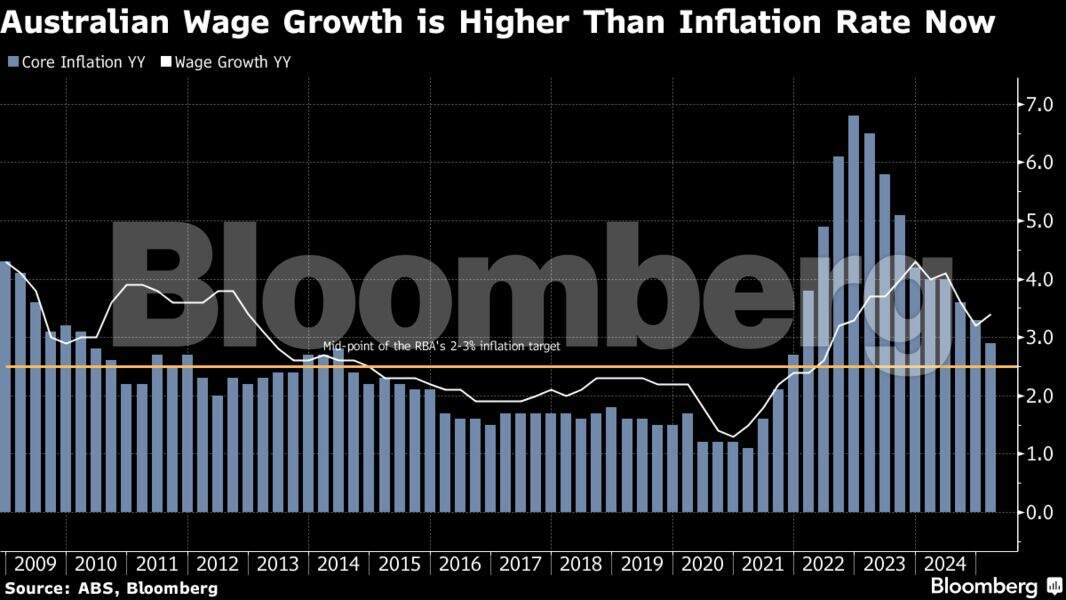

Australia’s wage growth was stronger than expected in the first three months of the year, highlighting the nation’s tight labor market that has been underpinned by a wave of public-sector hiring. The data did little to change market expectations for an interest-rate cut next week.

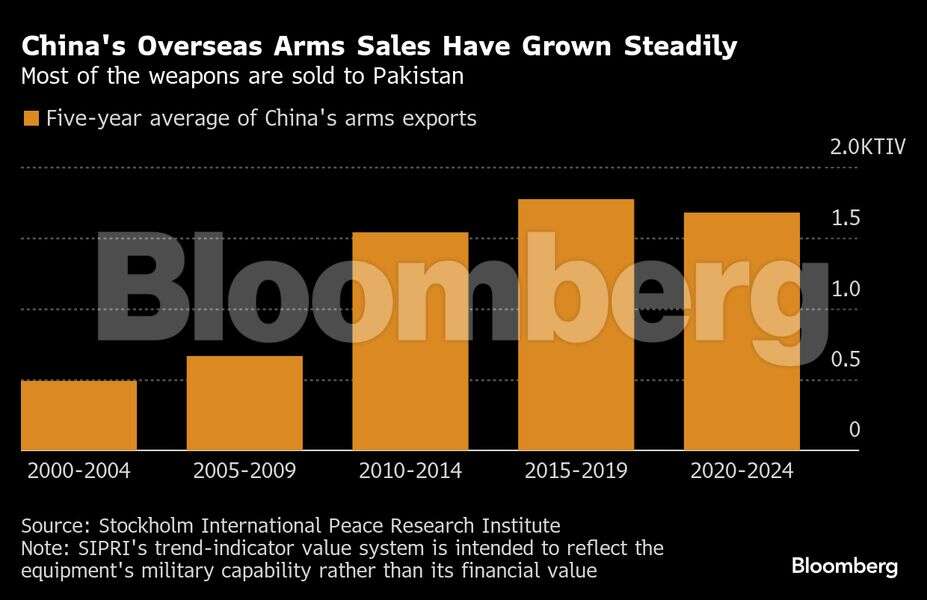

The recent conflict between India and Pakistan is prompting a reassessment of Chinese weapons, challenging long-held perceptions of their inferiority to Western arms and sparking concern in places wary of Beijing. Pakistan hailed the use of its Chinese J-10Cs to shoot down five Indian fighters, including French-made Rafale aircraft, last week in response to Indian military strikes.Europe

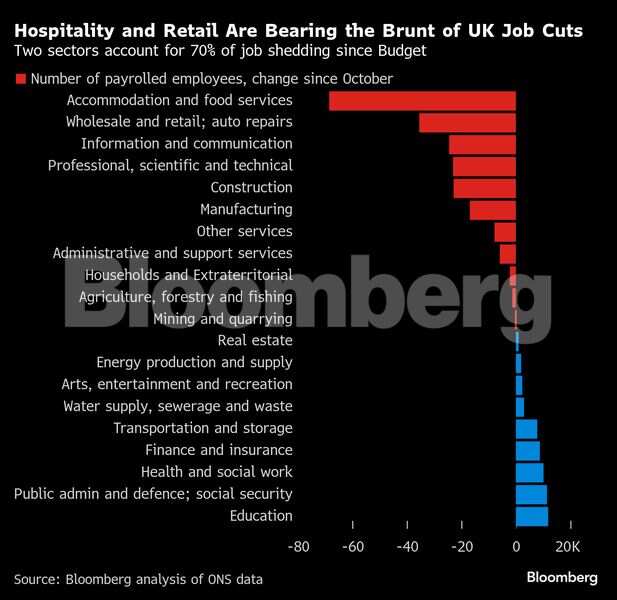

British businesses cut jobs for a third straight month in April as a £26 billion ($34 billion) tax hike took effect and US tariffs darkened the global economic outlook. The number of workers on payrolls dropped 32,532 to 30.3 million. Job vacancies fell the most in over a year in a sign of weakening demand for workers.

Negotiators in the military alliance are making progress on a path to achieve 5 per cent of gross domestic product on defense and defense-related spending by 2032 ahead of a North Atlantic Treaty Organization summit in The Hague in June, according to diplomats familiar with the matter. Since his first term, Trump has hectored allies for failing to meet a long-standing 2 per cent threshold for spending. Eight of 32 allies hadn’t reached 2 per cent spending as of NATO’s annual report in April.

Emerging Markets

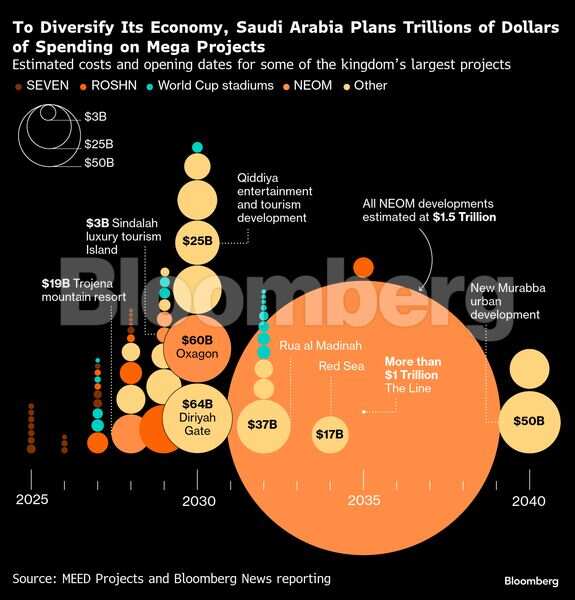

US President Donald Trump’s hopes of securing as much as $1 trillion in investment commitments from Saudi Arabia might clash with another costly ambition – transforming the kingdom’s own economy. Saudi Crown Prince Mohammed bin Salman’s plans to diversify the oil-dependent country are likely to cost close to $2 trillion, according to estimates compiled by Bloomberg News.

