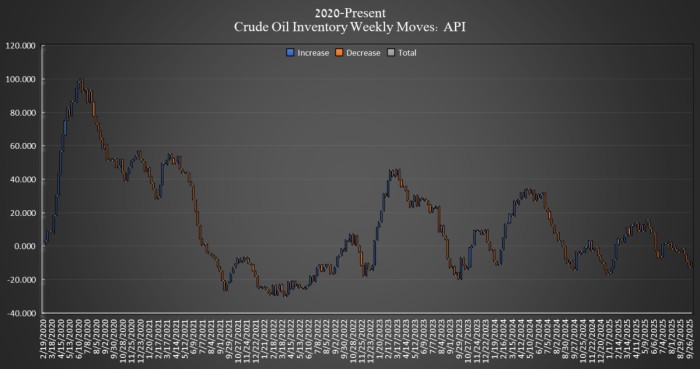

The American Petroleum Institute (API) estimated that crude oil inventories in the United States increased by 2.780 million barrels in the week ending October 3. Analysts had forecast a 2.25 million build for the week. Today’s figures come after three consecutive weeks of draws, including a 3.674 million barrel draw in the week ending September 26.

So far this year, net crude oil inventories have rose by just 557,000 barrels, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 300,000 barrels to 407 million barrels in the week ending October 3.

US production reached an all-time high for July 2025 of 13.642 million bpd—the second new high in as many months.

At 4:21 pm ET, Brent crude was trading up $0.26 (+0.40%) on the day, reaching $65.73. While up on the day, Brent prices are down $1.30 per barrel from this time last week. WTI was also trading up on the day, by $0.34 (0.55%) at $62.03—a roughly $0.50 per barrel drop week over week.

Gasoline inventories fell by 1.245 million barrels in the week ending October 3, after gaining 1.3 million barrels in the week prior. As of last week, gasoline inventories were at the five-year average for this time of year, according to the latest EIA data.

Distillate inventories also fell in the reporting period, losing 1.822 million barrels following the week prior’s 3.003-million-barrel gain. Distillate inventories were 6% below the five-year average as of the week ending September 26, the latest EIA data shows.

Cushing inventories rounded out the week’s losses, falling by 1.152 million barrels in the week, adding onto the week prior’s 693,000 barrel loss in the week prior. EIA data for week ending September 26 showed Cushing inventories at 23.467 million barrels—a figure that is unusually low. Levels this thin leave the market more vulnerable to regional supply disruptions and amplify price swings when pipeline flows shift.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com: