(Bloomberg) – Malaysia’s Petronas is evaluating a sale of its shale oil asset in Argentina, a move that would complete its exit from the country’s booming Vaca Muerta fields as several international drillers also look to divest from the region.

Petronas has begun a process that may result in a sale of its 50% stake in La Amarga Chica, a venture with state-run YPF SA in the oil production heartland of Vaca Muerta, according to people familiar with the matter who couldn’t be named discussing private matters. Petronas has already been in talks with a potential suitor, one of the people said.

Petronas didn’t respond to a request for comment.

Last year, Petronas left a venture with YPF to develop a project for liquefying and exporting shale gas.

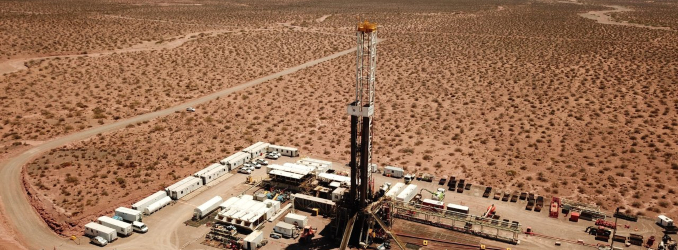

Petronas’ involvement in La Amarga Chica began in 2014, when Argentina’s shale industry was just getting started. The field’s size is about 46,000 acres, with half corresponding to each partner, according to YPF.

If the sale does go ahead, Petronas would follow Exxon Mobil Corp. in divesting from Argentine shale oil and monetizing the assets at a time when the outlook for Vaca Muerta is improving under President Javier Milei.

Equinor ASA is also eyeing the door, while TotalEnergies said this week it would sell if it could reap the sort of rich valuations that Exxon got. That’s left the stage largely to homegrown companies.

Image: YPF