The upcoming Trump-Putin meeting is sparking speculation over a potential deal that could ease sanctions and reshape oil markets.

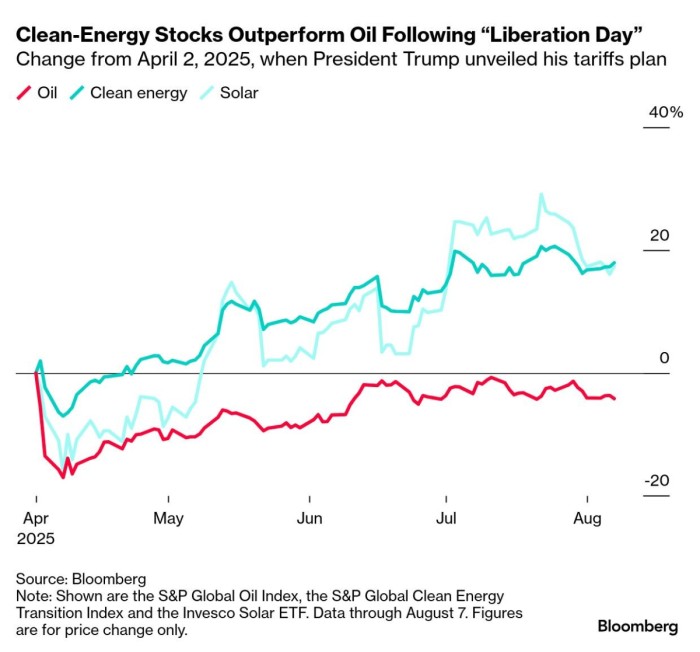

Ending a Four-Year Oil Bull Run, Hedge Funds Are Now Betting on Renewables

– Hedge funds are increasingly giving up on oil as the most profitable commodity play out there, with a Bloomberg analysis of some 700 funds’ strategies indicating that money managers have been betting against oil throughout 2025.

– Post-COVID recovery was the main engine of hedge funds’ oil craze, further boosted by the Russia-Ukraine war and ensuing sanctions, creating an almost four-year prevalence of long oil positions up until September 2024.

– Renewable energy stocks have outperformed oil since Trump came to office, with hedge funds now betting on AI driving a boom in electricity generation that would need to be satiated by clean energy, hence the industry’s net long on wind stocks even though Trump has called off US federal funding.

– With China actively promoting consolidation in its solar sector and Trump contributing to more than $22 billion cancelled renewable projects in the US, hedge funds believe the clean energy projects of the future will be more transparent and cost-efficient without public funds.

Market Movers

– US oilfield services giant SLB (NYSE:SLB) landed a huge six-well drilling contract in Iraq to increase production at the 4.6 TCf Akkas gas field in the country’s western Anbar governorate, aiming for 100 MMCf/d of output within one year.

– Norway’s state oil firm Equinor (NYSE:EQNR) was forced to delay drilling at the 350 MMboe Rosebank field, UK’s largest undeveloped discovery, after the British government requested additional assessments of Scope 3 emissions.

– Malaysia’s national energy company Petronas plans to expand the share of its international upstream portfolio to 60% over the next decade, up from the 40-45% currently as domestic oil and gas reserves mature.

– Global energy trader Hartree Partners is reportedly in talks to buy French agricultural trader Touton, which has been trading cocoa for 150 years and controls around 10% of the world’s output.

