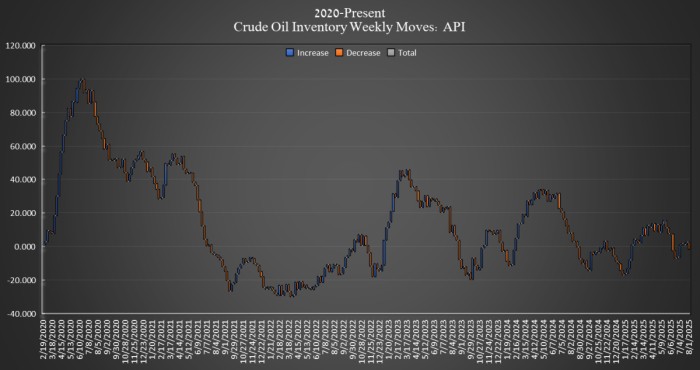

The American Petroleum Institute (API) estimated that crude oil inventories in the United States fell this week, shrinking by 4.2 million barrels in the week ending August 1. Analysts had expected a 1.8 million barrel draw.

So far this year, crude oil inventories are up nearly 9 million barrels, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) added another 300,000 barrels to 403 million barrels in the week ending August 1.

Despite a gradual rebound, U.S. emergency crude stockpiles are still deeply depleted compared to pre-2022 levels, when the Biden Administration’s SPR release began.

At 4:21pm ET, moment before data release, Brent crude was trading down $1.18 (-1.72%) on the day, landing at $67.58—down roughly $5 per barrel from last week’s prices after OPEC unwound its production quotas over the weekend.

WTI was also trading down on the day, by $1.20 (-1.81%) at $65.09, more than $4 shy of last week’s level.

Gasoline inventories fell in the week ending August 1 by 900,000 barrels, after falling by 1.739 million barrels in the week prior. As of last week, gasoline inventories were 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose again this week, by 1.6 million barrels after rising by 4.189 million barrels in the week prior. Distillate inventories were 16% below the five-year average as of the week ending July 25, the latest EIA data shows.

Cushing inventories—the benchmark crude stored and traded at the key delivery point for U.S. futures contracts in Cushing, Oklahoma—rose by 1.7 million barrels in the week. In the week prior, Cushing inventories had risen by 465,000 barrels.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com