(Bloomberg) – Oil swung in a turbulent session amid speculation the U.S. may join the Middle East conflict, with traders focused on flows through the region’s vital shipping chokepoint.

West Texas Intermediate was more than 1% to below $74 a barrel after swinging in a $3 range amid sharp reactions to developments in the Israel-Iran conflict. The recent pullback comes after comments from President Donald Trump suggested to markets that a decision on US involvement in the Israel-Iran conflict has yet to be made, said Rebecca Babin, a senior energy trader at CIBC Private Wealth Group.

“Today’s move lower appears more reflective of a temporary easing in headline risk rather than any real sense of clarity or resolution,” Babin said. “Implied volatility continues to climb, signaling that underlying market anxiety remains elevated — even if that’s not fully reflected in price action.”

Earlier, Iran Supreme Leader Ayatollah Ali Khamenei said his country won’t surrender to Israel after Trump called for the Islamic Republic’s capitulation as the conflict enters its fifth day.

Trump had demanded Iran’s “UNCONDITIONAL SURRENDER” and warned of a possible strike against its leader in social media posts Tuesday. The US is also moving more military assets into the region, including the USS Nimitz aircraft carrier strike group, which is sailing there ahead of schedule.

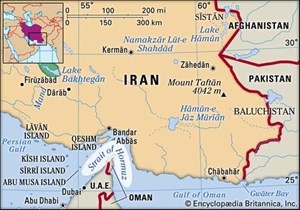

The oil market’s main concerns are flows from Iran and the threat to vessel traffic in the Strait of Hormuz, through which about a quarter of the world’s crude shipments flow. Early data from TankerTrackers.com Inc. show that Iran increased its exports significantly since the attacks began, and there has been no major disruption to the strait.

The risks to prices have permeated the oil derivatives market. Bullish options are fetching their biggest premiums in more than a decade, and volatility has surged to a three-year high. The cost of shipping crude from the Middle East to China is more than 50% higher since the attacks began.

The hostilities have also rattled wider markets, with investors seeking havens in assets such as gold.

“Oil remains on edge, and the worst-case scenario is the closure of the Strait of Hormuz,” said Keshav Lohiya, founder of consultant Oilytics. “There is a huge, fat tail risk in the oil and shipping world.”

Israel launched surprise airstrikes on Iran’s nuclear sites last week, but American weapons are seen as crucial to achieving a more complete destruction of Tehran’s atomic program than anything it can do alone.

Oil may break $80 a barrel on headlines of US involvement, said Chris Weston, the head of research at Pepperstone Group Ltd. The shape of the futures curve suggests that traders are pricing in a much tighter market, he said.

The gap between Brent’s two nearest December contracts — a key indicator on long-term balances — has widened significantly since the attacks and was almost $3 a barrel in a bullish backwardation structure. Prior to the conflict, it was in a bearish contango pattern that had signaled expectations of ample supply.

Meanwhile, US domestic crude inventories drew down by more than 11 million barrels last week. The drop is the more than was anticipated according to industry figures, and it was the largest decline in almost a year.