Crude oil futures posted a sharp weekly decline, pressured by a renewed wave of supply-side concerns and deteriorating demand outlooks. After reaching a seven-week high early in the week, WTI crude retreated aggressively, driven by speculation of an OPEC+ production hike, the return of Kurdish exports, and signs of softening global consumption. By Thursday, prices had notched a four-day losing streak, and sentiment turned decisively bearish.

OPEC+ Output Speculation Reignites Oversupply Fears

The central driver behind this week’s sell-off was the resurgence of supply concerns, primarily linked to OPEC+ output plans. Market chatter early in the week suggested the producer group was preparing for a modest production increase of 137,000 barrels per day (bpd). But by midweek, reports escalated, with multiple sources claiming OPEC+ could authorize a hike as large as 500,000 bpd in November. That would triple the October increase and signal a significant pivot by Saudi Arabia and its allies toward reclaiming lost market share.

Despite OPEC’s attempt to walk back the headlines—labeling the reports as “misleading” on social media—the damage was already done. Traders were quick to price in additional supply, particularly in a market already on edge from other bearish developments. The idea of a half-million-barrel increase has forced many speculative longs to reassess risk, contributing to this week’s accelerated pullback.

Strategists also flagged a shift in…

Crude oil futures posted a sharp weekly decline, pressured by a renewed wave of supply-side concerns and deteriorating demand outlooks. After reaching a seven-week high early in the week, WTI crude retreated aggressively, driven by speculation of an OPEC+ production hike, the return of Kurdish exports, and signs of softening global consumption. By Thursday, prices had notched a four-day losing streak, and sentiment turned decisively bearish.

OPEC+ Output Speculation Reignites Oversupply Fears

The central driver behind this week’s sell-off was the resurgence of supply concerns, primarily linked to OPEC+ output plans. Market chatter early in the week suggested the producer group was preparing for a modest production increase of 137,000 barrels per day (bpd). But by midweek, reports escalated, with multiple sources claiming OPEC+ could authorize a hike as large as 500,000 bpd in November. That would triple the October increase and signal a significant pivot by Saudi Arabia and its allies toward reclaiming lost market share.

Despite OPEC’s attempt to walk back the headlines—labeling the reports as “misleading” on social media—the damage was already done. Traders were quick to price in additional supply, particularly in a market already on edge from other bearish developments. The idea of a half-million-barrel increase has forced many speculative longs to reassess risk, contributing to this week’s accelerated pullback.

Strategists also flagged a shift in sentiment among institutional forecasters. Onyx Capital’s Jorge Montepeque highlighted that several major banks, including Macquarie, are now projecting the possibility of a “super glut” in crude. This aligns with broader concerns that oil markets could be heading into a structurally oversupplied environment if production rises into weakening demand.

Kurdish Crude Returns After Two-Year Hiatus

Further weighing on sentiment was the restart of crude flows from Iraq’s Kurdistan region. The long-stalled pipeline linking the semi-autonomous region to Turkey’s Ceyhan port resumed operations over the weekend, marking the first shipment in more than two years. According to Iraq’s oil ministry, the pipeline could return up to 230,000 bpd to global markets.

Though this flow is relatively modest on a global scale, its timing exacerbated bearish sentiment. The restart added to the perception that more barrels are headed to market just as the demand outlook continues to erode. Combined with the OPEC+ narrative, the return of Kurdish crude further tipped the balance of sentiment toward oversupply.

Russia Diesel Ban and Geopolitical Risks Offer Only Limited Support

While fears of excess supply dominated the week, geopolitical risks provided a modest floor under prices—though not enough to prevent declines. Russia extended its gasoline export ban through year-end and tightened controls on diesel shipments. These moves follow weeks of infrastructure disruption caused by Ukrainian drone strikes, which reportedly impacted up to 25% of Russia’s refining capacity.

Despite these tensions, the market has largely looked past the geopolitical risks due to their limited real-time impact on supply volumes. Traders remain skeptical of building long positions on potential disruptions that have yet to materialize at scale. Even the Group of Seven’s renewed commitment to tighten enforcement on Russian oil sales failed to stir bullish conviction.

Similarly, the resumption of Kurdish flows—which initially triggered a drop in cash Dubai premiums—underscored the market’s sensitivity to real versus implied disruptions. Unless geopolitical tensions escalate to the point of visible export losses, they are unlikely to drive sustained upward momentum in oil prices.

U.S. Inventory Builds Reinforce Bearish Narrative

The bearish tilt was reinforced by a fresh set of EIA inventory data showing a surprise build in U.S. crude stockpiles. According to the Energy Information Administration, inventories rose by 1.8 million barrels to 416.5 million barrels last week, well above analyst expectations. Gasoline and distillate stocks also climbed, signaling tepid refinery activity and weakening demand for refined products.

