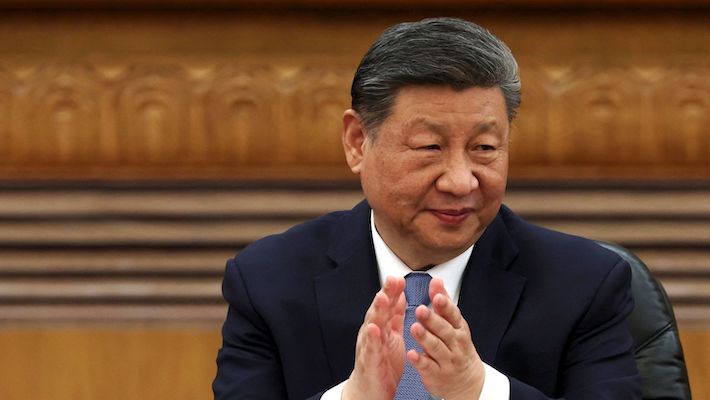

Protect global industry and supply chains. That was the message from Chinese President Xi Jinping when he spoke to a gathering of multinational CEOs on Friday.

Xi, who has a great dislike for turmoil, given the traumas he and his family endured during the Cultural Revolution, is seen as having deep concerns about the impacts of US tariffs on the Chinese economy, which has suffered a serious slowdown since the lockdowns of the Covid-19 epidemic.

China’s leaders are battling to dispel fears that the broad array of tariffs being imposed by US President Donald Trump will spur a renewed trade war.

ALSO SEE: Carmakers Shares Tumble After Trump Announces 25% Auto Tariff

But the country’s economy has suffered bitter blows from Beijing’s own policies – longstanding unease over China’s tightening regulations, abrupt crackdowns on foreign firms, and an uneven playing field favouring state-owned Chinese companies have also sapped business sentiment.

‘Help maintain stability’

“We need to work together to maintain the stability of global industry and supply chains, which is an important guarantee for the healthy development of the world economy,” Xi told the business leaders, who included the bosses of AstraZeneca, FedEx, Saudi Aramco, Standard Chartered and Toyota.

“I hope everyone can take a broad perspective, not be swayed by transient distractions in the industry, and not blindly follow actions that disrupt the security and stability of global industry and supply chains.”

Around 40 executives joined the meeting, the majority of whom represented the pharmaceuticals sector. The meeting ran for just over 90 minutes and seven companies were invited to speak, a source with direct knowledge of its planning said.

“This meeting is a big illustration of business diplomacy. Now there is not just dialogue between bodies, WTO entities and states, but diplomacy being led by companies that are not just representing themselves, but also their sectors,” said Frank Bournois, VP and dean of the China Europe International Business School in Shanghai, adding that its success would depend on future actions and not just words.

The executives sat in a horseshoe formation, with Mercedes-Benz CEO Ola Kallenius and FedEx’s Raj Subramaniam sitting directly across from Xi.

HSBC CEO Georges Elhedery, SK Hynix boss Kwak Noh-jung, Saudi Aramco president and CEO Amin Nasser, and chair of Hitachi Toshiaki Higashihara also sat in the first row.

Foreign investment plunging

“Foreign enterprises contribute one-third of China’s imports and exports, one-quarter of industrial added value and one-seventh of tax revenue, creating more than 30 million jobs,” Xi said.

“In recent years, foreign investment in China has also been interfered with by geopolitical factors… I often say that blowing out other people’s lights does not make you brighter.”

Xi last year met with American business leaders after the China Development Forum, prompting questions about whether China’s top leader meeting members of the global business community a few days after the annual business forum would become an annual fixture. China’s second-ranking premier used to meet them on the CDF’s sidelines.

“The essence of China-US economic and trade relations is mutually beneficial and win-win,” Xi told this year’s meeting.

Trump has announced a wave of fresh “reciprocal tariffs“ to take effect on April 2, targeting countries with trade barriers on U.S. products, which could include China.

He imposed 20% tariffs on Chinese exports this month, prompting China to retaliate with additional duties on American agricultural products.

The frequency of meetings between foreign executives and high-level Chinese officials has picked up over the past month, after official data showed foreign direct investment plummeted 27% year-on-year in local currency terms in 2024.

That marked the biggest drop in FDI since the 2008 global financial crisis.

“From the outside you can get the impression that this dialogue is just like a shuffling of papers, but I believe if it is followed by deeds and measures, only then we will see FDI trends change,” Bournois said.

Reuters with input (at top) and editing by Jim Pollard

ALSO SEE:

China Releases Mintz Employees Amid Push to Lure Foreign Cash

April 2 Set as Date for Unveiling of Trump’s Reciprocal Tariffs

Trump Launches Tariff Wars, China Hits Back With 10-15% Duties

China’s Quant Funds Change Tack Amid Regulatory Crackdown

Beijing’s Crackdown Wiped $1.1 Trillion Off Chinese Big Tech

China Raids Capvision Amid Crackdown on Due Diligence Firms