You know that horror movie trope where the babysitter gradually realizes the crazed killer is phoning, not from some distant location, but from inside the house? Something similar is happening in the oil market.

That’s because Saudi Arabia, the world’s biggest net exporter of crude, is using renewables to drastically reduce its petroleum consumption. The threat to the kingdom’s producers isn’t coming from the heartlands of electric vehicle adoption in Shenzhen, Oslo, or San Francisco — it’s right inside the house.

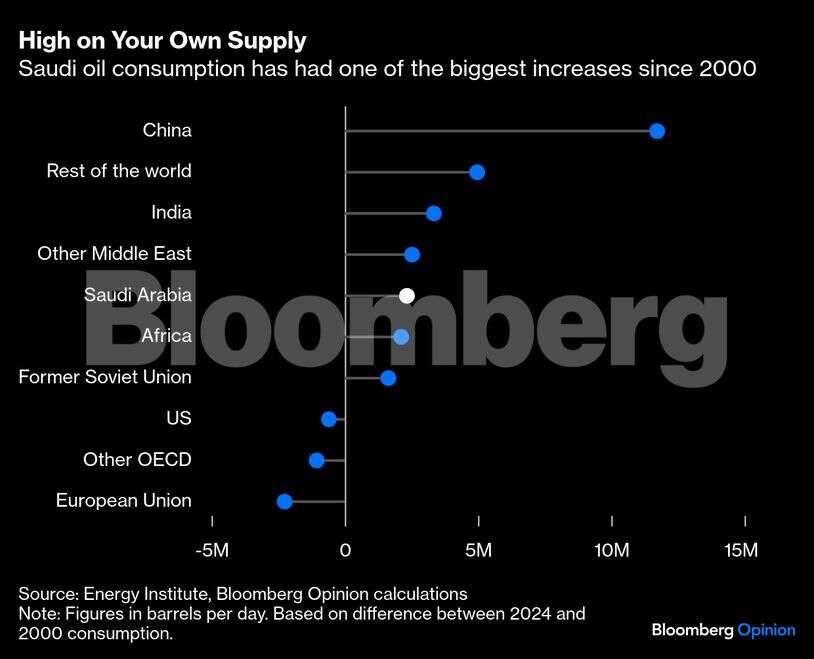

This is an extraordinary reversal. Since the start of the 21st century, Saudi Arabia’s oil consumption has increased more than any other country barring China and India. It’s doubled to 2.3 million barrels per day, greater than the incremental demand from Africa, Latin America or the former Soviet Union.

Between a quarter and a third of the country’s consumption goes into crude- and fuel oil-fired generators that provide electricity to ride out summer heatwaves. The government wants to replace all of that with renewables, with a target of 130 gigawatts by 2030 — roughly equivalent to all the solar power in India. Such a switch could represent the single largest decline in oil demand over the next five years, according to the International Energy Agency. It’s not news that the country has such ambitions. One of the cornerstones of Vision 2030, the program announced in 2016 to wean the kingdom’s economy off hydrocarbons, was to switch the grid to an exclusive gas-renewables mix.

However, such bold pronouncements are typically heavily discounted where Saudi Arabia is concerned. This is a country that’s been working on an unfinished one-kilometer (0.62 mile) skyscraper since 2013, and recently called in consultants to review the feasibility of The Line — an implausible science fiction city being built to house nine million people inside a 170 kilometer-long tower.

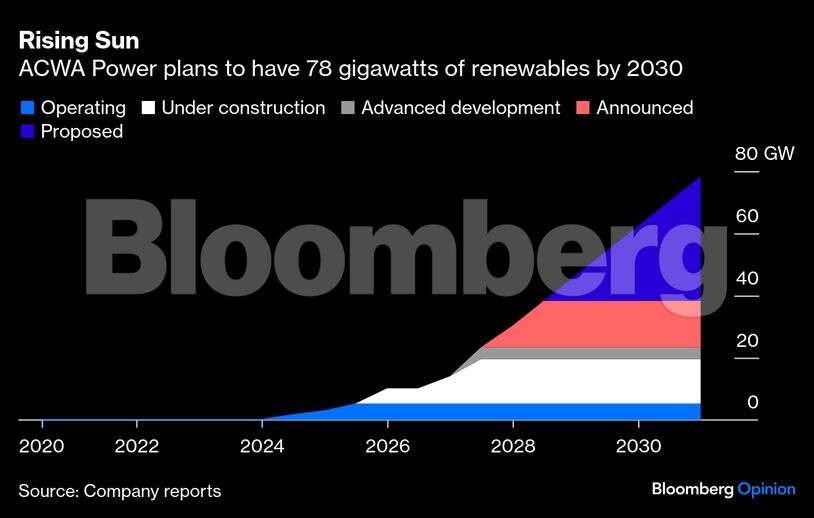

Kpler, a data company that tracks commodities flows, reckons only 14.8 GW of the planned 130 GW will be online by 2030. Such a serious shortfall would be enough to sustain crude in power generation well into the future.

It might be time to start reevaluating whether that skepticism is warranted, however. There’s certainly a huge gap between promise and execution where the kingdom’s megaprojects are involved. Still, when it comes to building humdrum energy infrastructure (as opposed to, say, a cube-shaped hollow tower as tall as the Empire State Building), one of the world’s biggest petroleum producers has a decent track record.

That’s now finally showing up not just in wells and export facilities, but in renewables, too. After years in which the only major solar project connected was a relatively modest 0.3 GW plant in the deserts between Jordan and Iraq, generators are now being plugged in at a rapid pace.

Since the start of 2024 alone, ACWA Power Co., the country’s biggest electricity and water developer, started commercial operations at four solar facilities totaling about 4.9 GW. Roughly the same amount is due to start up by the end of next year, the company told investors recently, shortly after completing a 7.125 billion riyal ($1.9 billion) capital raising. Last month, it signed deals with Saudi Arabia’s main utility to build another 15 GW, to be delivered by the middle of 2028.

The broader plan is for ACWA to hit 78 GW by 2030, sufficient on its own to provide all the electricity that Saudi Arabia generated from oil last year. Much more is in the pipeline from other developers.

With ACWA giving investors detailed timelines of further near-term completion dates, the onus is increasingly on the skeptics to explain why the recent run of successful project execution is going to be broken. Thanks to abundant sunlight, Saudi solar plants deliver electricity at less than half of the cost of the grid. Arrays of panels also tend to be much more simple, in engineering terms, than the petroleum extraction, transport and refining complexes in which the kingdom has long excelled.

Getting those renewables built is also crucial for the country’s overriding obsession: its position in the oil market. One justification given by Saudi Arabian Oil Co. President Amin Nasser for cutting back maximum output capacity last year was that removing crude from the domestic grid would boost exports as effectively as drilling extra wells. The plans to eliminate oil from the grid by 2030 are still “on track,” he told Aramco investors last week.

Saudi Aramco’s competitors might want to reflect on that. For Nasser, the country’s transition is reason enough to trim investments intended to meet hypothetical future demand. The kingdom’s grid uses more oil than all the cars and scooters in India. If such an enormous consumer of the world’s crude is going away by the end of the decade, an already oversupplied market risks heading still deeper into glut.