• The bill would bar BlackRock and State Street from casting any shareholder votes tied to the $1 trillion Thrift Savings Plan, the retirement system for U.S. federal employees.

• The legislation expands ongoing Republican efforts to curb asset-manager participation in ESG and climate coalitions, amid lawsuits alleging antitrust violations tied to sustainability initiatives.

• The proposal comes as major U.S. asset managers scale back climate-related commitments and support for ESG shareholder resolutions.

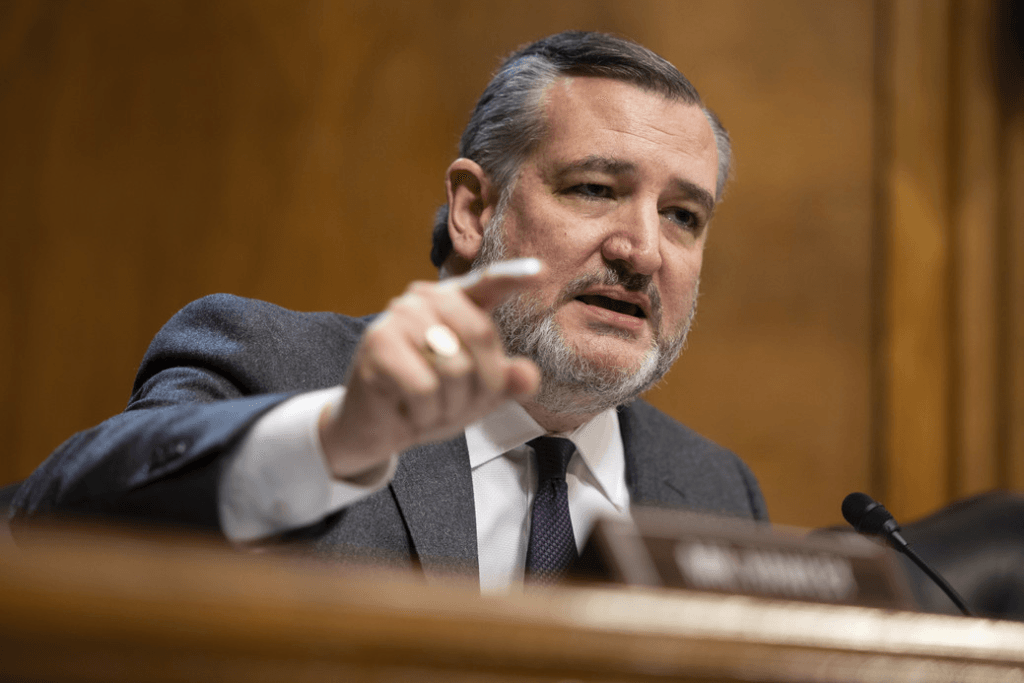

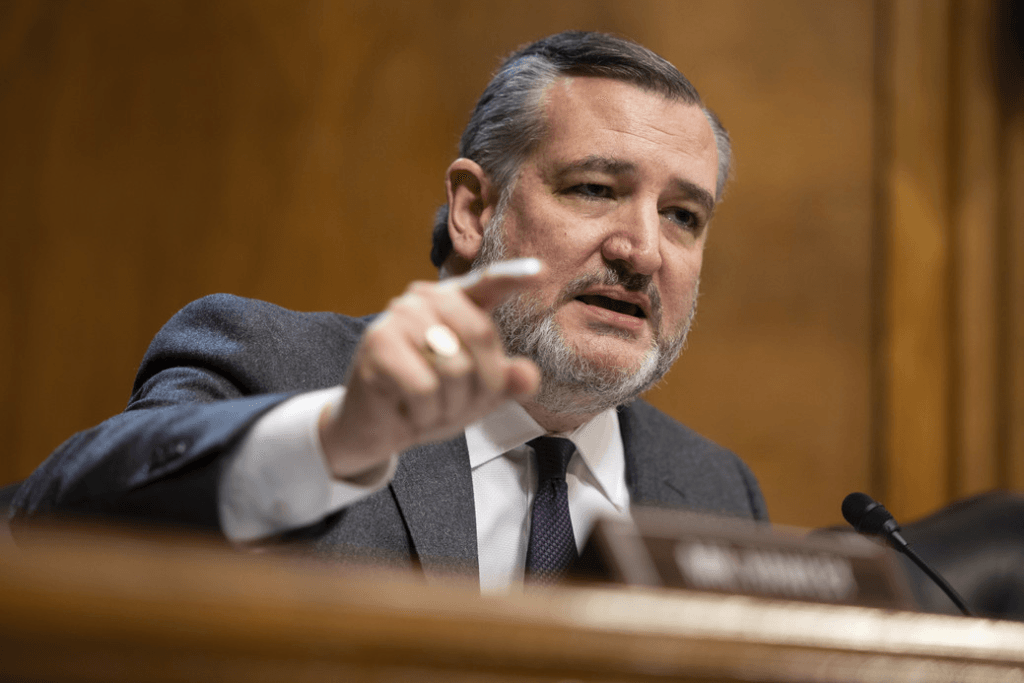

U.S. Senator Ted Cruz has introduced a bill aimed at stopping professional asset managers from voting the shares held in the federal Thrift Savings Plan, escalating a broader political fight over the role of Environmental, Social, and Governance considerations in public finance. The proposal, titled the Stop TSP ESG Act, seeks to prevent BlackRock and State Street from using proxy votes linked to the retirement savings of more than six million federal workers.

