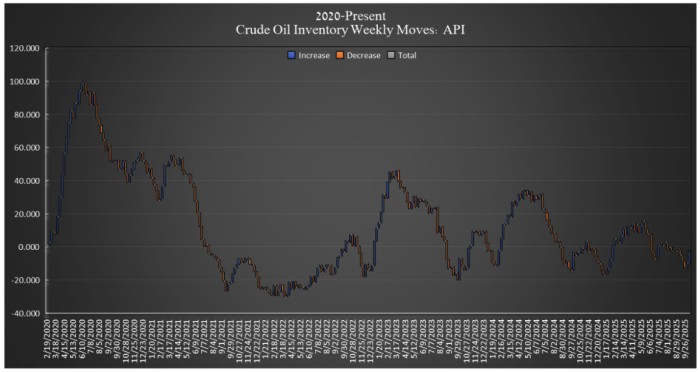

(Oil Price)- The American Petroleum Institute (API) estimated that crude oil inventories in the United States increased by a large 7.36 million barrels in the week ending October 10. Analysts had forecast a much smaller 120,000-barrel build for the week. Today’s build comes after the IEA predicted a smaller global oil demand growth estimate for this year, along with a higher supply growth, which would, according to the agency, result in a rather large supply overhang globally.

But crude oil inventories in the United States are not showing signs of an inventory overhang, with net crude oil inventories just 7.9 million barrels higher than they were at the beginning of the year, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) have risen by 700,000 barrels to 407.7 million barrels in the week ending October 10 as the government attempts to replenish stockpiles that were eaten into by the previous administration.

US production has reached an all-time high for the week of October 3, of 13.629 million bpd, according to the EIA.

At 4:14 pm ET, Brent crude was trading down again, by $0.28 (-0.45%) on the day, reaching $62.11 $65.73. Brent prices are now down $3.60 per barrel from this time last week following a fragile ceasefire and hopes of a lasting peace deal, on top of the IEA’s gloomy predictions of a bearish market. WTI was also trading down on the day, by $0.26 (-0.44%) at $58.44.

Gasoline inventories also saw a build, of 2.99 million barrels in the week ending October 10, after falling by 1.245 million barrels in the week prior. As of last week, gasoline inventories were about 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell in the reporting period, losing 4.79 million barrels on top of the week prior’s 1.822-million-barrel drawdown. Distillate inventories were already 6% below the five-year average as of the week ending October 3, the latest EIA data shows.

Cushing inventory data was not available at the time of writing.

By Julianne Geiger for Oilprice.com