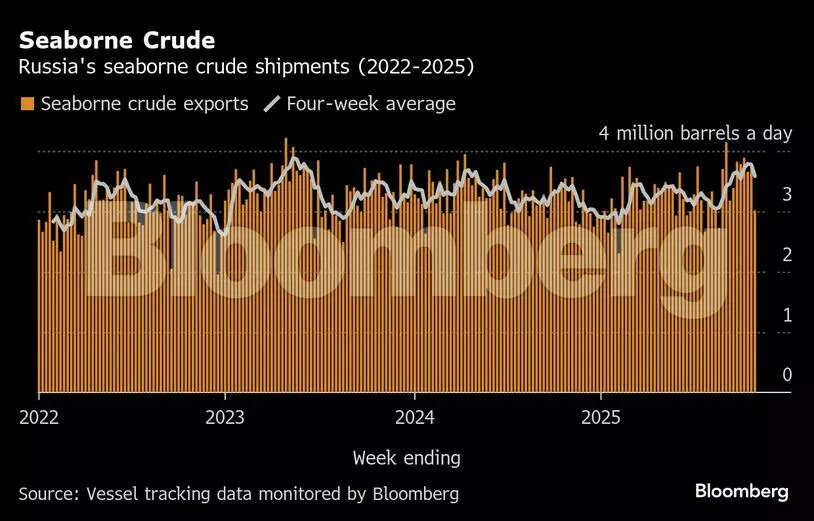

Russia’s seaborne crude shipments fell sharply, dropping by the most since January 2024, as the latest US sanctions led key buyers to shy away from Moscow’s oil. Cargo discharges have been hit even harder than loadings, with oil on the water surging.

Four-week average volumes from the country’s ports were 3.58 million barrels a day to Nov. 2, according to vessel-tracking data compiled by Bloomberg, down by about 190,000 from the revised figure for the period to Oct. 26. The average provides a clearer picture of underlying trends than more volatile weekly figures, which also sank.

The slump in flows hit Moscow’s oil revenue, which fell to the lowest since August, and follows a US ban on dealings with the country’s two biggest exporters, Rosneft PJSC and Lukoil PJSC. Refiners in China, India and Turkey are pausing purchases of sanctioned cargoes and seeking alternative supplies, at least for now.

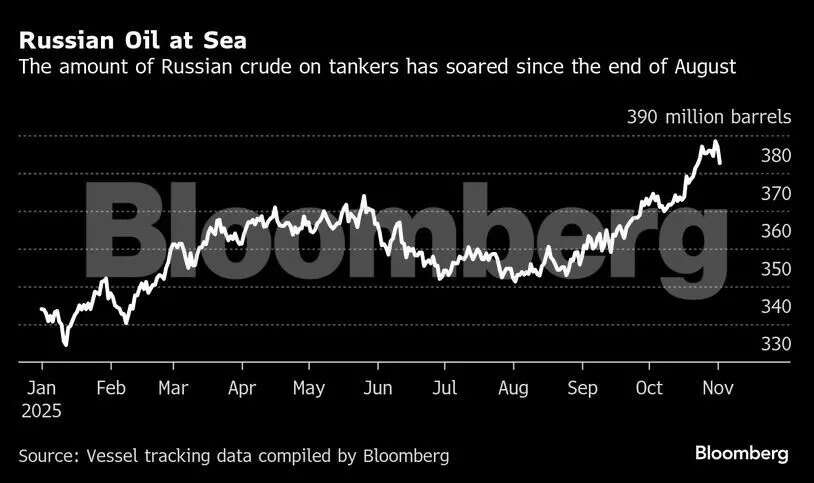

Russian exporters are continuing to load crude onto tankers, but refiners are less willing to take the cargoes into their storage tanks. That’s caused the amount of Russian crude at sea to soar to more than 380 million barrels, rising by 27 million barrels, or 8 per cent since the start of September, according to tanker-tracking data compiled by Bloomberg.

Together, India, China and Turkey sweep up more than 95 per cent of Russia’s seaborne crude exports, so it will be almost impossible to compensate for any significant pull-back in their purchases. Moscow will likely want to continue to load cargoes for as long as it can, even if they remain in floating storage. So oil held at sea will become an increasingly important measure of the impact of the latest sanctions.

