Treasury Secretary Scott Bessent on Tuesday accused India of profiteering from cheap Russian oil imports during the war in Ukraine, describing the practice as “arbitrage” and condemning it as unacceptable.

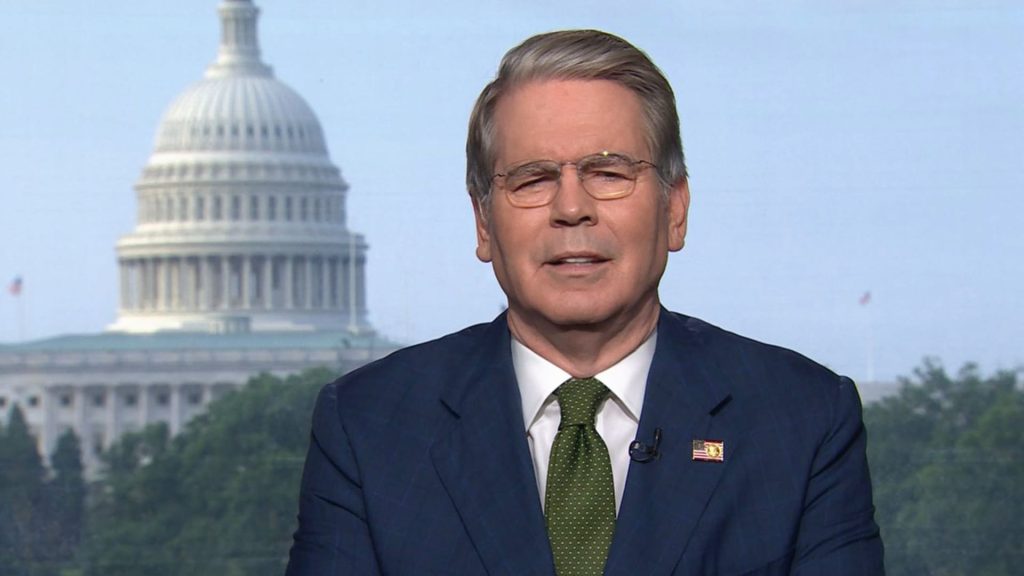

“They are just profiteering. They are reselling,” Bessent told CNBC’s “Squawk Box” in an interview. “This is what I would call the Indian arbitrage — buying cheap Russian oil, reselling it as product.”

“They’ve made $16 billion in excess profits — some of the richest families in India,” Bessent said.

India buys Russian oil at a discount due to sanctions, refines it into gasoline and diesel, and then sells the product back to regions that have sanctioned Moscow such as Europe, said Matt Smith, an oil market analyst at Kpler.

India’s imports of Russian oil have surged since the Kremlin launched its full scale invasion of Ukraine in February 2022. Prior to the invasion, India imported a miniscule amount of Russian crude.

New Delhi is now Russia’s biggest customer importing 1.5 million bpd in July, according to data from Kpler. China is the second largest buyer of Russian oil, importing about 1 million bpd last month.

President Donald Trump earlier this month ordered an additional 25% tariff on India’s exports to the U.S. to punish New Delhi for buying Russian oil. The tariffs take effect next week.

Trump is threatening what he calls “secondary tariffs” on Russian oil buyers like India to pressure the Kremlin to reach a negotiated settlement with Ukraine. So far, however, the U.S. has spared China from secondary tariffs over its imports of Russian crude.

When asked about China’s imports, Bessent suggested that Beijing’s imports were less egregious in the eyes of the Trump administration because it was also a major buyer before Russia invaded Ukraine.

But India actually started buying Russian oil in a major way at the behest of the U.S., said Bob McNally, president of Rapidan Energy and a former advisor to President George W. Bush.

The Biden administration had asked India to accept Russian oil as other countries imposed bans in order to prevent a major oil price spike after the invasion Ukraine that would result in high gasoline prices in the U.S., McNally told CNBC.

“India played a key role in the price cap sanction mechanism designed by the U.S. and its European allies to ensure Russian oil still flowed while trying to crimp the revenue Moscow earned,” McNally said.

CNBC has reached out to the Indian embassy in the U.S. for comment.