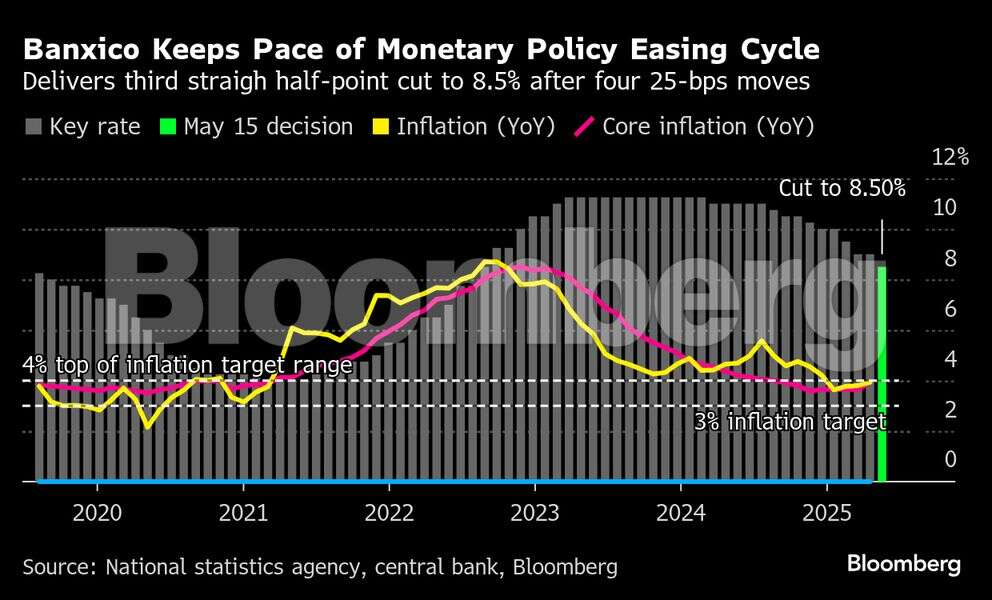

Mexico’s central bank cut borrowing costs by half a percentage point Thursday after the economy narrowly avoided falling into recession and inflation remained within the target range.

World

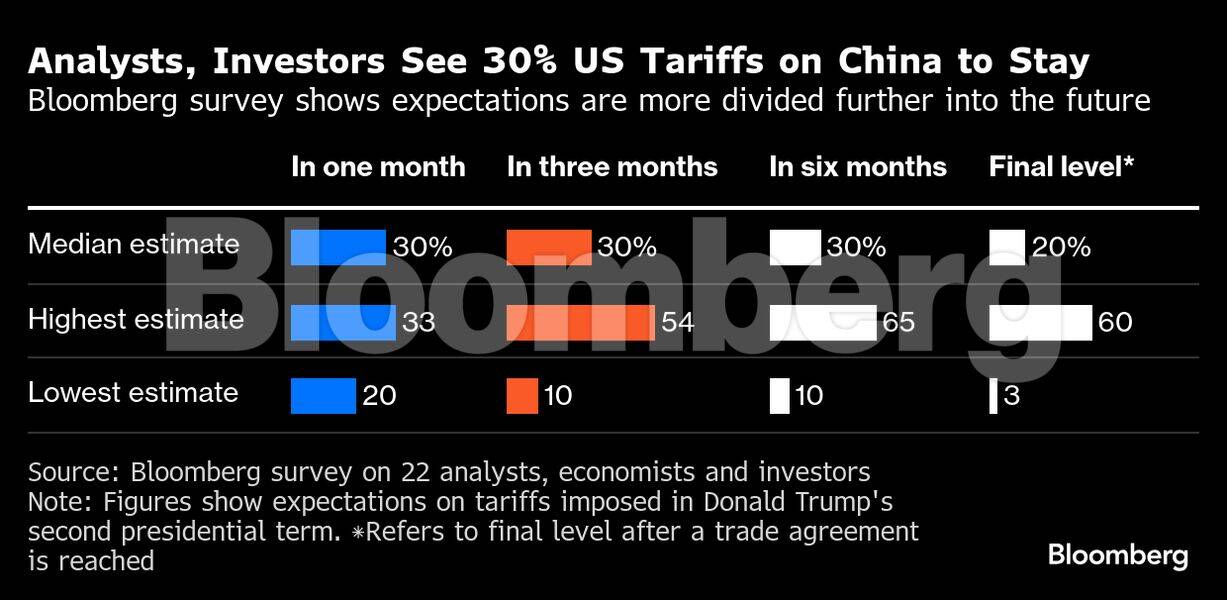

Donald Trump’s tariffs on China will likely remain at a level expected to severely curtail Chinese exports to the US after the 90-day truce, analysts and investors say, suggesting Beijing may have to endure further economic pain despite active talks.