Oil prices fell on Tuesday morning as concerns about oversupply increased after OPEC’s decision to pause supply hikes and as a stronger U.S. dollar eased buying from holders of other currencies.

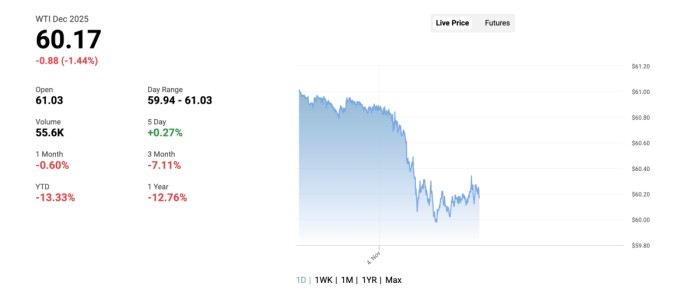

As of 8:44 a.m. ET on Tuesday, the U.S. benchmark price, WTI Crude, was flirting with the sub-$60 a barrel price it reached two weeks ago after the Trump Administration slapped sanctions on Russia’s biggest oil firms, Rosneft and Lukoil. The U.S. benchmark crude futures were trading down by 1.44% at $60.17.

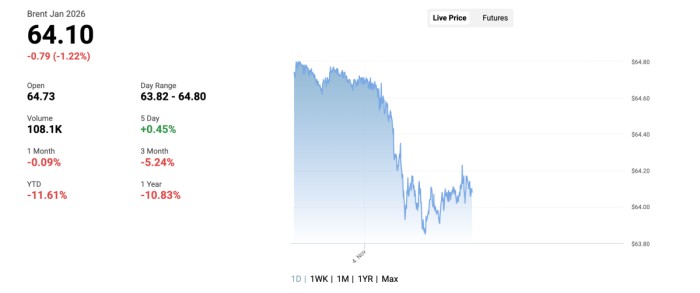

The international benchmark, Brent Crude, slipped below $65 per barrel as it was down by 1.22% on the day at $64.10.

After weak trading on Monday during which traders sought to decipher what OPEC’s latest move means, speculators appeared to have decided by Tuesday that the pause in output hikes is bearish as OPEC+ is likely seeking to prevent a price collapse in case the glut fears materialize.

On Sunday, the eight OPEC+ producers who have been withholding supply to the market decided to pause their reversal of the production cuts in the first quarter of 2026, after a small increase in December. Citing “seasonality” and historically weaker demand in the first quarter of any year, OPEC said it would halt the production increases in January, February, and March.

“(The) market may see this as the first sign of acknowledgement of potential oversupply situation from the OPEC+ front, who have so far remained very bullish on demand trends and ability of market to absorb the extra barrels,” Suvro Sarkar, energy sector team lead at DBS Bank, told Reuters on Tuesday.

OPEC+ continues to publicly project a bullish view of the market balances. One of the OPEC+ producers party to the deal to unwind the cuts, the UAE, on Monday dismissed fears of a glut, with its Energy Minister Suhail Al Mazrouei saying “I’m not going to talk about an oversupply scenario. I can’t see that.”

A stronger U.S. dollar also added to the downward pressure on oil prices early on Tuesday.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com