Oil rose as hawkish rhetoric by the European Union’s top diplomat raised expectations that sanctions on Russia will tighten.

West Texas Intermediate gained 1.4% to settle under $61 a barrel on Tuesday, pushing higher after the EU’s Kaja Kallas said that Moscow’s aggression against the bloc should be considered terrorism. The comments come against a background of surging diesel-market tightness, in which Russia is a significant player, with the difference between the two nearest ICE gasoil contracts surging Tuesday. Futures for the European benchmark rose by 4.5%.

Adding to bullish sentiment, the price of Russia’s flagship crude plunged to the lowest in over two years, with just days to go before US sanctions take effect against giant producers Rosneft PJSC and Lukoil PJSC over Moscow’s ongoing war in Ukraine.

Other impacts are emerging. Major Asian buyers paused at least some purchases. And traders making physical deliveries of diesel under ICE Gasoil contracts will soon be banned from supplying barrels made with Russian crude in third countries, ICE said.

Still, US benchmark futures are down this year as expectations for a glut weigh on the outlook, with the International Energy Agency forecasting a record surplus in 2026. The oversupply is being driven by the return of idled output from OPEC and its allies, as well as more supplies from outside of the group.

But for now, the price of WTI is staying stubbornly above the $60 mark, according to Frank Monkam, head of macro trading at Buffalo Bayou Commodities.

“It’s going to take a lot more than just a repeat of the same negative headlines to push the market below $60 a barrel unless we see a total unraveling of risk assets, particularly equities,” he said. “Absent of that, I think we’re still very vulnerable to an upside push here in the form of a short squeeze, if we see any headlines like we did today with the EU pressuring Russia on sanctions.”

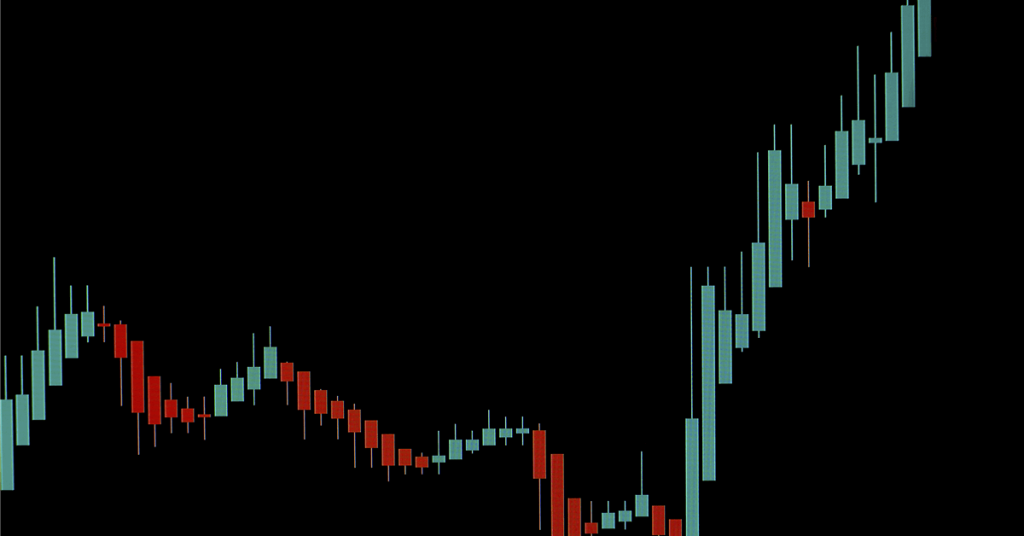

Oil Prices

WTI for December delivery rose 1.4% to settle at $60.74 a barrel in New York.

Brent for January climbed 1.1% to settle at $64.89 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ” +

‘‘ +

”;

var initJobSearch = function () {

//console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 65 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});