Tuesday, August 12, 2025

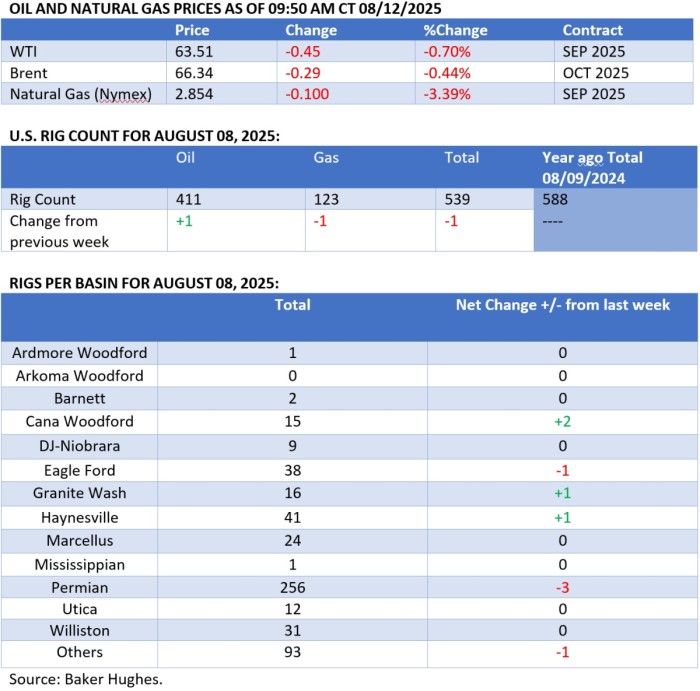

The extension of the US-China trade truce has sparked some upbeat sentiment across the commodity spectrum, however, the impact on oil markets has been fairly muted, with ICE Brent clinging to the $66 per barrel mark. The Trump-Putin summit in Alaska this Friday is set to be the main trendsetter for the upcoming weeks, with a failure to reach a deal most certainly triggering further US pressure on buyers of Russian oil.

OPEC Hikes 2026 Oil Demand Outlook. Running counter to industry consensus, OPEC lifted its demand growth forecast for next year by 100,000 b/d to 1.38 million b/d in its monthly report, keeping 2025 numbers unchanged, whilst cutting non-OPEC+ supply growth to 630,000 b/d.

Chinese Refiners Curb Their Saudi Purchases. Saudi Arabia’s crude exports to China are set to decline in September after the Asian powerhouse’s refiners nominated only 43 million barrels for the month (1.43 million b/d), down 200,000 b/d compared to July-August outflows.

The Race for Citgo Is Heating Up. US miner Gold Reserve (CVE:GRZ) and global commodity giant Vitol will be squaring off for the much-coveted assets of Venezuela-owned refiner Citgo Petroleum, with the latter offering $8.45 billion ahead of the final sale hearing on August 18.

Iraq Paralyzed by Nationwide Blackout. Almost all of Iraq was debilitated by a nationwide power outage that occurred after a sudden shutdown at the Hamidiya power plant damaged the electricity transmission network, with the semi-autonomous region of Kurdistan being the only exception.

Forest Fires Halt Turkish Straits Passage. Turkish authorities suspended shipping traffic through the Dardanelles Strait this week as rampant wildfires ravage the south of the passage, hampering flows of Russian crude and refined products that are loaded in the country’s Black Sea ports.

Beijing Fights Back Against Canadian Canola. China’s Ministry of Commerce slapped preliminary anti-dumping duties on Canadian canola imports, setting the levy at a hefty 75.8% and making it effective as soon as August 14, despite sourcing almost all its imports from Canada.

Congo Rejigs Terms After Failed Oil Auction. The Democratic Republic of Congo is working to reform its fiscal terms for oil production after its latest licensing round launched in 2022 after a 15-year hiatus failed to trigger any interest with oil majors, with only 3 blocks awarded out of 27.

ADNOC Nears Santos Takeover. ADNOC, the national oil company of UAE’s Abu Dhabi, has extended its six-week due diligence period to finalize its $18.7 billion takeover bid for Australia’s upstream giant Santos (ASX:STO) to August 22, seeking to comply with regulatory requirements.

Germany Eyes US-Style Solar Subsidy Cuts. Germany’s solar industry warned its government against ending subsidies for new rooftop solar panels, introduced back in 2000, after the Economy Minister stated that new rooftop systems no longer need public funding as Berlin boosts defence spending.

Norway Readies for First Frontier Auction Since 2021. Norway’s Energy Ministry is preparing to launch its next licensing round, offering frontier blocks for the first time in four years, after the Labour government’s 2021 four-year moratorium on frontier drilling expired.

The World’s Wind Champion Falls by the Wayside. Denmark’s Orsted (CPH:ORSTED), the world’s largest wind developer, saw its shares collapse this week after it asked shareholders to for $9.4 billion to fund its Sunrise Wind project off the US East Coast, despite Trump’s suspension of licensing.

China’s Lithium Mining Woes Boost Prices. China’s top EV battery maker CATL (SHE:300750) said it had suspended production at its Yichun lithium mine amid a broader crackdown on overcapacity, sending lithium carbonate prices up 8% on Monday, to ¥73,000 per tonne ($10,150/mt).

Jellyfish Derail France’s Nuclear Plants. The restart of four reactors at France’s Gravelines nuclear plant has been delayed by the operator EDF by a week as 3.6 GW of capacity was forced offline by a swarm of jellyfish detected within the plant’s cooling systems, citing global warming as the cause.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com