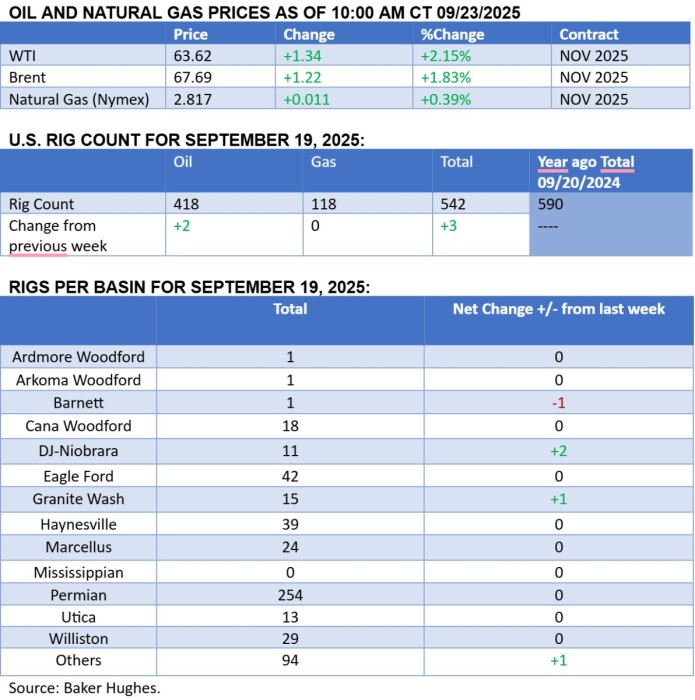

Oil prices rallied on Tuesday morning as Russia’s supply disruption concerns and the delays in restarting exports from Iraqi Kurdistan kept the markets tight.

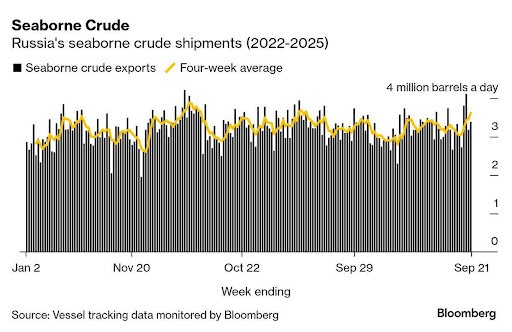

Russia Floods Market with Crude as Refining Saps

– Russia’s seaborne crude exports have risen to their highest since May 2024 after a string of Ukrainian drone strikes in recent weeks forced the country’s refiners to drastically cut their intake.

– Four-week average shipments soared to 3.62 million b/d in the week ending September 21, with volumes buoyed by the country’s refinery runs dipping below 5 million b/d for the first time since April 2022.

– On the other hand, Russia’s diesel exports have been trending around 400,000 b/d this month to date, half of this year’s peak of 820,000 b/d recorded in February.

– India remains the largest buyer of seaborne Russian oil, normally accounting for 1.6-1.7 million b/d of flows, however these volumes could rise to 2 million b/d soon with the additional barrels hitting the market.

– Russia’s OPEC+ production quota has been rising by 105,000 b/d over the past months, with the September target standing at 9.449 million b/d after 9.344 million b/d in August.

Market Movers

– US utility firm Sempra (NYSE:SRE) agreed to sell a 45% equity interest in its infrastructure holdings to investment firms KKR (NYSE:KKR) and Canada’s Pension Plan Investment Board for $10 billion.

– US oil major Chevron (NYSE:CVX) is reportedly looking to build a portfolio in European regasification terminals, as part of its strategy to expand in LNG, potentially supplied by its assets in the Eastern Mediterranean.

– Australia’s leading oil and gas producer Santos (ASX:STO) reported first gas from its $4.5 billion Barossa LNG project, aiming for peak output of 850 MMCf/d by mid-2030s.

– US oil major Occidental Petroleum (NYSE:OXY) has started drilling its ultra-deep Bandit exploration well, potentially the second field in the US Gulf of Mexico that would be producing at reservoir pressures exceeding 20,000 psi (20k).

