The removal of Venezuelan President Nicolás Maduro is expected to have limited immediate impact on global crude supply, but analysts say the geopolitical shift could reshape upstream investment and market dynamics over the medium to long term.

According to a joint note from TD Cowen’s equity research and global strategy teams, near-term supply disruptions from Venezuela’s most acute geopolitical crisis in more than a century are likely muted, in part due to an ongoing global oil glut. Analysts said market attention is focused less on short-term supply losses and more on whether sanctioned Venezuelan barrels could re-enter the system and how quickly exports might recover under a new political framework.

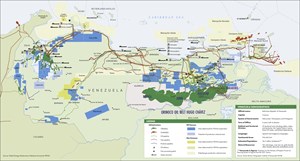

For U.S. upstream producers, the macro backdrop remains an overhang, with uncertainty surrounding the pace and conditions under which Venezuelan oil could return to global markets. TD Cowen noted that Chevron is best positioned among U.S. majors, given its existing footprint and U.S. Office of Foreign Assets Control license, which has allowed it to continue producing and exporting crude from Venezuelan joint ventures since late 2022. Chevron currently produces about 200,000 bpd from those assets, which analysts estimate contributes roughly 2% of its total cash flow from operations. ExxonMobil and ConocoPhillips also have historical operating exposure to the country.

Analysts said a regime change could conceptually improve ConocoPhillips’ position through asset recovery or improved payment mechanisms, while also marginally reducing the risk of broader regional disputes that carry implications for offshore developments in Guyana. However, TD Cowen cautioned that international oil companies are likely to wait for political stability, legal clarity and fiscal certainty before committing capital, despite Venezuela’s estimated 303 billion boe of proven reserves.

The note also examined implications for heavy crude markets, particularly in Canada. TD Cowen said the removal of Maduro does not pose an immediate threat to Canadian Western Select differentials, given Venezuela’s structural fragility and the unlikelihood of a rapid production recovery. However, analysts warned that if Venezuelan volumes currently flowing to China are redirected into open markets, Canadian heavy pricing could come under shorter-term pressure. Over the longer term, outcomes will hinge on whether Venezuela can realistically increase production from about 0.9–1.0 MMbpd toward historical levels above 2.5 MMbpd—a scenario TD Cowen views as uncertain and highly dependent on sustained investment and institutional reform.