The Thrift Savings Plan, which recently surpassed $1 trillion in assets, is one of the largest defined contribution systems in the world. Its core mutual funds are managed chiefly by BlackRock Capital Advisers and State Street Global Advisors. These firms have long viewed proxy voting as part of their fiduciary stewardship responsibilities. Cruz argues the opposite, claiming the managers have used their positions to advance ESG and Diversity, Equity, and Inclusion agendas that he says fall outside prudent financial management.

“Americans deserve assurance that their retirement savings are being invested in the most fiscally responsible ways,” Cruz said in a statement. “Instead investment fund managers are using the retirement savings of federal employees to push ESG and DEI agendas that conflict with their investors’ interests. The Stop TSP ESG Act would end that practice and restore accountability, and I urge my colleagues to pass it expeditiously.”

A Bill Framed as an ESG Crackdown but Written to Remove Voting Power Entirely

While Cruz’s office describes the legislation as targeting ESG and DEI-aligned shareholder proposals, the text goes further. It would bar asset managers from casting any proxy votes on behalf of the TSP, regardless of topic. That would eliminate one of the primary mechanisms through which large index managers participate in corporate governance, leaving voting decisions either centralized within government or not exercised at all.

The move reflects a wider trend across Republican-led states and federal offices. Over the past two years, BlackRock, State Street, and Vanguard have faced rising scrutiny from conservative attorneys general and state treasurers, alongside a multistate lawsuit accusing them of violating antitrust laws through participation in climate-oriented investor coalitions. The complaint alleges that coordinated commitments on net zero could distort competition. All three firms reject the charge.

Under pressure, asset managers have already cooled their public sustainability positions. BlackRock scaled back its involvement in certain climate alliances earlier this year, and State Street recently withdrew its U.S. business from the Net Zero Asset Managers initiative. Both have reduced support for ESG-related shareholder proposals, particularly those seen as prescriptive or operationally intrusive.

Retreat from Climate Coalitions Sets a New Landscape for Stewardship

The chilling effect on stewardship is particularly notable for global investors who rely on large asset managers to push for clearer climate disclosures, transition plans, and board accountability. Major ESG advocates argue that proxy voting is integral to fiduciary duty, especially given the systemic financial risks posed by climate change. The Cruz proposal challenges that premise directly, asserting that disallowing proxy voting protects investors rather than undermines them.

The bill could influence future U.S. rulemaking on asset-manager obligations. It also intersects with the Biden administration’s approach to sustainable finance, which has emphasized risk-based integration rather than ideological mandates. Although the legislation faces uncertain prospects in a divided Congress, it deepens the political divide over how public retirement systems should navigate climate and governance risks that carry material financial implications.

RELATED ARTICLE: U.S. Announces Rule Allowing Consideration of ESG Factors in Retirement Plan Investments

What C-Suite Leaders, Investors, and Global ESG Professionals Should Track

For executives and investors operating across jurisdictions, the Stop TSP ESG Act illustrates growing U.S. fragmentation in ESG-related governance. If enacted, the policy would weaken the stewardship role of two of the largest global index managers over one of the world’s largest pension pools. It would also embolden similar efforts in state-level pension systems, where ESG restrictions already affect procurement, mandates, and manager selection.

Corporate boards could see fewer shareholder proposals backed by large asset managers, potentially shifting influence toward activist funds, public pension systems, and international investors that continue to prioritize climate risk. Companies with global footprints may face more polarized pressure depending on the regional origin of their largest shareholders.

Global Implications for Climate Finance and Corporate Governance

The debate around the TSP’s governance comes at a time when climate-finance frameworks are tightening internationally. Europe is strengthening sustainability reporting and stewardship expectations, while Asian regulators are accelerating taxonomy development and climate-related disclosure rules. The U.S. remains a contested space where regulatory signals diverge sharply between federal agencies, courts, and political coalitions.

Whether or not Cruz’s bill advances, it underscores how ESG and climate governance remain flashpoints in U.S. financial politics. For global investors, the episode highlights the need to navigate a market where climate-risk management is treated as a material financial factor in most of the world, yet increasingly challenged in parts of the United States.

Follow ESG News on LinkedIn