The ban on dealing with Russian companies, which now extends to its four biggest crude exporters, will hit global oil supplies, the CEOs of big European oil companies warned, potentially reducing the size of any glut next year.

Several large Indian oil refiners, who have been buying almost 1 million barrels a day of Russian crude, are pausing purchases, at least until workarounds can be found. That’s expected to hit deliveries for December and January, crude that should begin loading at Russian ports this month. India’s state-run refiners are considering whether they can continue to take some cargoes from small suppliers instead of Russia’s sanctioned energy giants.

Chinese refiners are taking similar steps. State-owned processors Sinopec and PetroChina Co. have canceled some Russian cargoes following the US sanctions, with the buyers’ caution likely to affect as much as 45 per cent of China’s total seaborne crude imports from Russia, or about 400,000 barrels a day, according to Rystad Energy AS. The move could hit Russia’s key ESPO grade, shipped from the Pacific port of Kozmino, which is just a few days sailing from refineries in northern China.

Refiners in Turkey, the third-largest buyer of Russian crude, have also started cutting purchases, seeking alternative supplies from other short-haul suppliers including Iraq, Libya, Saudi Arabia and Kazakhstan.

Nevertheless, some think the disruption will be temporary. “Down the line, you will see that more and more of the disrupted Russian oil, one way or another, finds its way to the market,” Gunvor Group Chief Executive Officer Torbjörn Törnqvist said in an interview on Tuesday. “It always does somehow.”

Separately, Russia’s crude processing continued to climb in the final week of October, as plants increased runs after seasonal maintenance or Ukrainian drone strikes. But it is likely to fall again this week after another attack, the seventh so far this year, on Rosneft’s Saratov plant.

Crude Shipments

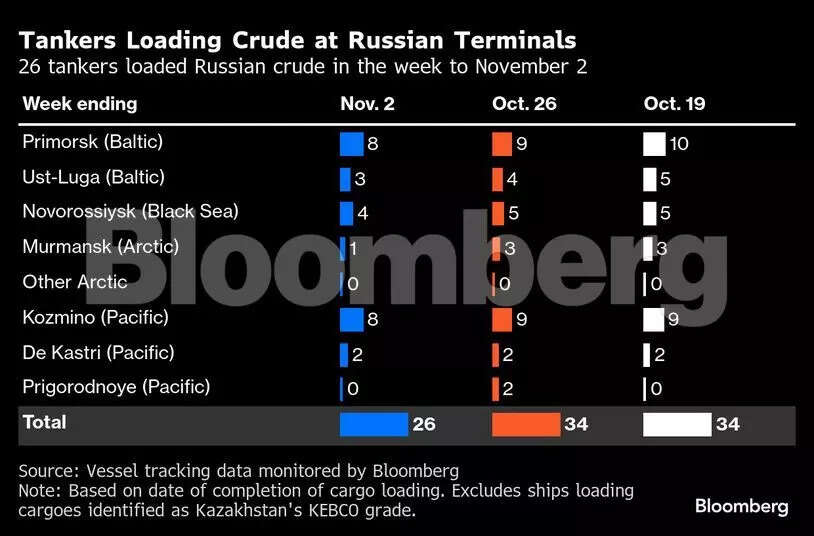

A total of 26 tankers loaded 21.11 million barrels of Russian crude in the week to Nov. 2, vessel-tracking data and port-agent reports show. The volume was down from a revised 26.41 million barrels on 34 ships the previous week.

On a daily average basis, shipments in the week to Nov. 2 dropped to 3.02 million barrels a day, the lowest in 10 weeks. Separately, two cargoes of Kazakhstan’s Kebco grade were shipped from Ust-Luga and one from Novorossiysk during the week.

Shipments were down from all regions, with De Kastri — linked to the Sakhalin 1 project –the only port to show stable flows.

