(Bloomberg) — US consumer prices probably picked up in April after the smallest advance in nine months, foreshadowing a broader acceleration as many companies seek to pass on higher tariffs.

Most Read from Bloomberg

A closely watched gauge of prices paid by Americans for goods and services, excluding volatile food and energy costs, is forecast to have risen 0.3%, based on a Bloomberg survey of economists. In March, the so-called core consumer price index inched up just 0.1%.

While Tuesday’s report is likely to show limited pass-through so far of higher US duties on imported goods, many economists anticipate the impact becoming more pronounced over time.

That helps explains growing apprehension among consumers about inflation specifically and the economy and job market more broadly. Retail sales due Thursday are expected to show some of that anxiety; after a healthy 1.5% jump at the end of the first quarter, economists forecast little change in April sales as front-loaded demand for motor vehicles cooled.

For their part, companies are threading the needle between attempting to mitigate the costs of tariffs through price hikes, and trying to guard against a drop in sales as consumers recoil from sticker shock.

With the Trump administration having temporarily dialed back certain tariffs while working to reach country-specific trade deals, some businesses may hold off on price increases. US officials have been holding talks with China over the weekend in Switzerland.

What Bloomberg Economics Says:

“Why is consumer price inflation so moderate even though the costs of tariffs have been borne mostly by the US side? We think it’s because demand is slowing (retail sales, Thurs,), and retailers are finding it difficult to pass on higher prices without suffering a sharp drop in demand — though they’ll still try. If that effect prevails, then the net impact of tariffs will be less inflationary than commonly thought.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou & Chris G. Collins, economists. For analysis, click here

At the same time, recent surveys of manufacturers and service providers show rising input costs that may force their hand on price adjustments. The government’s April producer price index on Thursday will shed light on evolving wholesale cost pressures.

After keeping interest rates unchanged on May 7, Federal Reserve policymakers said there’s a greater risk that trade policy will lead to both higher inflation and rising unemployment.

The inflation and retail sales reports headline a busy week for US economic data. In addition to weekly jobless claims, traders will pay attention to the University on Michigan’s preliminary May consumer sentiment survey, which will include inflation expectations.

Other reports include April housing starts and industrial production. Meanwhile, US central bankers scheduled to speak include Fed Chair Jerome Powell on Thursday. He’ll offer remarks on the Fed’s monetary policy review. Vice Chair Philip Jefferson and Governors Adriana Kugler and Christopher Waller are slated to appear at separate events.

In Canada, Prime Minister Mark Carney is set to unveil a new cabinet tasked with an ambitious economic agenda, including removing internal trade barriers and reorienting exports away from the US. Home sales for April will offer insight into a spring slump, while Ontario, the country’s most populous province, releases its budget.

Elsewhere, gross domestic product reports from Japan to the UK and Switzerland, inflation data in India, multiple speeches by central bankers, and a likely interest-rate cut in Mexico are among the highlights.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

Asia

Days after the US-China trade talks in Geneva, trade ministers from APEC gather in South Korea Thursday and Friday to hash out a strategy for sustaining what amounts to roughly 49% of global commerce.

A focus will be on ensuring the viability of regional supply chains and any hints on what US measures might replace the so-called AI diffusion rule.

India on Thursday will report April trade figures that may highlight the importance of its proposal to secure a deal with the US for zero tariffs on steel, auto components and pharmaceuticals. Indonesia releases its own trade accounts on Thursday.

In other data, India’s consumer inflation is seen having cooled in April to 3.2% year on year, the slowest pace since July 2019, giving the Reserve Bank of India scope to cut rates again when it next sets policy on June 6.

Preliminary data on Friday is likely to show Japan’s economy slipped into contraction during January-March for the first time in a year. Business investment is seen slowing, while private consumption is expected to stall.

Australia on Tuesday gets gauges for April business sentiment and May consumer confidence, with first-quarter wage price index due a day later. Finally, unemployment for April is due on Thursday.

Europe, Middle East, Africa

UK data will shed light on an economy whose clouded outlook kept the Bank of England cautious at its decision on Thursday. The BOE cut rates by a quarter point after a three-way vote split between officials, with a minority wanting either a bigger reduction or none at all.

On Tuesday, UK wage numbers will probably show weakening pay pressures at a time when inflation remains noticeably above the 2% target. Thursday’s GDP report may reveal a growth spurt in the first quarter before Trump’s trade war hit.

Eight of the nine members of the BOE’s Monetary Policy Committee are scheduled to speak during the week, including Governor Andrew Bailey. Appearances by at least 10 European Central Bank officials are also on the calendar.

Aside from Germany’s ZEW investor sentiment survey on Tuesday and eurozone industrial production on Friday, most data releases in the region are second estimates of growth or inflation. One highlight will be the European Commission’s spring economic forecasts at the end of the week.

Switzerland and Norway release first-quarter GDP figures on Thursday. Swiss National Bank President Martin Schlegel will speak in Lucerne the following day, just as zero inflation and a strong franc put the spotlight on his next policy move.

Israel’s central bank on Thursday will watch to see if inflation slowed in April from a prior reading of 3.3%. It remains above the target of 1% to 3%, with the expanding war in Gaza complicating efforts to lower it.

On Friday, Russian officials will look for signs that inflation, currently above 10%, may have weakened in April. After holding the key rate at a record high last month, Bank of Russia Governor Elvira Nabiullina said that price growth will probably peak in May.

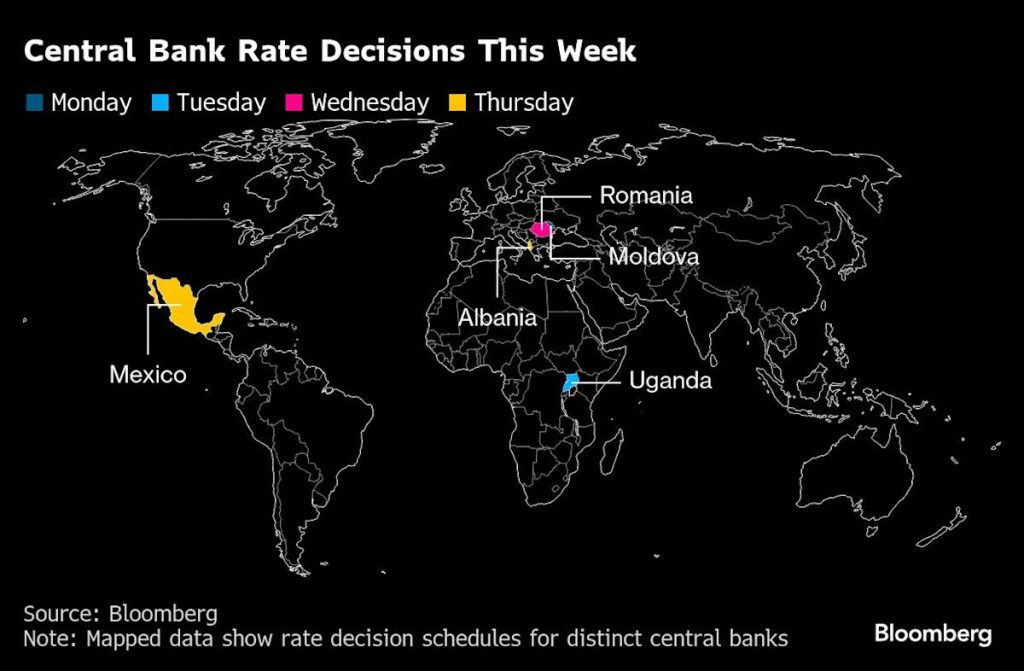

In monetary decisions, officials in Uganda will likely cut the key rate on Tuesday from 9.75%; the announcement was rescheduled from May 8. Inflation remains below the 5% target and the shilling has been largely steady since mid-April.

Romania’s central bank is expected to keep borrowing costs on hold on Wednesday ahead of a presidential runoff election on May 18. A recent market selloff and the weakest leu on record may prompt officials to signal future tightening.

Latin America

Argentina’s national inflation likely slowed for a 12th straight month in April, data on Wednesday should show. Though the monthly pace may have topped 3% for a second month, the annual rate probably slipped below 50% for the first time in almost four years.

Chile’s central bank on Thursday posts the minutes of its April decision to maintain its key rate at 5%.

In Peru, April labor market data for the capital, Lima, are on tap as well as the March GDP-proxy report. The finance ministry earlier this month trimmed its 2025 GDP forecast to 3.5% from 4%.

After slowing the pace of tightening on May 7 with a half-point hike, Banco Central do Brasil’s post-decision communique sounded very much like “we’re done.” Brazil watchers will pore over the minutes of that meeting, to be posted on Tuesday, to double-check.

Colombia in the coming week becomes the second economy among the region’s big six to report first-quarter output. Economists see GDP growth accelerating for a second year in 2025.

Mexico’s central bank on Thursday will all but certainly deliver a seventh straight rate cut — likely a half-point, to 8.5% — despite April’s uncomfortably warm inflation readings.

–With assistance from Brian Fowler, Laura Dhillon Kane, Mark Evans, Monique Vanek, Piotr Skolimowski, Robert Jameson and Tony Halpin.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.