Tesla has reportedly ordered lithium iron phosphate (LFP) battery cells worth billions from LG Energy Solution. The batteries are said to be produced in the United States and primarily intended for Tesla’s stationary energy storage systems – which the company recently highlighted in its own announcements.

According to Reuters, Tesla has entered into a $4.3 billion supply agreement with LG Energy Solution for US-made LFP battery cells. At current exchange rates, that’s equivalent to around €3.7 billion. While the South Korean battery manufacturer has confirmed a deal of this size, it has not officially named the customer. Reuters, citing informed sources, reports that the contract is with Tesla – but not for electric vehicles. Instead, the LFP cells are reportedly destined for Tesla’s stationary storage products.

However, details remain somewhat vague. LGES states it will deliver the cells globally over the three-year term of the contract (2027 to 2030) but has not specified their intended use. The Reuters source goes further, naming Tesla as the buyer and pointing to LGES’ factory in Michigan as the origin of the LFP cells. These cells, they claim, will be used exclusively in Tesla’s energy storage systems – not in its EVs.

The reasoning behind the deal appears clear: Tesla is looking to reduce its dependence on Chinese imports. Rising tariffs have made Chinese battery cells not only more expensive but also harder to plan around. Tesla CFO Vaibhav Taneja already noted back in April that US tariffs were having a disproportionate impact on the company’s energy business, given that its LFP cells were sourced from China. That said, Tesla also builds its Megapacks in Shanghai, among other locations.

Tesla is actively working to diversify its battery supply chains. In its Q2/2025 earnings report last week, the company reiterated that it is on track to bring its US-based lithium refinery online later this year. Tesla also expects to begin domestic production of its own LFP cells in 2025. However, as with its in-house EV cells, Tesla is unlikely to cover its full requirements early on – making additional supply deals, such as the one with LGES, all the more plausible.

While LFP cells have a lower energy density than NMC (nickel-manganese-cobalt) chemistry, they are more robust and significantly more cost-effective. For high-performance or long-range EVs, NMC cells will likely remain the go-to option. But in the high-volume segment, where price is key, LFP cells are gaining traction. In China in particular, carmakers and battery suppliers alike are increasingly turning to lithium iron phosphate – a trend confirmed by recent production figures.

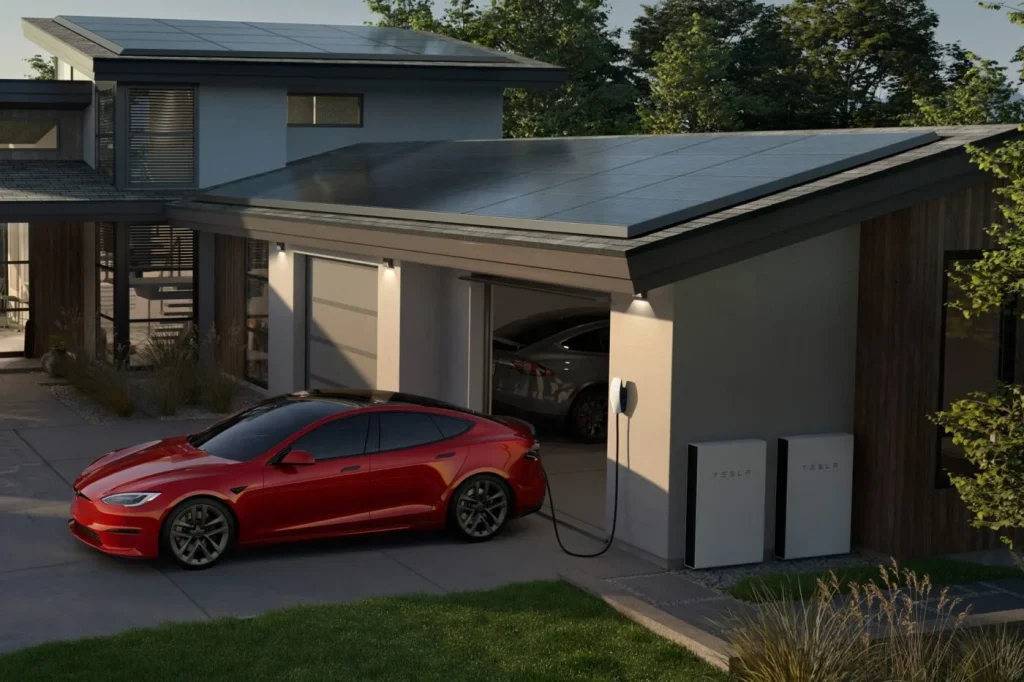

Tesla already uses LFP cells in the standard versions of the Model 3 and Model Y, primarily supplied by CATL. For a time, the Model Y also featured BYD’s Blade batteries. However, Tesla does not disclose how many of its vehicles are equipped with LFP cells. In its energy products – such as the Powerwall for residential use and the commercial-scale Megapack – Tesla has also relied on LFP cells from China. In this context, energy density is less critical, while durability and price are decisive factors.

Tesla’s energy business – covering battery storage and solar roofing – accounts for roughly ten per cent of its total revenue. In Q2, it reached 12.4 per cent. The segment sees seasonal fluctuations, as installations do not follow the same steady rhythm as EV sales. However, home battery installations have grown for five consecutive quarters.

reuters.com (Tesla), reuters.com (LGES announcement)