Russia’s oil producers may have to reduce output as intensified Ukrainian drone attacks have damaged critical export and port infrastructure.

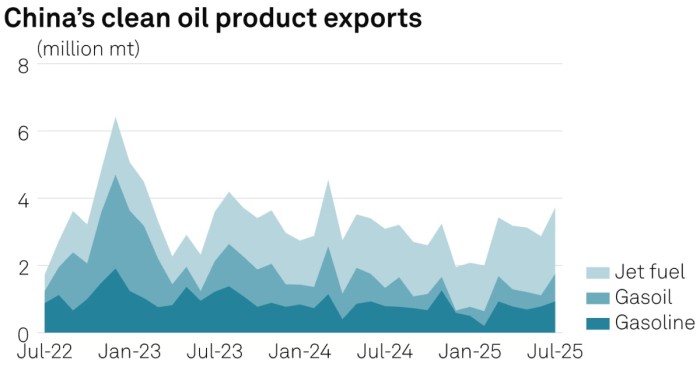

Beijing Tightens the Tap on Oil Products with Third 2025 Export Quota

– Keeping the markets on their toes for longer than anticipated, the Chinese government has at last announced the remaining tranche of clean oil product exports quotas for 2025, to the disappointment of many.

– The third export quota batch was announced at 8.395 million tonnes, notably lower than the 9 million tonnes expected by the market, indicating that Beijing continues to tighten export controls.

– This brings the total of Chinese product exports this year to 40.77 million tonnes, down 0.6% compared to 2024 readings, despite a worsening oversupply situation on the domestic market.

– Beijing seems to be narrowing opportunities for private refiners seeking to export their produce, with the country’s largest private downstream firm ZPC seeing a lower 2025 quota for both clean and dirty products, down by 6% and 62%, respectively.

– Breaking with previous years when gasoline was the main export product coming from China, jet fuel has taken pole position in both 2024 and 2025 as refiners sought to market their surpluses, with this year’s exports rising to 280,000 b/d (38% of the total).

Market Movers

– US oil major ExxonMobil (NYSE:XOM) will be rolling out a unique shareholder voting mechanism that will allow retail investors to automatically vote in step with board recommendations, seeking to fend off activist campaigns from investors such as Elliott Management.

– Azerbaijan’s state oil company SOCAR is close to conclude a deal with Italy’s Brachetti-Peretti family to buy the Italiana Petroli downstream firm, operating two refineries in Ancona and Trecate.

– US investment firm Blackstone (NYSE:BX) announced it had agreed to buy a natural gas plant in Western Pennsylvania from another PE firm Ardian for nearly $1 billion, with the Hill Top Energy Center adding 620 MW capacity to its portfolio.

– Canada’s upcoming Ksi Lisims LNG project, with a 12 mtpa capacity and partially owned by First Nations, has received an environmental approval from British Columbia authorities, eyeing a 2029 launch.

– US oil producer Chord Energy (NASDAQ:CHRD) agreed to buy Williston Basin assets from ExxonMobil’s XTO Energy for $550 million in cash, adding 48,000 net acres and some 9,000 boe/d of output.

