(Bloomberg) — A historic stock-market run came to a halt as President Donald Trump’s latest tariff remarks provided little relief to investors bracing for the impacts of his trade war on the economy and corporate earnings.

Most Read from Bloomberg

Not even data showing a pick-up in growth at US service providers was able to erase equity losses, with the S&P 500 set to halt its longest rally in about 20 years. While Trump suggested some trade deals could come as soon as this week, he signaled no imminent accord with China. As the president extended his restrictive policies on US imports to the entertainment sector, shares of companies like Netflix Inc. and Paramount Global fell.

Recent economic data seems to have assuaged market concerns of a recession, but the outcome of Trump’s tariff war has yet to be felt. For several market observers, tariffs will eventually slow the US economy as supply chains are upended and consumer confidence tumbles, with the increases in levies possibly delivering at least a temporary inflation shock.

Subscribe to the Stock Movers Podcast on Apple, Spotify and other Podcast Platforms.

“The S&P 500 erased the tariff selloff with one of its strongest bursts of short-term momentum of the past 20 years, but it remains to be seen whether that can translate into a fresh bull market,” said Chris Larkin at E*Trade from Morgan Stanley.

Attention will soon shift to this week’s Federal Reserve decision after bond traders dialed back rate-cut bets that had steadily mounted as Trump’s trade war unleashed havoc in financial markets.

As long as the labor market holds firm, the central bank can more easily justify the standing pat. While Jerome Powell and his colleagues would typically welcome the latest inflation cooling, higher US duties on imports risk upending the progress on that front.

The S&P 500 fell 0.3%. The Nasdaq 100 slid 0.4%. The Dow Jones Industrial Average added 0.2%. The yield on 10-year Treasuries rose two basis points to 4.33%. The Bloomberg Dollar Spot Index slipped 0.3%.

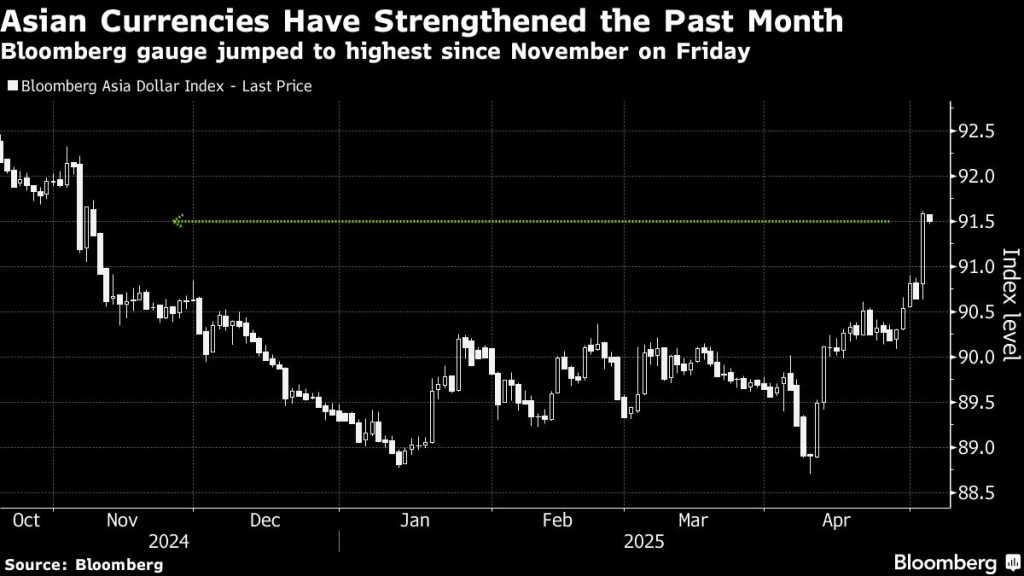

Oil sank as OPEC+ agreed to a bumper output increase. Taiwan’s dollar surged the most since 1988 on bets authorities might allow it to appreciate to help reach a trade deal with the US.

Corporate Highlights:

Palantir Technologies Inc. investors have been betting that the results coming after the markets close on Monday will be another blowout, but the recent run up has given the stock a high bar to clear.

Berkshire Hathaway Inc. followed Chief Executive Officer Warren Buffett’s recommendation, naming Vice Chairman Greg Abel to replace the billionaire as CEO, effective Jan. 1.

Tyson Foods Inc.’s earnings jumped more than expected as increased profits from chicken sales outweighed another quarter of losses at the company’s beef business.

Shell Plc is working with advisers to evaluate a potential acquisition of BP Plc, though it’s waiting for further stock and oil price declines before deciding whether to pursue a bid, according to people familiar with the matter.

Sunoco LP agreed to acquire Parkland Corp., one of the largest owners of gas stations in Canada, for about $9.1 billion including debt.

Investment firm 3G Capital will acquire footwear maker Skechers USA Inc. for $9.4 billion.

Story Continues