2026-02-10T16:31:12.095Z

Share

Copy link

X

Bluesky

Threads

lighning bolt icon

An icon in the shape of a lightning bolt.

Impact Link

Save

Saved

Read in app

subscribers. Become an Insider

and start reading now.

Have an account? Log in.

Wall Street has cooled a bit after a massive sell-off wiped more than $1 trillion in Big Tech valuations.

Recent AI advancements have undermined some investors’ faith in established software names.

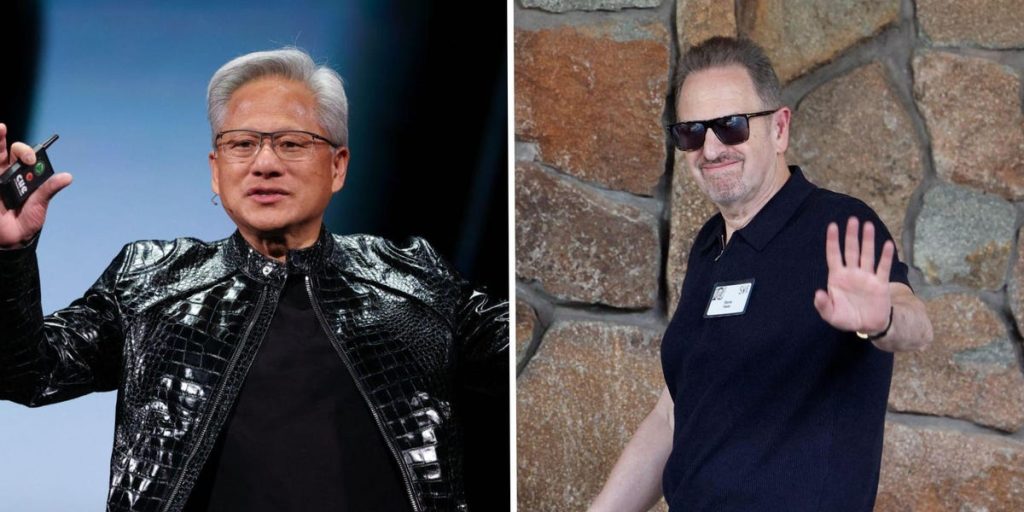

Jensen Huang, Arm CEO Rene Haas, and former Microsoft exec Steven Sinofsky were skeptical of the market’s reaction.

Big Tech is beginning to bounce back after a brutal sell-off.

Wall Street’s fears of AI-related disruption drove a sell-off of software stocks after the release of Anthropic’s new industry-specific plug-in.

Not everyone in finance and tech is sold on the idea that AI is going to kill the software business.

From Nvidia’s CEO dismissing the concerns, to Zoho’s founder acknowledging the industry is “ripe for consolidation,” here’s what leaders in tech and finance are saying:

Jensen Huang

Steve Marcus/REUTERS

Nvidia CEO Jensen Huang said software is a tool for AI to use, rather than replace.

“There’s this notion that the tool industry is in decline and will be replaced by AI,” Huang said during a recent Cisco AI event. “You could tell because there’s a whole bunch of software companies whose stock prices are under a lot of pressure because somehow AI is going to replace them. It is the most illogical thing in the world and time will prove itself.”

Huang named ServiceNow, SAP, Cadence, and Synopsis, as bright spots in the industry.

Sam Altman

Mandel Ngan/AFP/Getty Images

OpenAI CEO Sam Altman said volatility will remain in the software market.

“It’s different, it’s definitely not dead,” Altman said during an interview on TBPN. “How you create it, how you’re going to use it, how much you’re going to have written for you each time you need it, versus how much you’ll want sort of a consistent UX —yeah, that’s all going to change.”

In the meantime, sell-offs like the one Wall Street has continued now are likely to continue.

“I think it’s just going to be volatile for a while as people figure out what this looks like.”

Sridhar Vembu

Sridhar Vembu, founder of Zoho, a cloud-based software company, said SaaS was “ripe for consolidation” long before the rise of AI.

“An industry that spends vastly more on sales and marketing than on engineering and product development was always vulnerable,” he wrote on X. “The venture capital bubble and then the stock market bubble funded a fundamentally flawed, unsustainable model for too long. AI is the pin that is popping this inflated balloon.”

Vembu said he asks his employees to consider the possibility of the company’s death.

“When we accept that possibility, we become more fearless and that is when we can calmly chart our course.”

Steven Sinofsky

Reuters

Steven Sinofsky, who helped lead the development of Windows 7 and 8, said AI may change “what we built and who builds it,” but tales of software’s demise are just “nonsense.”

“Wall Street is filled with investors of all types. There’s also a community, and they tend to run in herds. The past couple of weeks have definitely seen the herd collectively conclude that somehow software is dead. That the idea of a software pure play will just vanish into some language model,” Sinofsky wrote in a lengthy post on X. “Nonsense.”

Sinofsky said it is true some companies will fail. He also noted that such cycles have happened in retail and media.

“Strap in,” he wrote. “This is the most exciting time for business and technology, ever.”

Rene Haas

Reuters

Arm CEO Rene Haas isn’t panicking.

“As I look at enterprise AI deployment, we aren’t anywhere close to where it can be,” Haas told the Financial Times.

Haas, who leads the SoftBank-owned semiconductor company, said the current market reaction is “micro-hysteria.”

Stephen Parker

JPMorgan analyst Stephen Parker said investors shouldn’t be too worried by the sell-off.

“We’re seeing a rotation,” Parker told CNBC. “It’s about a broadening of the recovery story. Cyclicals are picking up the slack, and it’s not just the AI infrastructure plays and the hyperscalers that are driving markets higher.”

Parker, the co-head of global investment strategy at JPMorgan Private Bank, said AI developments are likely to continue to cause disruption in the software industry.

Anish Acharya

Harry Murphy/Sportsfile for Collision via Getty Images

Anish Acharya, a general partner at A16z, said the sell-off was an overreaction based on a misunderstanding of how AI will be deployed.

“You have this innovation bazooka with these models,” Acharya told podcaster Harry Stebbings during an episode of “20VC.” “Why would you point it at rebuilding payroll or ERP or CRM, right? You’re going to take it and use it to extend your core advantage as a business, or you’re going to take it to optimize the other 90% that you’re not spending on software today.”

Acharya said there “will be secular losers,” but overall, the sell-off was misguided.

“I think the general story that we’re going to vibe code everything is flat wrong and the whole market is oversold software,” he said.