With traders across the globe refreshing their X accounts every 3 seconds, expecting to see news of imminent “kinetic action” in Iran, they instead got a report from NBC indicating that military action is far from certain and could take days to launch.

According to the report which cites multiple anonymous sources – including a U.S. official, two people familiar with the discussions and a person close to the White House – Trump has told his national security team that “he would want any U.S. military action in Iran to deliver a swift and decisive blow to the regime and not spark a sustained war that dragged on for weeks or months.”

“If he does something, he wants it to be definitive,” one of the people familiar with the discussions said.

The punchline: Trump’s advisers have so far not been able to guarantee to him that the regime would quickly collapse after an American military strike, and there is concern that the U.S. may not have all the assets in the region it would need to guard against what administration officials expect would be an aggressive Iranian response.

Indeed, earlier today, we showed that US aircraft carriers – so critical in supporting any type of operation against Iran – are days away from reaching the Gulf, which means that any full-blown assault would likely have to be delayed.

It also means that as we suggested earlier, the current dynamics “could lead Trump to approve a more limited U.S. military offensive in Iran, at least initially, while reserving options to escalate — if he decides to take any military action at all,” said the U.S. official and one of the people familiar with the discussions.

They also said that it is a fast-evolving situation and that as of Wednesday afternoon no decisions had been made. During a visit to Detroit on Tuesday, Trump told protesting Iranians that “help is on its way” and called the situation in the country “fragile.”

Meanwhile, the question of what happens to the power vacuum in Iran has also reared its head, and in a separate report, Trump told Reuters on Wednesday that while Iranian opposition figure Reza Pahlavi “seems very nice”, he expressed uncertainty over whether Pahlavi would be able to muster support within Iran to eventually take over.

In other words, the CIA does not have a ready plan for who will step in to fill the power vacuum once the current regime is forced out.

Trump has repeatedly threatened to intervene in support of protesters in Iran, where thousands of people have been reported killed in a crackdown on the unrest against clerical rule. But he was reluctant on Wednesday to lend his full support to Pahlavi, the son of the late shah of Iran, who was ousted from power in 1979.

“He seems very nice, but I don’t know how he’d play within his own country,” Trump said. “And we really aren’t up to that point yet.

“I don’t know whether or not his country would accept his leadership, and certainly if they would, that would be fine with me.”

Trump’s comments went further in questioning Pahlavi’s ability to lead Iran after saying last week that he had no plans to meet with him.

Trump also said it is possible the government in Tehran could fall due to the protests but that in truth “any regime can fail.”

“Whether or not it falls or not, it’s going to be an interesting period of time,” he said.

Trump’s comments to Reuters and the NBC report have effectively eliminated the probability of an imminent action, and as a result, crude oil, which was rising again on geopolitical fears, tumbled with WTI set to dip below $60 after trading above it all day…

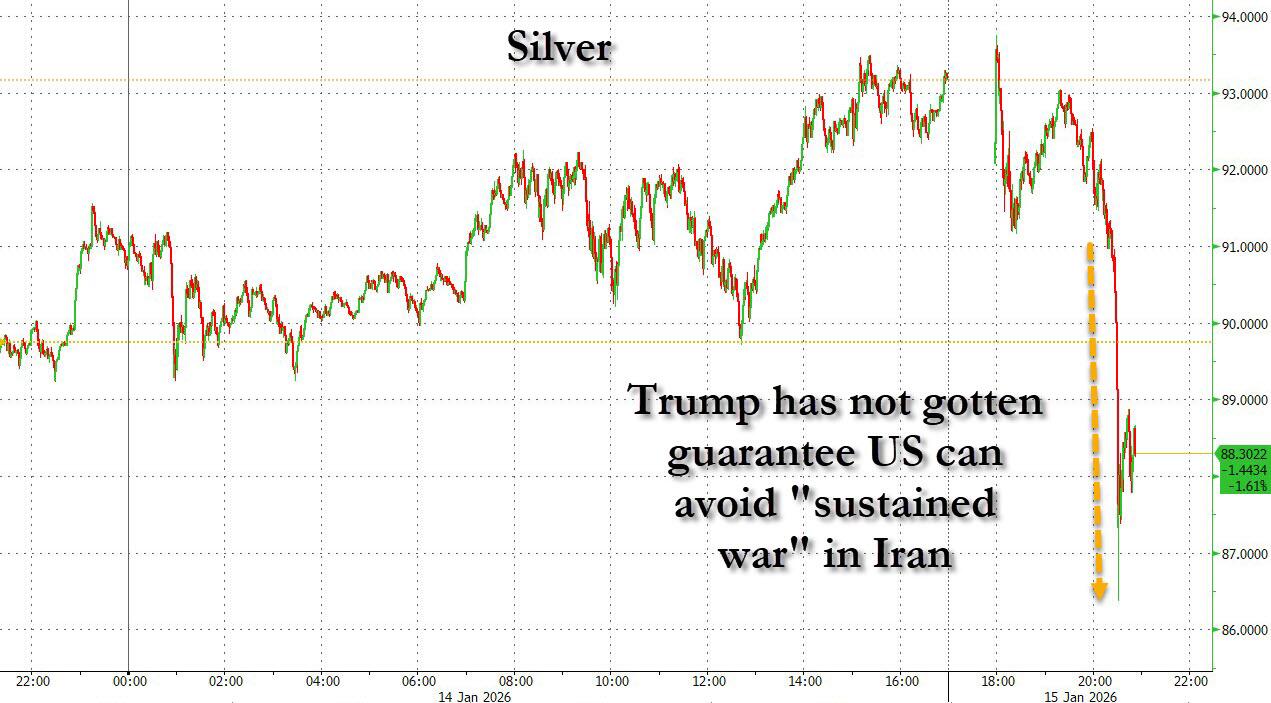

… while silver plunged as much as $6, from $92 to $86, in seconds as stop loss selling kicked in, in a preview of how painful the unwind of the current historic rally will eventually be.

By Zerohedge.com

More Top Reads From Oilprice.com