Sub-$70 oil is squeezing margins, forcing Exxon, Chevron, and BP to rethink $100 billion in annual returns.

Dividends to Dry Up as Sub-$70 Crude Squeezes Supermajors

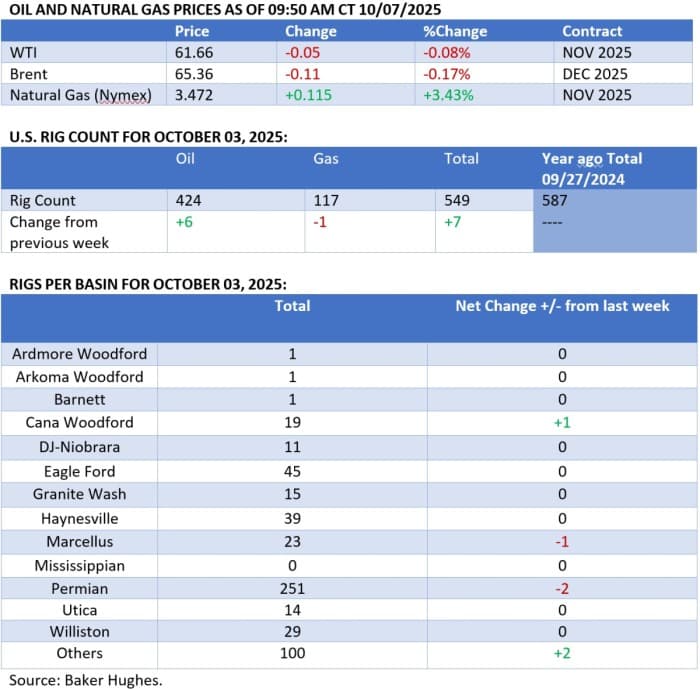

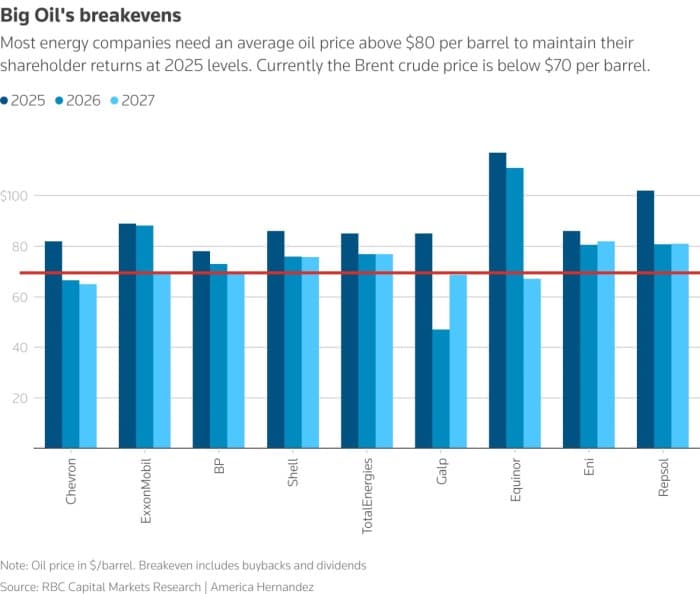

– Amidst fears of oversupply and tariff-impacted demand slowdown, global oil majors are widely expected to start cutting their shareholder payouts as sub-70 oil prices loom large over the horizon.

– Most majors need oil prices above $80 per barrel to sustain current levels of dividends and share buybacks, with France’s TotalEnergies already flagging that it will reduce buybacks from Q4 2025 onwards.

– Most US oil firms have been primarily focused on job cuts lately, with ExxonMobil, Chevron and ConocoPhillips announcing significant layoffs (the former to the extent of 20-25% of global workforce).

– Five leading supermajors (Chevron, ExxonMobil, BP, Shell and TotalEnergies) are about to spend $108.5 billion on shareholder returns this year, only slightly lower than the 2024 total of $112 billion, even though Brent has averaged $70 per barrel this year, down from $80 per barrel in 2024.

– ExxonMobil and Chevron are expected to start the Q3 2025 earnings call timeline on October 25.

Market Movers

– US oil major Chevron (NYSE:CVX) is reportedly seeking to divest $2 billion worth of pipeline assets in Colorado’s Denver-Julesburg shale basin, largely inherited from its 2020 takeover of Noble Energy and its midstream business.