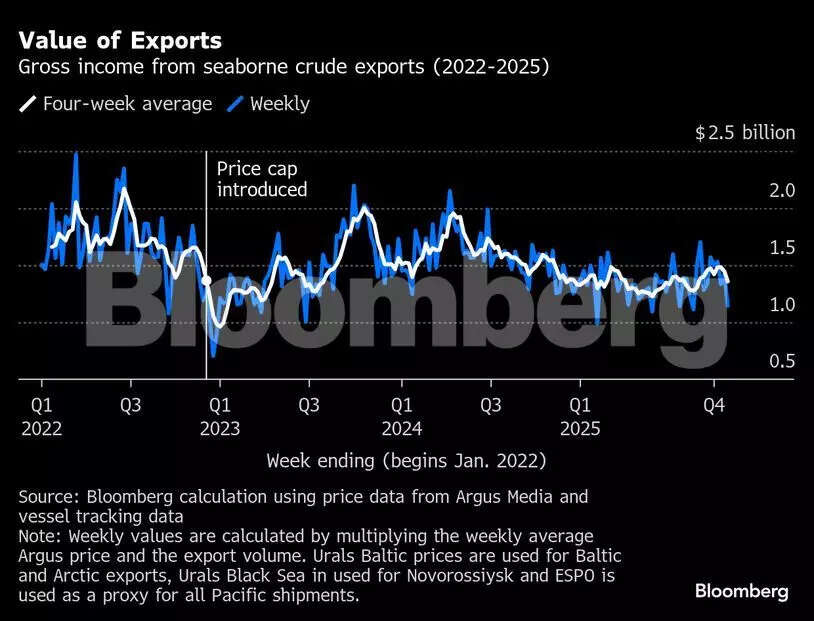

Export Value

On a four-week average basis, the gross value of Moscow’s exports fell by about $90 million to $1.36 billion a week in the 28 days to Nov. 2, with export quantities and prices both falling.

Using this measure, the export prices of Russia’s Urals from the Baltic and Black Sea both fell by about $0.60 a barrel to $51.42 and $51.79, respectively. The price of Pacific ESPO crude dropped by $0.80 to average $59.20 a barrel, remaining below the G-7 price cap of $60 for a second week. Delivered prices in India also dropped, falling by $0.60 to $62.13 a barrel, all according to numbers from Argus Media.

On a weekly basis, the value of exports averaged about $1.15 billion in the 7 days to Nov. 2, down by 27 per cent from the revised figure for the period to Oct. 26.

