Oil prices slipped in early Asian trade on Thursday as markets digested renewed hope for a Russia-Ukraine peace deal and braced for a key OPEC+ meeting scheduled to take place on Sunday.

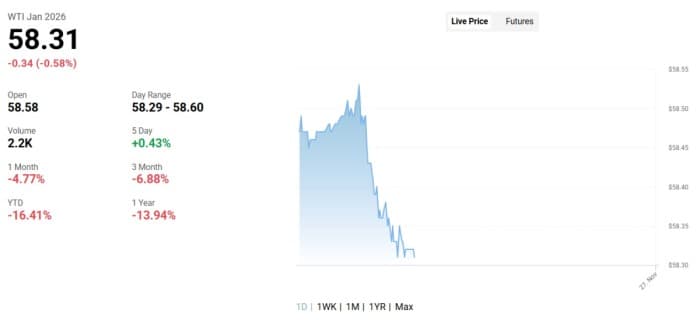

At the time of writing, front-month West Texas Intermediate had dipped by about 0.55% to $58.33 per barrel:

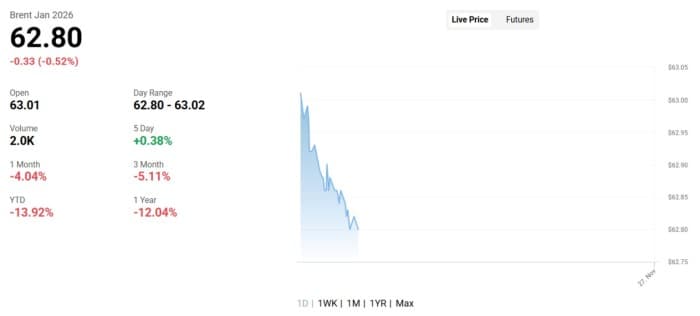

Similarly, Brent Crude had fallen by 0.48% and was trading around $62.83:

The recent softness follows a slight gain in Wednesday’s session when prices bounced off one-month lows, but analysts warned that those upticks were likely driven by short covering and technical buying rather than a shift in fundamentals.

The most important development in oil markets this week is the apparent progress in a peace deal between Russia and Ukraine. U.S. envoy Steve Witkoff is set to travel to Moscow next week, while Ukraine is reported to have agreed to a peace deal with just some minor details to be sorted out. The prospect of a peace deal unlocking additional Russian crude supply and adding to already ample global inventories is likely to continue to weigh on prices through the week.

While hopes remain for increased demand tied to softer U.S. rates or seasonal factors, the longer-term outlook appears tilted toward oversupply, consistent with recent assessments projecting a surplus in 2026.

The upcoming OPEC+ meeting adds another layer of uncertainty. Market participants will be watching closely for any signals on production quotas or output strategy that could either support prices or reinforce bearish pressure. Currently, expectations are that the group is unlikely to alter its first quarter output policy or change the group-wide 2026 output levels.

While trading is likely to remain thin during Thanksgiving, crude appears vulnerable to further downside unless a clear demand catalyst emerges.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com