U.S. liquefied natural gas exporters pushed higher Monday following the European Union’s announcement of a $750?billion energy purchasing framework for the next three years, heavily focused on LNG. But signals from natural gas futures and producers like EQT suggest near-term sentiment is more cautious than heady.

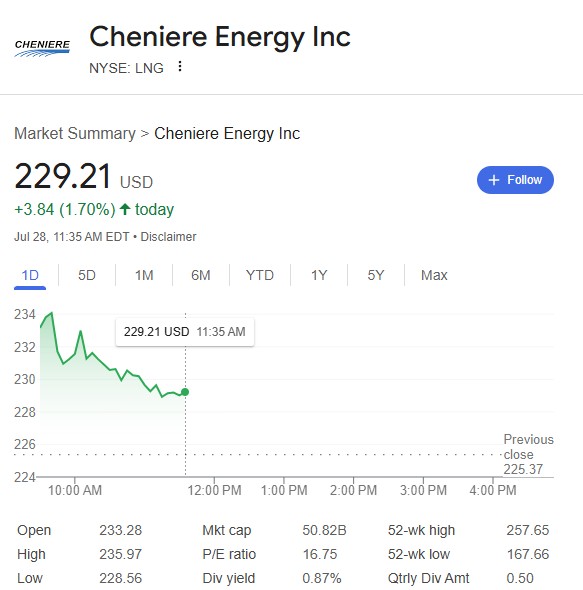

Cheniere Energy (LNG)—America’s flagship LNG exporter—rose about 1.7%, trading at $229.23, as renewed optimism over long-term European contracts fueled buying. The stock had earlier popped around 4%, with some profit-taking later in the session reducing the final gain

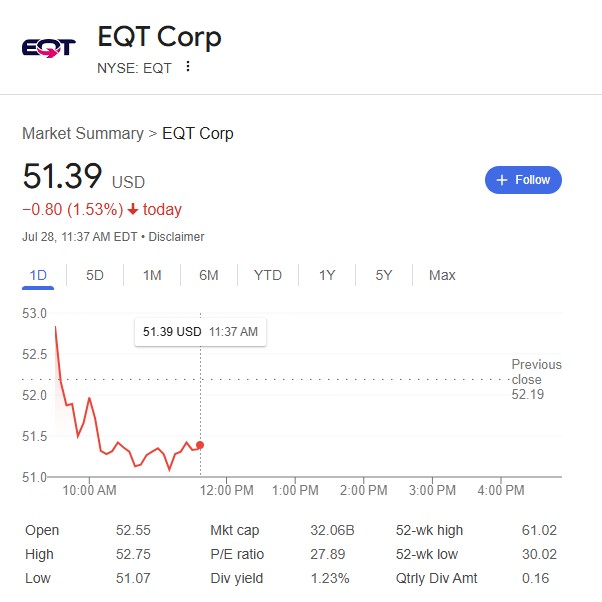

Meanwhile, EQT Corp (EQT)—a major U.S. natural gas producer without downstream exposure—fell 1.7% to $51.32, reflecting a disconnect between export infrastructure and upstream commodity sentiment.

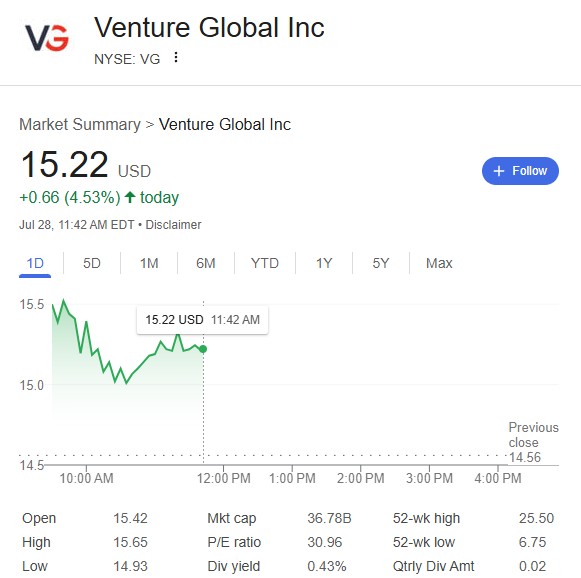

Venture Global (VG), a fast-growing developer with operational and under-development projects including Plaquemine LNG and Port Arthur, is trading up 4.53% today at $15.22.

On the futures side, the August Henry Hub contract dropped to about $3.09 per MMBtu, down roughly 2%, weighed down by rising production and softening seasonal demand.

The EU’s commitment anchors confidence in long-term LNG demand, notably benefiting Cheniere and downstream developers working to sign multi-year supply contracts. Those companies stand to deliver real export volume—making them the market’s favored beneficiaries of the massive deal.

By contrast, upstream producers and spot gas futures face headwinds from rising U.S. production and weaker immediate consumption amid mild summer weather. The supply-heavy environment is keeping prices in check and headwinds for commodity-driven operators like EQT.

Analysts have cautioned that the headline $750 billion figure may be more aspirational than assured. Sources suggest EU import volumes may fall short of expectations unless U.S. export infrastructure expands rapidly. Still, even modest long-term contracts would give downstream names a lift.

In short: export-focused LNG equities are benefiting from softened uncertainty and pledged demand. At the same time, natural gas futures and upstream plays remain under pressure from oversupply.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com