Tuesday, September 16, 2025

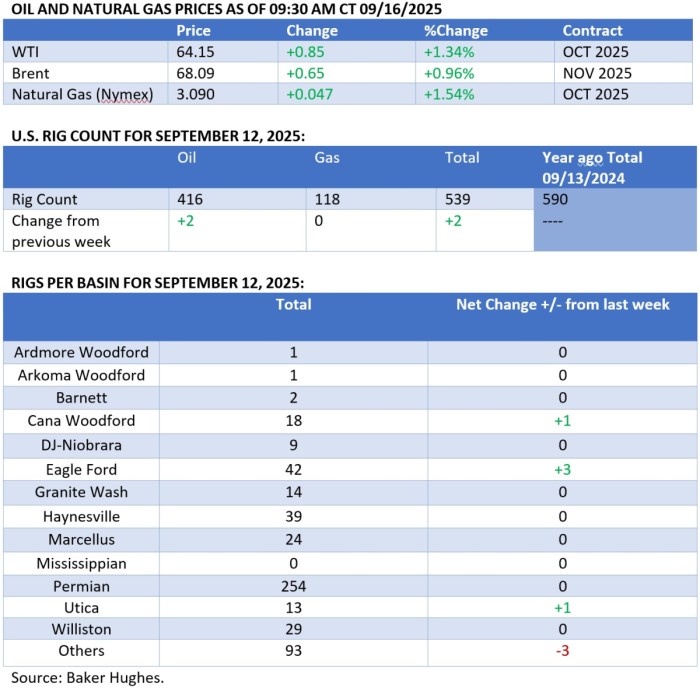

Oil prices have been edging marginally higher this week on concerns of potential supply disruptions in Russia, with further Ukrainian drone strikes disrupting crude flows to Russia’s Baltic ports. The US Federal Reserve could provide a much-needed boost from the macroeconomics side, with Wednesday afternoon potentially seeing another attempt from ICE Brent to reach $69 per barrel again.

IEA Warns of Steepening Oil Output Declines. Shifting tone from its previous focus on renewables, the IEA has warned that 90% of upstream investment annually is dedicated to offsetting supply losses at producing assets, putting the average rate of declines from conventional oil fields at 5.6%.

China Accuses US of Energy Bullying. Chinese authorities have accused the United States of ‘unilateral bullying’ and ‘classic economic coercion’ as the Trump administration has started calling on allies to impose tariffs on China over its purchases of Russian oil and gas.

India’s Sanctioned Refiner Seeks State Help. India’s sanctioned Nayara Energy, majority owned by Russian state oil firm Rosneft and operating the 400,000 b/d Vadinar refinery, has sought government help in sourcing specialized equipment and catalysts for its upcoming planned turnarounds.

Ukraine Strikes Major Russian Refinery. Ukraine carried out a drone strike on one of Russia’s largest oil refineries, the Kirishi plant in the Leningrad region wielding a capacity of 360,000 b/d, prompting the owner Surgutneftegaz to cut runs in the country’s leading producer of diesel and fuel oil.

EU Delays 19th Russia Sanctions Package. Under pressure from the Trump administration demanding that Brussels plays a stronger role in depriving Russia of its energy revenues, the European Commission has delayed its 19th sanctions package indefinitely, initially planned for this week.

Mercuria Eyes Giant Aluminium Pull. Global trading firm Mercuria indicated that it plans to take almost 100,000 metric tonnes of aluminium from LME-registered warehouses, some 25% of its total warrants, pushing the 3-month LME futures above $2,700 per metric tonne for the first time since March.

Permian Crude Turns Highly Sulphurous. Crude pipelines linking the US Permian Basin to the port of Corpus Christi operated by Plains All American (NASDAQ:PAA) have seen surging mercaptan readings, a naturally occurring sulphur, prompting the operator to charge a $0.50 per barrel fee for exceeding specs.

Related: Ukraine Drone Attacks Could Force Russia to Cut Oil Production

Mexico Borrows Money to Pay Back Pemex Debt. Confirming that the Sheinbaum government will continue with state support for Mexico’s embattled Pemex state oil firm, the Latin American country launched a $6 billion three-tranche bond exclusively to pay back Pemex’s outstanding securities.

Canada’s Oil Sands Defy Hostile Takeovers. Canada’s last major pure-play oil sands firm MEG Energy (TSO:MEG) keeps on resisting takeover pressure from peer Strathcona Resources, with the company’s board urging investors to reject its bid, reaffirming support for a merger with Cenovus.

China Needs Fossil Help to Beat Summer Heat. China’s fossil-fuelled power generation soared to its highest monthly level since 1998 last month as lower hydro output prompted companies to maximize coal and natural gas amidst the country’s hottest summer on record, totalling 627.4 billion Kwh.

Copper Bulls Hope for Tariff Normalization. The world’s benchmark copper prices, the three-month LME futures, climbed to their highest since June 2024 on the back of a weakening US dollar and positive signs from the US-China trade talks in Madrid, touching $10,190 per metric tonne.

Waha Prices Turn Negative Again. US natural gas prices in West Texas’ Waha hub turned negative, for the first time since May, trading at -$1.26 per MMBtu earlier this week as seasonal pipeline maintenance trapped natural gas in the country’s largest oil-producing basin.

Iraq’s Oil Revival Dives into Phase Two. French oil major TotalEnergies (NYSE:TTE) has started the second phase of its $27 billion multi-energy project in Iraq, building a seawater desalination and treatment plant next to the giant Ratawi oil field, aiming for 210,000 b/d of output by 2028.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com