– US LNG developer Excelerate Energy (NYSE:EE) has been appointed by the Government of Iraq to develop the country’s first every floating LNG import terminal to boost domestic power generation and reduce Baghdad’s reliance on Iranian piped gas.

– Italy’s oil major ENI (BIT:ENI) has resumed offshore exploration drilling in Libya after a 5-year break caused initially by the COVID-19 pandemic and then by security concerns, spudding the BESS-3 well in Block 16/4.

– US oil major ExxonMobil (NYSE:XOM) is in talks to re-enter the African country of Gabon, with an exploration agreement potentially covering as many as six offshore blocks expected to be signed this month.

Tuesday, October 07, 2025

Speculation about OPEC+ unleashing triple or quadruple the usual 137,000 b/d supply hikes turned out to be untrue, with the relatively small month-over-month increase prompting a quick upward correction for oil as ICE Brent has traded around $65 per barrel this week. A full recovery to $70 per barrel is unlikely, thoug,h as booming crude exports raise the prospect of major inventory builds over the upcoming weeks.

OPEC+ Goes For Modest Hikes. OPEC+ agreed to raise output from November by 137,000 b/d, sticking to the same monthly increment as in October, with media reports suggesting the group’s top producers, Saudi Arabia and Russia, have increasingly differing views on the pace of hikes.

Aramco Freezes Prices on OPEC+ Hike. Defying expectations of a small increase from October prices, Saudi Arabia’s oil firm Saudi Aramco (TADAWUL:2222) rolled over the November prices of its benchmark Arab Light grade to Asian buyers, setting $2.20 per barrel above the Oman/Dubai average.

Denmark to Tighten Baltic Sea Checks. Seeking to clamp down on shadow tankers passing through the Danish Straits, part of the 4.5 million b/d of total flows coming from the Baltic Sea area, Denmark has pledged to tighten environmental checks on ships as many are older than 20 years.

Iran Announces Huge Gas Find. The Iranian Oil Minister announced the discovery of 10 TCf new natural gas reserves and 200 MMbbls of oil in the onshore Pazan field, the continuation of a 2015 discovery that wasn’t properly appraised back then, aiming to start production by 2030.

Indian Fuel Demand Disappoints. India’s fuel consumption dipped to 18.63 million metric tonnes in September, declining by 0.5% month-over-month and posting the weakest result in a year, as higher domestic ethanol blending requirements (switching to E20 in August) freed up gasoline for exports.

China to Build New Refinery in Ethiopia. Ethiopia has formalized its plans to build its first ever refinery, a 70,000 b/d plant in the eastern town of Gode, entering a partnership with China’s Golden Concord Group, seeking to meet 70% of the African country’s current fuel requirements.

IEA Slashes Renewable Power Outlook. The International Energy Agency lowered its forecast for renewable electricity growth by 2030 to 4,600 GW, down 248 GW compared to its previous outlook, citing the US phaseout of federal tax incentives and China’s move away from fixed-tariff contracts.

China’s SPR Bonanza Shows No Signs of Stopping. China’s national oil companies are building 11 new crude oil storage sites across the country in 2025-2026, adding at least 169 million barrels of additional strategic storage, of which 37 million barrels has been already built and commissioned.

$4,000 Is the Next Stop for Gold. Gold prices continued their unprecedented rally as the bullion hit $3,978 per ounce in intra-day trading on Tuesday, with December gold futures already trading the once impenetrable 4,000/oz threshold amidst intense political turmoil in France and Japan.

Japan’s To-Be PM Scares Markets. Japan’s renewable stocks such as Renova (TYO:9519) saw double-digit stock drops this week after Sanae Takaichi became the most likely candidate to become prime minister, calling for less foreign-built clean energy technology and more locally sourced nuclear.

Ukraine Mulls Higher Gas Imports. Ukraine will be forced to raise natural gas imports by 30% after its main upstream sites incurred heavy damage from Russia’s bombardments last week, having 13 bcm in storage facilities currently but needing additional 6 bcm ahead of the heating season.

Congo Raises the Stakes for Cobalt Exports. Congo’s President Felix Tshisekedi has warned all mining firms operating in the country that exporters that violate its quotas will be permanently banned, as the new system that caps 2026 exports at 96,600 tonnes kicks in October 16.

Russian Oil Firms Pitch Yuan Crude Sales. Seeking to exploit the recent thaw in Indo-Chinese relations, Russian oil sellers have begun asking Indian refiners to pay for crude purchases in Chinese yuan, with IOC reported to have bought three cargoes of Urals denominated in Chinese currency.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com: