(Oil & Gas 360) – Supply Expectations High And Demand Expectations Low, Running Counter To U.S. Supply Demand Data Have The Consensus Set UP To Be Caught Short.

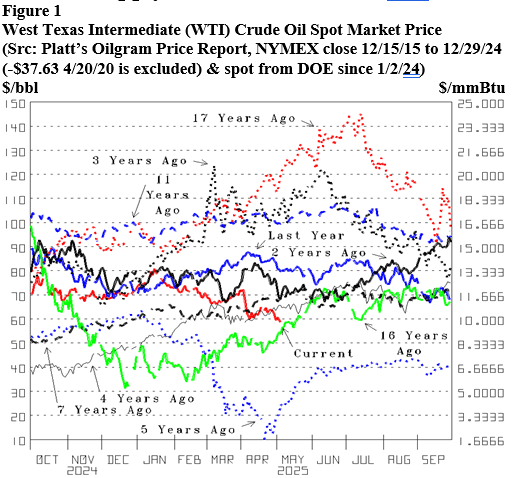

The price of WTI crude oil back below $60 reflects much fear plus news that OPEC+ will increase production. The Organization of Petroleum Exporting Countries (OPEC), + other world exporters announcing Monday, that production limits will be increased 411,000 barrels per day in June deflated the spot market price of West Texas Intermediate (WTI) crude oil back below $60 per barrel (Figure 1, red line). More supply plus Inflation, Tariff, and Recession fears increasing uncertainty are also minimizing demand expectations and exaggerating down.

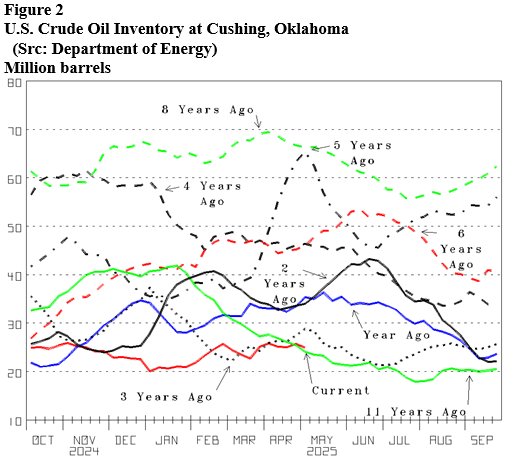

While price expectations are extra depressed, crude oil inventory at Cushing (where futures contracts are delivered) is down extra low. Crude oil inventory at Cushing Oklahoma (where New York Mercantile Exchange [NYMEX] futures contracts are delivered), declining to extra low as the year began (Figure 2, red line), tugged the WTI spot price up to $80 per barrel (Figure 1). It then increasing to an early-April high helped deflate the price. Nevertheless, this inventory remains extra low, and we predict: decline is next.

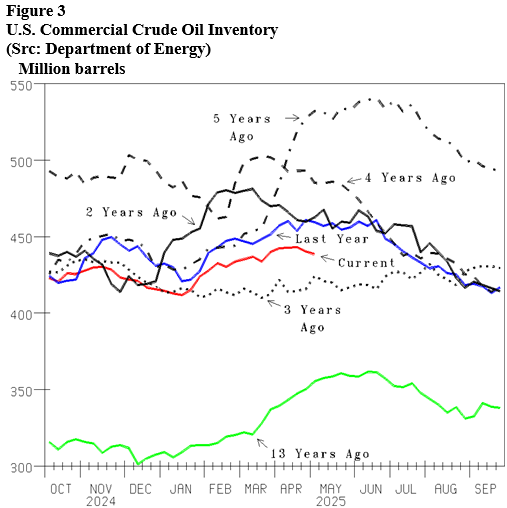

Oil bearishness is helped by the increase in total U.S. crude oil inventory since early January. Nevertheless, it is now 21.2 mmb less than last year. Total U.S. crude oil inventory declining to a multi-year low as the year began (Figure 3, red line) helped the price of WTI rise to $80 (Figure 1). It then increasing 31.4 million barrels (mmb) to 443.1 April 18 helped deflate. The drop back below $60, despite this inventory declining 4.7 mmb the last two weeks, encourages our conclusion that an exaggerated price-drop opportunity is in place.

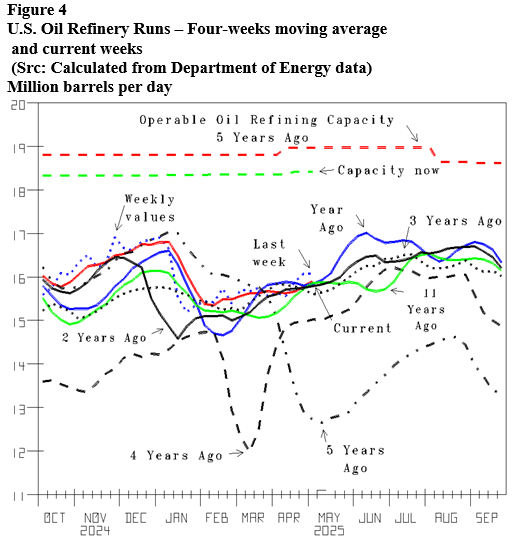

Oil bearishness is also helped by analysis thin helping most be unaware that more crude oil is next needed to fuel Summer. Refinery runs showing good year-over-year (YOY) growth October into January (Figure 4, red line versus blue) helped U.S. Commercial crude oil inventory show good YOY decline to January’s low (Figure 3). YOY refinery run increase switching to decline mid-March helped pressure prices and expectations lower. Now, runs need to increase to fuel Summer, with hours of sunshine increasing and encouraging much getting out-and-about.

By oilandgas360.com contributor Michael Smolinksi with Energy Directions

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Oil & Gas 360. Please consult with a professional before making any decisions based on the information provided here. The information presented in this article is not intended as financial advice. Contact Energy Directions for the full report. Please conduct your own research before making any investment decisions.