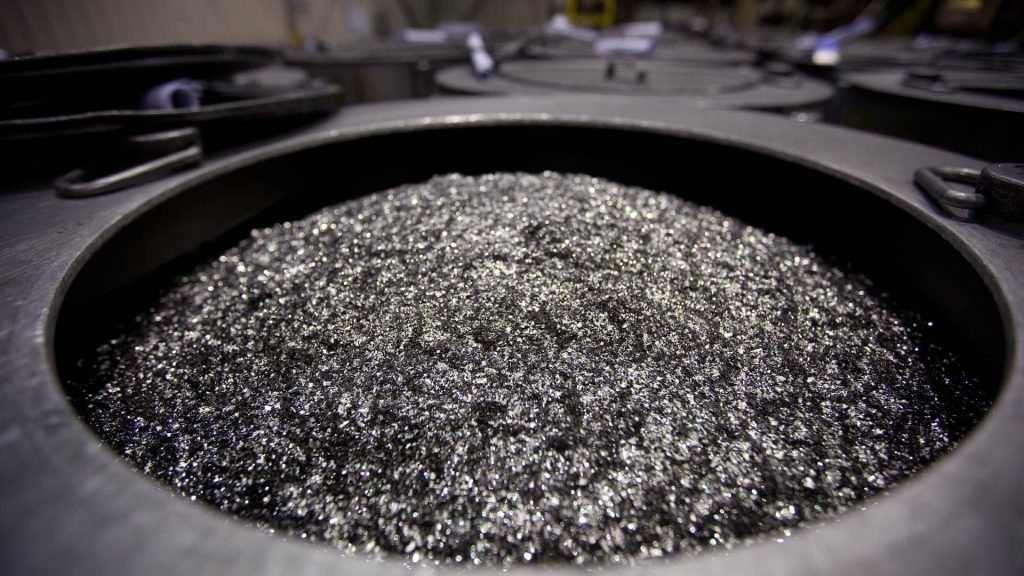

Annealed neodymium iron boron magnets sit in a barrel at a Neo Material Technologies Inc. factory in Tianjin, China on June 11, 2010.

Bloomberg | Bloomberg | Getty Images

Rare earth magnet makers are having a moment as Western nations scramble to build domestic “mine-to-magnet” supply chains and reduce their dependence on China.

A turbulent year of supply restrictions and tariff threats has thrust the strategic importance of magnet manufacturers firmly into the spotlight, with rare earths surging toward the top of the agenda amid the U.S. and China’s ongoing geopolitical rivalry.

Magnets made from rare earths are vital components for everything from electric vehicles, wind turbines, and smartphones to medical equipment, artificial intelligence applications, and precision weaponry.

It’s in this context that the U.S., European Union and Australia, among others, have sought to break China’s mineral dominance by taking a series of strategic measures to support magnet makers, including heavily investing in factories, supporting the buildout of new plants, and boosting processing capacity.

The U.S. and Europe, in particular, are expected to emerge as key growth markets for rare earth magnet production over the next decade. Analysts, however, remain skeptical that Western nations will be able to escape China’s mineral orbit anytime soon.

“Frankly, we were the solution to the problem that the world didn’t know it had,” Rahim Suleman, CEO of Canadian group Neo Performance Materials, told CNBC by video call.

Photo taken on Sept. 19, 2025 shows rare-earth magnetic bars at NEO magnetic plant in Narva, a city in northeastern Estonia.

Xinhua News Agency | Xinhua News Agency | Getty Images

“The end-market is growing from the point of physics, not software, so therefore it has to grow in this way,” he continued. “And it’s not dependent on any single end market, so it’s not dependent on automotive or battery electric vehicles or drones or wind farms. It’s any energy-efficient motor across the spectrum,” Suleman said, referring to the demand for magnets from fast-growing industries such as robotics.

His comments came around three months after Neo launched the grand opening of its rare earth magnet factory in Narva, Estonia.

Situated directly on Russia’s doorstep, the facility is widely expected to play an integral role in Europe’s plan to reduce its dependence on China. European Union industry chief Stéphane Séjourné, for example, lauded the plant’s strategic importance, saying at an event in early December that the project marked “a high point of Europe’s sovereignty.”

Neo’s Suleman said the Estonian facility is on track to produce 2,000 metric tons of rare earth magnets this year, before scaling up to 5,000 tons and beyond.

“Globally, the market is 250,000 tons and going to 600,000 tons, so more than doubling in ten years,” Suleman said. “And more importantly, our concentration is 93% in a single jurisdiction, so when you put those two factors together, I think you’ll find an enormously quick growing market.”

‘Skyrocketing demand’

To be sure, the global supply of rare earths has long been dominated by Beijing. China is responsible for nearly 60% of the world’s rare earths mining and more than 90% of magnet manufacturing, according to the International Energy Agency.

A recent report from consultancy IDTechEx estimated that rare earth magnet capacity in the U.S. is on track to grow nearly six times by 2036, with the expansion driven by strategic support and funding from the Department of Defense, as well as increasing midstream activity.

Magnet production in Europe, meanwhile, was forecast to grow 3.1 times over the same time period, bolstered by the EU’s Critical Raw Materials Act, which aims for domestic production to satisfy 40% of the region’s demand by 2030.

Regional composition of rare earths and permanent magnet production in 2024, according to data compiled by the International Energy Agency.

IEA

John Maslin, CEO of Vulcan Elements, a North Carolina-based rare earth magnet producer, told CNBC that the company is seeking to scale up as fast as possible “so that this fundamental supply chain doesn’t hold America back.”

Vulcan Elements is one of the companies to have received direct funding from the Trump administration. The magnet maker received a $620 million direct federal loan last month from the Department of Defense to support domestic magnet production.

“Rare earth magnets convert electricity into motion, which means that virtually all advanced machines and technologies—the innovations that shape our daily lives and keep us safe—require them in order to be operational,” Maslin told CNBC by email.

“The need for high-performance magnets is accelerating exponentially amid a surge in demand and production of advanced technologies, including hard disk drives, semiconductor fabrication equipment, hybrid/electric motors, satellites, aircraft, drones, and almost every military capability,” he added.

Separately, Wade Senti, president of Florida-based magnet maker Advanced Magnet Lab, said the only way to deliver on alternative supply chains is to be innovative.

“The demand for non-China sourced rare earth permanent magnets is skyrocketing,” Senti told CNBC by email.

“The challenge is can United States magnet producers create a fully domestic (non-China) supply chain for these magnets. This requires the magnet manufacturer to take the lead and bring the supply chain together – from mine to magnet to customers,” he added.