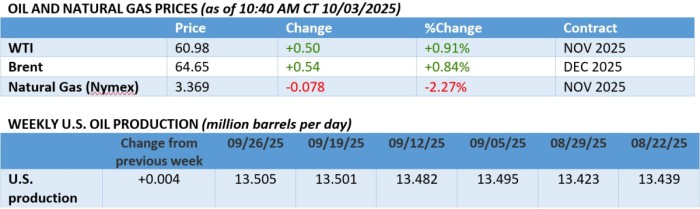

Oil prices saw a small recovery on Friday morning after a continued selloff this week.

Friday, October 3, 2025

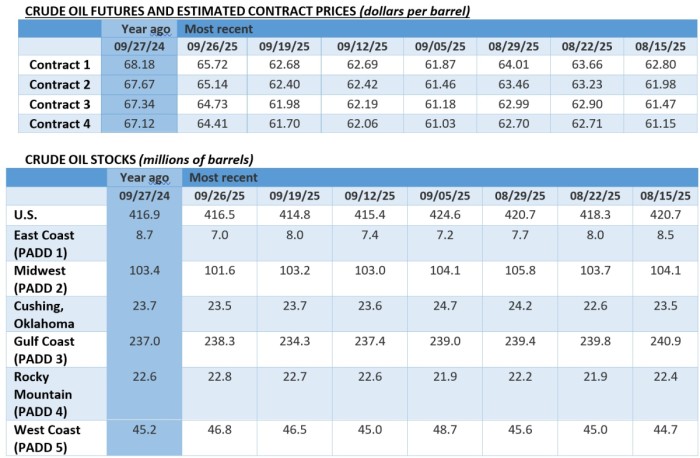

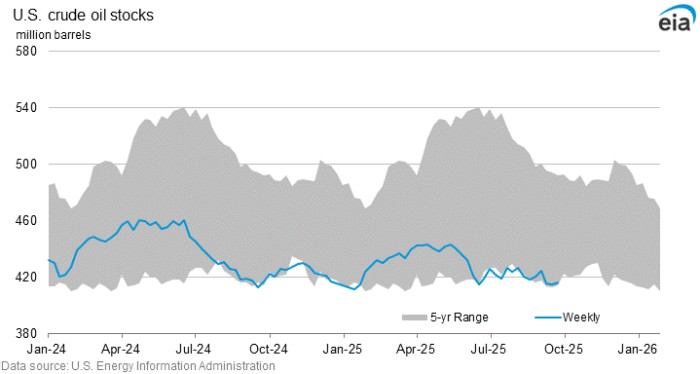

An 8% weekly loss is a rare occurrence in oil markets, especially if it comes on the back of five straight daily declines. Even though Friday’s trading has shown a marginal recovery with ICE Brent edging closer to $65 per barrel, however it seems that Sunday’s OPEC+ meeting could prompt further price declines in case members agree to expedited production unwinding. Amidst a US government shutdown and record year-to-date high OPEC+ crude exports in September, bearishness is gradually becoming the mainstream sentiment.

OPEC+ Demands Stricter Compliance. The joint ministerial monitoring committee of OPEC+ has stressed the need for full compliance with respective members’ production quotas, just as Kazakhstan’s output came in at 1.65 million b/d last month or 12% above its 2025 quota, despite seasonal field maintenance.

Warren Buffett Doubles Down on Oxy. Warren Buffett’s Berkshire Hathaway (NYSE:BRK) has agreed to buy Occidental’s (NYSE:OXY) petrochemical business OxyChem for $9.7 billion in cash, helping the oil and gas major to pay down debt to 15 billion in the wake of its $10.8 billion acquisition of CrownRock.

Related: USA Rare Earth Stock Surges on White House Talks

Oil Majors Say Yes to Mozambique. Italian oil major ENI (BIT:ENI) has at last taken an FID on its Coral North floating LNG project off the coast of Mozambique alongside partners CNPC, Kogas, ENH and XRG, seeking to add 3.6 mtpa liquefaction capacity to the embattled country with first gas expected in 2028.

