Vista Energy has acquired Petronas’ 50% stake in the Vaca Muerta shale basin in a deal valued at $1.5 billion USD. Vista estimates that the area, known as La Amarga Chica (LACh) could potentially hold 400 new well locations to be drilled in its inventory (at 100% working interest). The remaining 50% of LACh is held by operator YPF S.A.

The purchase price is comprised of US$ 900 million in cash, US$ 300 million in deferred cash payments and 7,297,507 American Depositary Shares.

LACh spans across 46,594 acres in the black oil window of Vaca Muerta. As of December 31, 2024, it had 247 wells on production. In addition, as of December 31, 2023, LACh had 280 million barrels of oil equivalent (MMboe) of P1 reserves according to the Argentine Secretary of Energy (at 100% working interest). During the fourth quarter of 2024, LACh produced 79,543 barrels of oil equivalent per day (boed) at 100% working interest, of which 71,471 barrels per day (bpd) were oil, according to the Argentine Secretary of Energy.

Vista estimates LACh could potentially hold 400 new well locations to be drilled in its inventory (at 100% working interest). The remaining 50% of LACh is held by operator YPF S.A.

“With this acquisition we gain significant scale in Vaca Muerta with a premium block that has growing production and low operating costs, enabling the acceleration of our long-term plan and strengthening our free-cashflow profile,” said Miguel Galuccio, Vista’s Chairman and CEO. “The acquisition both increases our profitability and enhances our portfolio of ready-to-drill locations in the core area of Vaca Muerta. Importantly, in the current global macro and oil price environment we are consolidating a high- margin, low- breakeven asset, with strong synergies with our ongoing operation, reflecting our constructive long-term view on crude oil demand and supply dynamics. I firmly believe this represents a unique opportunity to create long-term value for our shareholders.”

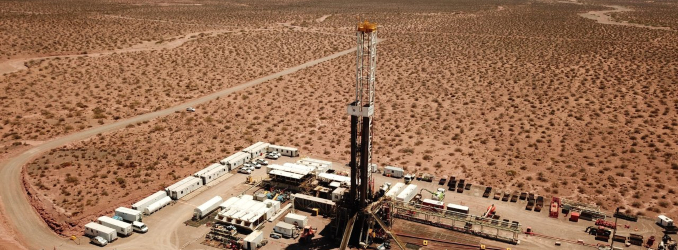

Images: YPF