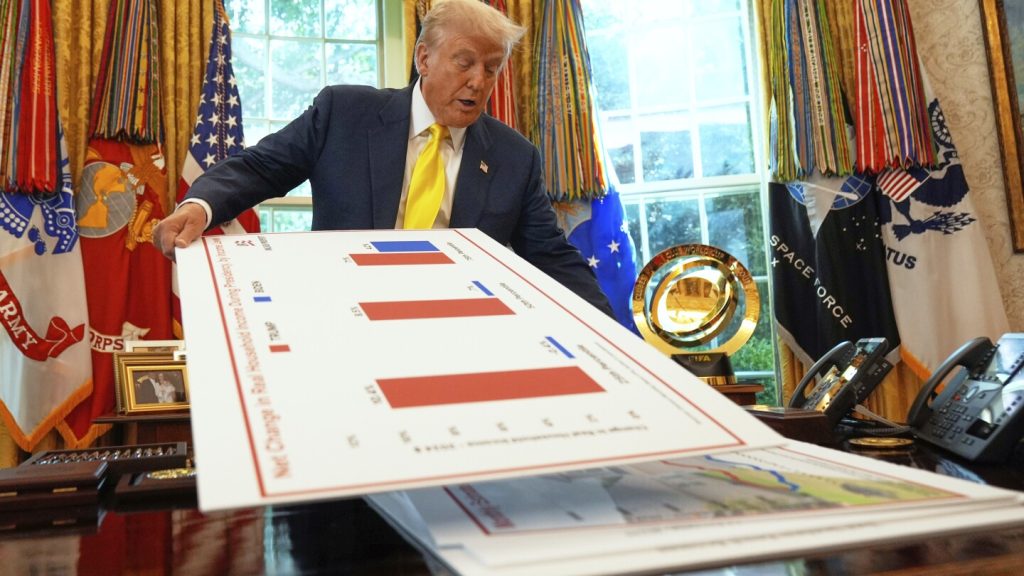

WASHINGTON (AP) — President Donald Trump unexpectedly summoned reporters to the Oval Office on Thursday to present them with charts that he says show the U.S. economy is solid following a jobs report last week that raised red flags and led to the Republican firing the head of the Bureau of Labor Statistics.

Joining Trump to talk about the economy was Stephen Moore, a senior visiting fellow in economics at the Heritage Foundation, a conservative think tank, and the co-author of the 2018 book “ Trumponomics.”

Flipping through a series of charts on an easel, Moore sought to elevate Trump’s performance as president and diminish the economic track record of former President Joe Biden. Trump stood next to Moore and interjected with approvals.

The moment in the Oval Office spoke to the president’s hopes to reset the narrative of the U.S. economy. While the stock market has been solid, job growth has turned sluggish and inflationary pressures have risen in the wake of Trump imposing a vast set of new tariffs, which are taxes on imports.

Moore said he phoned Trump because he put together some data that shows he was correct to dismiss Erika McEntarfer as the head of the BLS. He noted that’s because reports from the BLS had overestimated the number of jobs created during the last two years of Biden’s term by 1.5 million.

“I think they did it purposely,” said Trump, who has yet to offer statistical evidence backing his theory. Revisions are a standard component of jobs reports and tend to be larger during periods of economic disruption.

The economy has seldom conformed to the whims of any president, often presenting pictures that are far more mixed and nuanced than what can easily be sold to voters. Through the first seven months of this year, employers have added 597,000 jobs, down roughly 44% from the gains during the same period in 2024.

The July jobs report showed that just 73,000 jobs were added last month, while the May and June totals were revised downward by 258,000.

While Biden did face downward revisions on his job numbers, the economy added 2 million jobs in 2024 and 2.6 million in 2023.

The fundamental challenge in Biden’s economy was the jolt of inflation as the annual rate of the consumer price index hit a four-decade high in June 2022. That level of inflation left many households feeling as though groceries, gasoline, housing and other essentials were unaffordable, a sentiment that helped to return Trump to the White House in the 2024 election.

There are signs of inflation heating back up under Trump because of his tariffs. On Thursday, Goldman Sachs estimated that the upcoming inflation report for July will show that consumer prices rose 3% over the past 12 months, which would be up from a 2.3% reading in April.

Trump promised that he could galvanize a boom. And when nonpartisan data has indicated something closer to a muddle, he found an advocate in Moore, whom he nominated to serve as a Federal Reserve governor during his first term. Moore withdrew his name after facing pushback in the Senate.

Moore said that through the first five months of Trump’s second term in office that “the average median household income adjusted for inflation and for the average family in America, is already up $1,174.” Moore said his numbers are based on unpublished Census Bureau data, which can make them difficult to independently verify.

“That’s an incredible number,” Trump said. “If I would have said this, nobody would have believed it.”