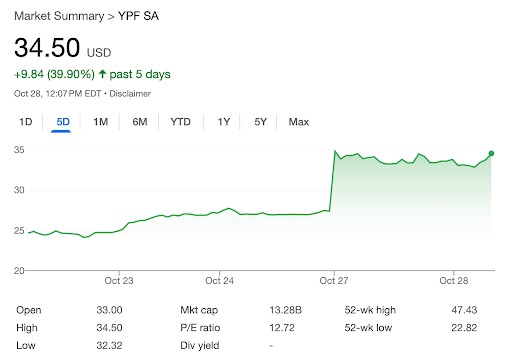

Argentina’s energy market has entered a sharp re-rating phase as YPF S.A. (NYSE: YPF) extended its rally nearly 40% over the past five days, driven by foreign investment interest and renewed political stability.

The surge follows reports that XRG, the low-carbon investment arm of Abu Dhabi National Oil Company, is in advanced discussions to join YPF’s flagship LNG export project, according to Arabian Business.

The rally also coincides with President Javier Milei’s mid-term election victory and his administration’s $20 billion energy-financing agreement with Washington, which secured crucial backing for LNG terminals, pipeline expansion, and infrastructure in the Vaca Muerta shale. The combined developments have strengthened investor confidence in Argentina’s upstream liberalization and export ambitions, and given a struggling Milei more time to defragment his alliances.

Argentina’s mid-term map was fractured heading into the vote, with Milei’s La Libertad Avanza governing from a minority and relying on shifting alliances while the opposition remained split among Peronists, the UCR, and powerful provincial blocs. The result on 26 October consolidated Milei’s hand after weeks of coalition strain, as his camp translated a late surge into larger congressional leverage and a clearer pathway for energy reforms.

Opposition forces failed to unite behind a single program, leaving multiple Peronist currents competing for primacy and centrist parties divided over strategy. The subsequent momentum, significantly boosted by the $20-billion U.S. financing package tied to energy infrastructure, reduced the immediate threat of defections and helped secure victory for Milieu.

YPF is a clear beneficiary of this new momentum.

For YPF, the XRG negotiations represent both financial and geopolitical leverage. The proposed project centers on floating-LNG capacity targeting 12-18 million tons annually, scalable to 24-28 million tons, according to YPF’s LNG project site. YPF has previously collaborated with Eni S.p.A. and Shell plc on early-design phases of the complex.

The stock’s climb reflects investor expectations that Milei’s pro-market mandate, combined with U.S. credit lines and Gulf participation, could re-establish Argentina as a rising LNG supplier. Analysts tracking Buenos Aires-listed energy firms said the pace of reform and execution on new export infrastructure will determine whether the rally can hold.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com