– Global trading house Glencore (LON:GLEN) is reportedly in talks to sell its 75% controlling stake in the Kamoto Copper unit, a major copper/cobalt project in the Democratic Republic of Congo.

Tuesday, September 23, 2025

Oil prices have been volatile this week as industry watchers are following Iraq’s struggle to restart pipeline flows via Turkey after a two-year-long hiatus, with initial hopes for a quick resolution squashed by several Kurdish producers voicing their reservations. With the ‘Trump impact’ much less noticeable these days, seeing ICE Brent hover slightly below $68 per barrel, the outlook for incremental supply will be the main pricing factor in the upcoming days.

Iraq Cajoles Kurds to Restart Key Pipeline. Iraq’s Federal government announced that it had reached a deal with the semi-autonomous government of Kurdistan to resume crude exports via Turkey as soon as this week, allowing for some 230,000 b/d of exports after flows were cut in March 2023.

US Court Rejects Trump’s Offshore Wind Ban. The Columbia District Court issued a preliminary injunction against US President Trump’s order to halt the construction of Orsted’s Revolution Wind offshore project off the coast of Rhode Island, allowing the Danish wind developer to restart work.

Related: Norwegian Offshore Oil and Gas Production Surges Past Expectations

China Receives Sixth Cargo from Arctic LNG 2. The LNG carrier Arctic Mulan delivered the sixth cargo of liquefied gas from Russia’s sanctioned Arctic LNG 2 project to China’s Beihai terminal, marking the ship’s second delivery in a month after more than a year of seeing no deliveries at all.

Gold Hits Another All-Time High. Gold prices soared above $3,790 per ounce this week after new US Federal Reserve Governor Stephen Miran called for more aggressive interest rate cuts, with the bullion further buoyed by physical gold premiums in India rising to their highest in 2025 to date.

EU Delays Anti-Deforestation Law Again. The European Union will delay its anti-deforestation law for the second time, with Brussels citing concerns about the safe operations of their IT systems, amidst heavy lobbying against it by US paper and pulp producers and Indonesia’s palm oil industry.

South Korea Caps Coal-Fired Generation. South Korea’s Energy Ministry has mandated that coal-fired power plants minimize their operations over the next two months, halting 42 among all 55 coal plants outside the Seoul metropolitan area to suspend operations altogether.

Kuwait Brags About Production Capacity. Simultaneously to OPEC’s ongoing assessment of members’ total crude production capacity, Kuwait’s Oil Ministry stated that it currently wields an oil production capacity of 3.2 million b/d, some 200,000 b/d higher than its year-ago assessments.

China Mulls ‘Strict’ Steel Capacity Curbs. According to Chinese media, Beijing is considering harsh restrictions on new steel production capacity, in line with mandated curbs in recent months that saw 2025 output dip by almost 3% year-over-year in January-August to 672 million tonnes.

Exxon Greenlights Seventh Guyana Project. US oil major ExxonMobil (NYSE:XOM) has taken a final investment decision on its Hammerhead development offshore Guyana, its seventh project in the country, seeking to build a 150,000 b/d FPSO that is anticipated to come online in 2029.

Traders Warm Up to Uranium Markets. According to Reuters, global trading house Mercuria has become the first commodity house to set up physical trading in uranium, competing with banking giants Goldman Sachs and Citibank in a $15 billion market heretofore dominated by banks.

Congo Announces New Cobalt Quota System. The Democratic Republic of Congo announced that it would lift its ban on cobalt exports from October 16 and replace it with an annual export quota system, allowing miners to ship 18,125 tonnes of the metal in the remaining months of 2025.

Beijing Expedites Rare Earth Exports, But Not to All. Statistics from China’s customs show that the country’s exports of rare earth magnets increased again to reach 6,146 metric tonnes in August, up 10.2% compared to July readings, however outflows to US remain down 12% from a year ago.

Russia Mulls Extension of Gasoline Export Ban. With half a dozen Russian refineries impacted by Ukrainian drone strikes in recent weeks, Russia’s Energy Ministry is considering extending its gasoline export ban through year-end as export flows dissipated to a mere 16,000 b/d last month.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com