These inventory gains have reintroduced concerns about domestic oversupply and feed into a broader global trend of demand softening. Market participants are increasingly focused on downstream indicators, such as implied gasoline demand and refinery utilization, both of which have shown signs of fatigue heading into Q4.

Government Shutdown Adds Pressure to Demand Outlook

Layered on top of the supply narrative is a deteriorating demand picture, especially in the United States. The ongoing federal government shutdown has already begun disrupting economic data reporting, with the Bureau of Labor Statistics suspending critical releases such as payrolls and CPI. Without these metrics, the Federal Reserve may be forced to delay or alter rate decisions, injecting further uncertainty into economic forecasts.

More urgently, the shutdown threatens consumer spending. Nearly 750,000 federal workers face furloughs, with some roles potentially eliminated under Reduction in Force (RIF) procedures. This drag on disposable income could weigh on consumption in energy-sensitive categories such as transportation, autos, and household appliances—key drivers of refined product demand.

Internationally, Chinese crude buying remains elevated but may not be enough to offset demand risks in the U.S. and Europe. Reuters noted that China has been importing nearly one million barrels per day above domestic requirements through the first eight months of the year, indicating ample stockpiles that could limit future purchases.

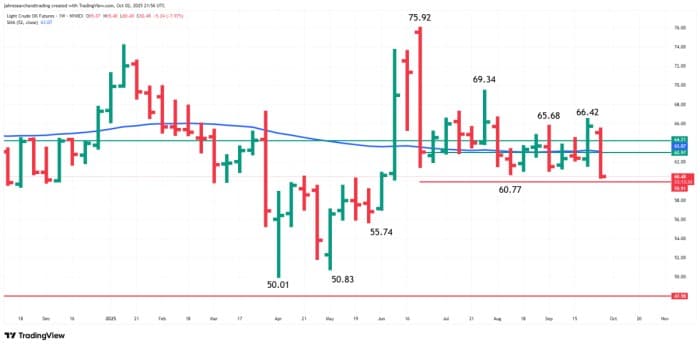

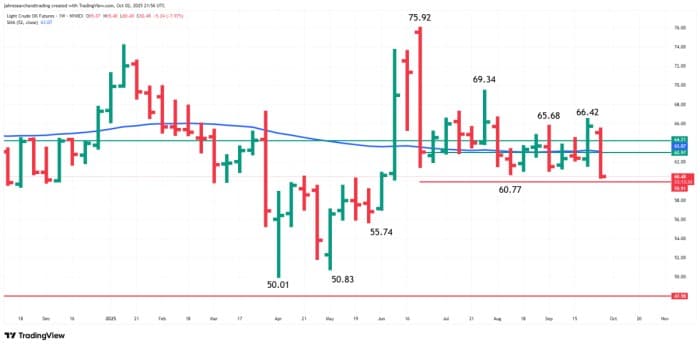

Weekly Light Crude Oil Futures

Trend Indicator Analysis

Light crude oil futures are in a weak position late Thursday after plunging through the 52-week moving average at $63.07. Given the shift in momentum to the indicator’s bearish side, it now becomes new resistance. Additional resistance is the long-term 50% level at $64.21.

Sellers also probed the weak side of the former bottom at $60.77, putting the 61.8% Fibonacci level at $59.91 in play. Taking out this level with conviction could fuel an acceleration into $55.74.

Weekly Technical Forecast

The direction of the Weekly Light Crude Oil Futures market the week ending October 10 is likely to be determined by trader reaction to the 61.8% Fibonacci level at $59.91.

Bullish Scenario

A sustained move over $59.91 will signal the return of buyers. This won’t change the trend, but if this creates enough upside momentum, we could see a retest of a minor 50% level at $62.97 and the major 52-week moving average at $63.07. Overcoming this level will signal strong short-covering, but traders will still have to deal with resistance at $64.21.

Bearish Scenario

A sustained move under the Fibonacci level at $59.91 will indicate the return of sellers. This could fuel the start of a steep break since there isn’t any strong support until $55.74.

Weekly Forecast: Bearish Bias Dominates

The fundamental backdrop for crude oil has shifted to a clearly bearish posture. Rising supply expectations—from both OPEC+ and Kurdish flows—are colliding with deteriorating demand conditions and weakening refinery economics.

While geopolitical risks persist, they have so far failed to deliver meaningful support to prices. Unless there is a material escalation in global disruptions or a surprise reversal in production policy, the path of least resistance for crude remains lower heading into next week.

Technically, the key level to watch is $59.91. In addition to serving as potential support, it could act as a trigger for a sharp $4.00 decline. On the upside, the combination of the 52-week moving average at $63.08 and the long-term pivot at $64.21 represents strong resistance.