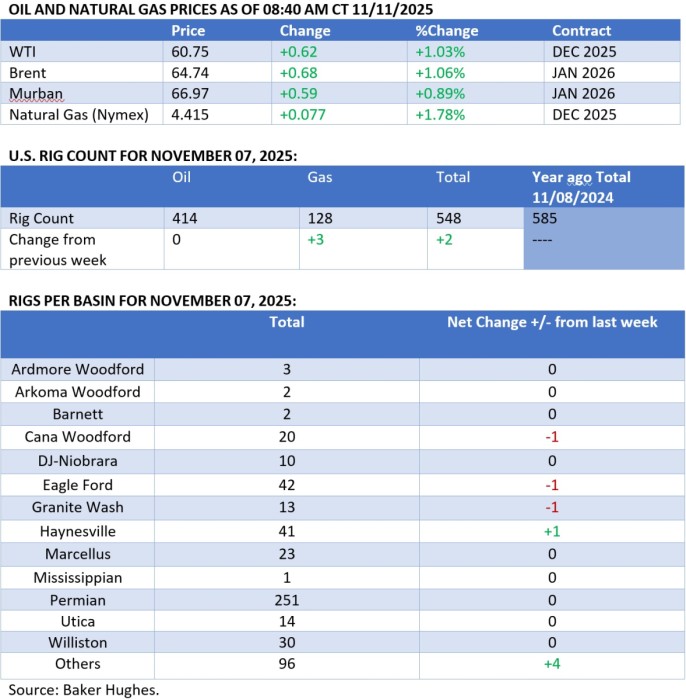

Oil prices gained on Tuesday as fresh U.S. sanctions on Russian oil disrupted exports.

OPEC+ Plays the Waiting Game as Stock Builds Loom Large

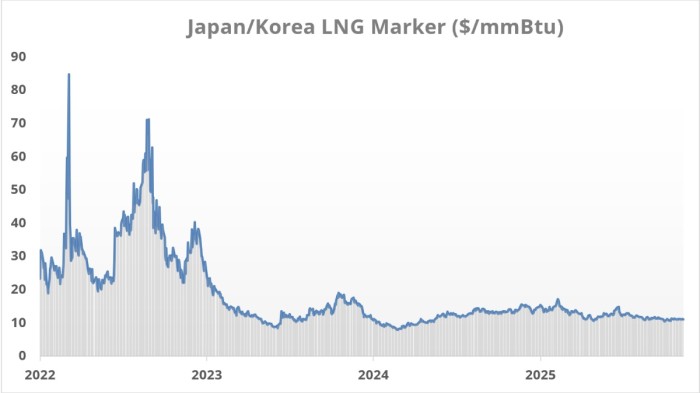

– This winter’s LNG markets are unlikely to replicate last year’s tightness as key Asian buyers have built up sufficient inventories ahead of Q4 2025 and have minimized spot purchases in October.

– South Korea, having imported a whopping 5 million tonnes LNG in August, has been winding up imports in recent months amidst ample stocks, whilst Chinese LNG imports were 15% lower year-over-year in October, tallying just 5.5 million tonnes.

– Japan’s warming season started up later than usual this year as October temperatures averaged 17° C, 2° C above historical norms, with a dip into single-digit average daily temperatures expected only by mid-November.

– Egypt’s sudden policy shift to export LNG has pushed liquefied gas prices in the Mediterranean below $10 per mmBtu, potentially triggering a downward spiral for Asia’s JKM benchmark, too, which currently prices around $11 per mmBtu.

Market Movers

– US oil major ExxonMobil (NYSE:XOM) agreed to farm in to Greece’s offshore Block 2 license covering 598,500 acres, taking a 60% operated interest in the project previously developed by Energean and Helleniq Energy.

– Mexico’s state oil firm Pemex reported an oil discovery with its Xomili-1 exploration well in the offshore Sureste Basin, reaching an initial production rate of 1,670 b/d of light oil.

– Arcius Energy, the joint venture of BP (NYSE:BP) and ADNOC’s XRG investment arm, has entered into a binding agreement with Shell to acquire its 30% operated interest in Egypt’s Harmattan field.