UK Mulls Full Ban on Fracking. The British government plans to pass a bill that bans hydraulic fracturing (also known as fracking), simultaneously bringing forward a law that aims to end new onshore oil and gas drilling for good, just as the opposition Reform UK party pledged to boost domestic oil extraction.

Angola’s NOC Declares Itself Ready for IPO. Sonangol, Angola’s national oil company, stated that it is close to finalizing its public listing in a bid to encourage new investment in Angola, just as the African country’s production continues to linger around 1 million b/d despite its 2024 exit from OPEC.

Algeria Commits to Massive Licensing Bids. Algeria’s upstream regulator Alnaft said that the country will launch its next licensing round for new oil and gas blocks in March-April 2026, offering 6 to 10 exploration licenses, with three additional auctioning rounds expected to be held by 2028.

Canada’s LNG Outlook Improves with New Launch. Following several months of technical issues that capped the output LNG Canada’s 1st liquefaction train at 50% capacity, UK-based energy major Shell (LON:SHEL) started preparing the second 6.5 mtpa liquefaction train for final commissioning this month.

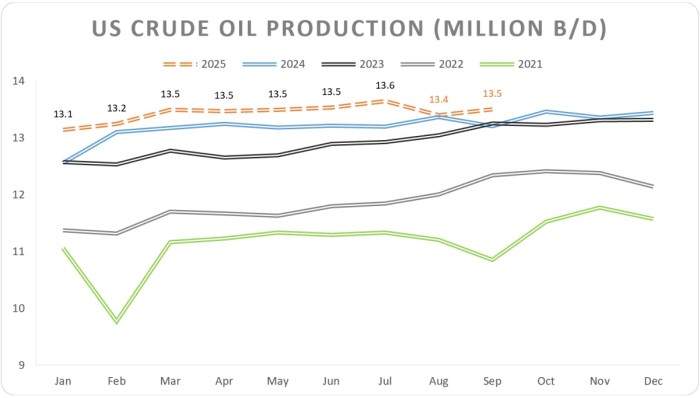

Shale Bosses Predict US Shale Peak. Kaes van’t Hof, the chief executive of US shale driller Diamondback Energy (NASDAQ:FANG), said that output growth in the country will stall if prices stay near $60 per barrel as current prices are equivalent to $45 per barrel from 6-7 years ago on an inflation-adjusted basis.

Russia Loads Record Amounts of Oil. With refinery runs heavily constrained by Ukraine’s barrage of drone strikes, Russia’s crude oil exports have jumped by 25% month-over-month in September, loading 2.5 million b/d in its three Western ports of Primorsk, Ust-Luga and Novorossiysk.

Greenpeace Forces LNG Carriers to Divert from Belgium. Ongoing protests by Greenpeace activists at Belgium’s key Zeebrugge import terminal have forced at least three LNG carriers to divert away to other destinations, with terminal operator Fluxys expecting disruptions to last until Sunday.

California’s Refineries Are Struggling. A giant blast has rocked Chevron’s (NYSE:CVX) 295,000 b/d El Segundo refinery in Los Angeles, with flames engulfing its Isomax 7 jet fuel production unit, just as the adjacent Wilmington refinery operated by Phillips 66 is set for a final shutdown by mid-October.

BP Needs a Partner to Launch Its Boomerang. UK oil major BP (NYSE:BP) is reportedly seeking for a strategic partner to help develop its multi-billion-barrel Bumerangue discovery offshore Brazil, however Petrobras (NYSE:PBR) keeps is reservations as the field’s CO2 content exceeds industry standards.

Tin Soars Further as Indonesia Fights Illegal Mining. The LME three-month tin contract jumped over $37,500 per metric tonne this week after Indonesia clamped down on illegal mining across the country, confiscating 42,000 tonnes of tin sands and vowing to close 1,000 illegal mines over the next months.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com