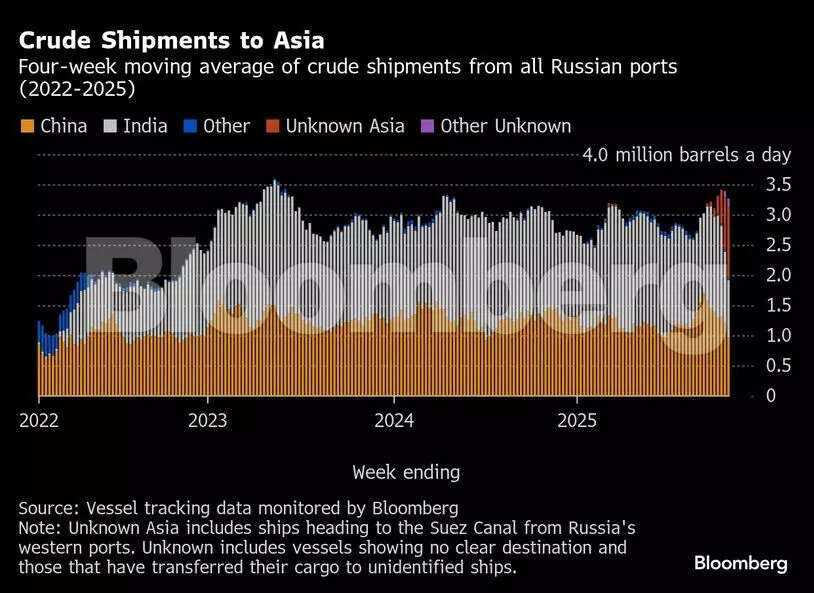

Flows by Destination

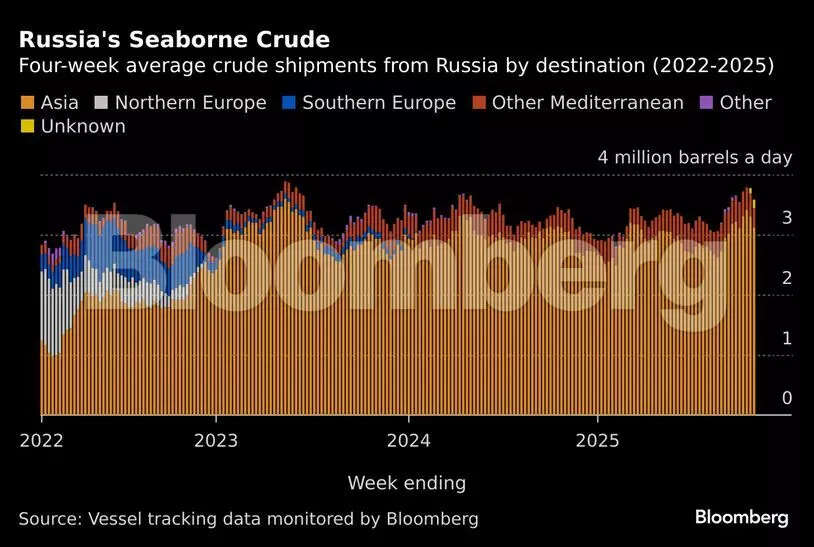

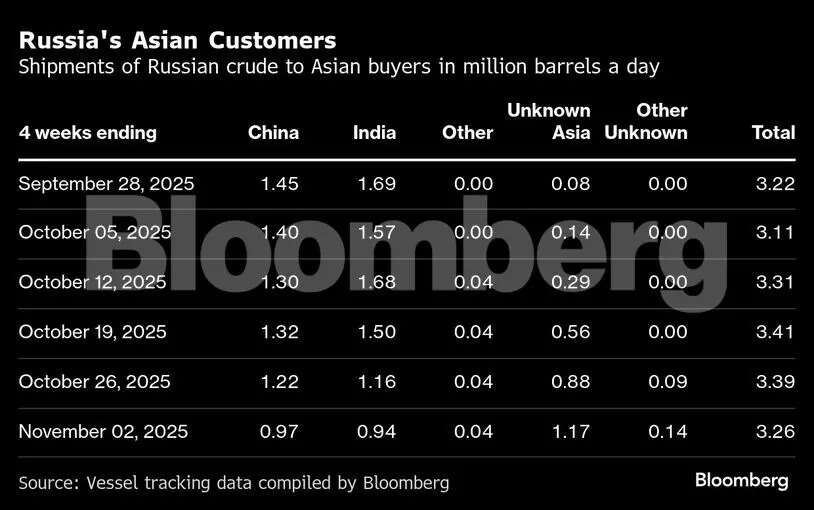

Observed shipments to Russia’s Asian customers, including those showing no final destination, slipped to 3.26 million barrels a day in the 28 days to Nov. 2, down from a revised 3.39 million barrels a day in the period to Oct. 26.

While the amount of Russian crude heading to both China and India appears to be falling steeply, there are large quantities on vessels yet to show a final destination, allowing for that pattern to be reversed. Tankers are increasingly showing no final destination until they are well across the Arabian Sea, while some never show a final destination, even after mooring to discharge.

Flows on tankers signaling Chinese ports fell to 970,000 barrels a day in the four weeks to Nov. 2, while the amount destined for India fell to 940,000 barrels a day from a revised 1.16 million barrels a day in the period to Oct. 26. But there is the equivalent of more than 1.3 million barrels a day on vessels yet to show a final destination.

Of that, about 1.2 million barrels a day is on ships from Russia’s western ports showing their destination as Port Said or the Suez Canal, or those from Pacific ports with no clear delivery point, and a further 140,000 barrels a day is on tankers yet to signal a destination.

In the past, those cargoes have almost all ended up in India or China, but tougher US sanctions may keep that oil on the water unless, or until, workarounds can be found by the Russian sellers.

Flows to Turkey in the four weeks to Nov. 2 fell to about 320,000 barrels a day. Shipments to Syria remained at zero. Tankers hauling Russian crude to the east Mediterranean nation rarely signal their destination and usually disappear from automated tracking systems when they’re south of Crete, making it difficult to estimate flows in advance of ships arriving off the port of Banias.