– Workers of Brazil’s national oil company Petrobras (NYSE:PBR) rejected the company’s work agreement and moved on to approve a potential company-wide strike, only days after the firm posted a $6 billion net profit for Q3.

Tuesday, November 11, 2025

Flattening backwardation curves and rising floating storage volumes across Asia are reminding oil market participants that the 2026 outlook remains firmly bearish, even if oil prices could see a brief spike in the upcoming days. ICE Brent has been trading within the $63 to $66 per barrel so far in November, a very narrow bandwidth that failed to react in earnest to Lukoil’s force majeure announcement in Iraq.

Chinese Buyers Cool Off on Saudi Buying. Chinese buyers of Saudi crude have nominated the lowest total volumes since April for December delivery, with media reports indicating they China’s refiners will only buy 36.5 million barrels (1.18 million b/d) despite Aramco cutting December formula prices.

Lukoil Calls Force Majeure at Giant Oil Field. Russia’s second largest oil producer Lukoil (MOEX:LKOH) declared force majeure at its West Qurna 2 oil field in Iraq, currently producing 480,000 b/d, with state oil marketer SOMO cancelling three November cargo loadings.

Wind Projects Are Still Not Making the Cut. London-based energy major Shell (LON:SHEL) has exited two offshore wind projects in Scotland, selling a 50% interest in MarramWind to a renewable utility firm and relinquishing CampionWind altogether, shedding some 5.5 GW of potential capacity.

Related: Iran’s Deputy Foreign Minister Calls for New Nuclear Talks

China Lifts Metals Ban but Keeps Controls. Chinese authorities have suspended their ban on exports of gallium, germanium and antimony to the US; however, Beijing reiterated its right to broader export controls that require shippers to first get export licences from the Commerce Ministry.

Trump Turbo-Boosts US Offshore Licensing. US President Trump approved the upcoming lease sale in the US Gulf of America, offering 80 million acres in previously untapped blocks in the auction set to take place December 10, whilst also signing off on a 2026 Alaska lease sale next March.

Hungary Gets Indefinite Russia Sanctions Waiver. Hungary’s Prime Minister Viktor Orban claimed that the country’s state oil firm MOL has received an indefinite waiver from the Trump administration to continue importing Russian oil and gas, citing its landlocked geographic location.

TMX Dreams Up Another Expansion. Canada’s Trans Mountain oil pipeline is considering an expansion to its current 890,000 b/d throughput capacity to 1.25 million b/d over the next five years, by boosting flows through the Puget Sound pipeline that also feeds HF Sinclair’s Anacortes plant.

Kuwait Needs Gasoline, Urgently. Kuwait’s national oil firm KPC sought a prompt gasoline cargo of 35,000 metric tonnes for November delivery, its second over the past month, as a fire incident at its 615,000 b/d Al Zour refinery last month debilitated large parts of its key downstream asset.

US to Block Energy Agency Layoffs. The legislative package proposed to reopen the US federal government after a 41-day shutdown includes provisions that would block large-scale furloughs in agencies that deal with energy matters, most notably the Federal Energy Regulatory Commission.

Shutdown End Boosts Gold’s Prospects. After three weeks of declines, gold prices have soared on expectations of an impending US government reopening with the bullion reaching $4,140 per ounce again as traders bet that resumed data could strengthen the case for further Fed Reserve cuts.

Indonesia Seeks to Keep More Gas at Home. Indonesia’s Energy Minister Bahlil Lahadalia announced that the Asian country is facing a shortage of 20 cargoes of LNG this year due to higher-than-expected demand, seeking to delay some of its 1 Mt/month export obligations in 2026.

Houthis Signal End to Red Sea Attacks. Yemen’s Houthi militant group has flagged a potential pause to its maritime attacks in the Red Sea, saying it will reinstate its ban on Israeli navigation if Israel resumes attacks on Gaza, suggesting the September 29 attack on a Dutch cargo ship could be its last.

Nigeria to Open New Licensing Round Soon. Nigeria’s oil industry regulator NUPRC announced that the African country would launch its 2025 licensing round next month, focusing on discovered but untapped fields and fallow assets in the Niger Delta, seeking to boost natural gas production.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com